Concept explainers

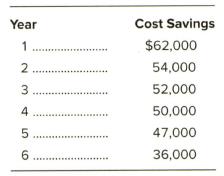

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for

A new piece of equipment will cost

The firm's tax rate is 25 percent and the cost of capital is 12 percent.

a. What is the book value of the old equipment?

b. What is the tax loss on the sale of the old equipment?

c. What is the tax benefit from the sale?

d. What is the

e. What is the net cost of the new equipment? (Include the inflow from the sale of the old equipment.)

f. Determine the depreciation schedule for the new equipment.

g. Determine the depreciation schedule for the remaining years of the old equipment.

h. Determine the incremental depreciation between the old and new equipment and the related tax shield benefits.

i. Compute the aftertax benefits of the cost savings.

j. Add the depreciation tax shield benefits and the aftertax cost savings, and determine the present value. (See Table 12-20 as an example.)

k. Compare the present value of the incremental benefits (j) to the net cost of the new equipment (e). Should the replacement be undertaken?

a.

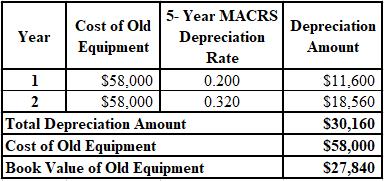

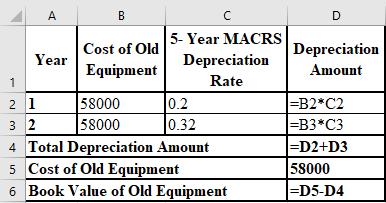

To calculate: The book value of the old equipment.

Introduction:

Book value:

It refers to the total worth of the company if it liquidates all its assets and pays off all the liabilities. It is also referred to as asset price in the balance sheet.

MACRS depreciation method:

MACRS stands for modified accelerated cost recovery system, which is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with pre-specified depreciation periods.

Answer to Problem 33P

The calculation of the book value of the old equipment is shown below:

Hence, the book value of the old equipment is $27,480.

Explanation of Solution

The formulae used for calculation of the book value of the old equipment are shown below:

b.

To calculate: The tax loss incurred on the sale of the old equipment.

Introduction:

Tax loss:

It is the loss incurred when the total deduction claimed in a financial year exceeds the total assessable income of the year.

Answer to Problem 33P

The tax loss incurred on the sale of the old equipment is $3,040.

Explanation of Solution

The calculation of the tax loss on the sale of the old equipment is shown below:

c.

To calculate: The tax benefit from the sale of the old equipment.

Introduction:

Tax benefit:

It is the allowable deductions on the assessable income of the taxpayer, with an intent to reduce the tax liability and burden of the taxpayer.

Answer to Problem 33P

The tax benefit from the sale of the old equipment is $760.

Explanation of Solution

The calculation of the tax benefit from the sale of the old equipment is shown below:

d.

To calculate: The cash inflow received due to sale of old equipment.

Introduction:

Cash inflow:

It is the money received by the firm as the result of its operating, investing, and financing activities. It is the money which is received in the business and recorded in the cash flow statement.

Answer to Problem 33P

The cash inflow received due to sale of old equipment is $25,560.

Explanation of Solution

The calculation of the cash inflow from the sale of the old equipment is shown below:

e.

To calculate: The net cost of the new equipment.

Introduction:

Net cost:

The cost that is computed by deducting all the expenses related to an object, such as freight costs, discounts, etc. from the gross cost of the object.

Answer to Problem 33P

The net cost of the new equipment is $122,440.

Explanation of Solution

The calculation of the net cost of the new equipment is shown below:

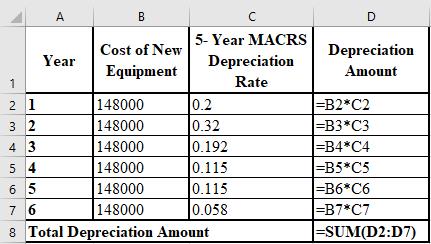

f.

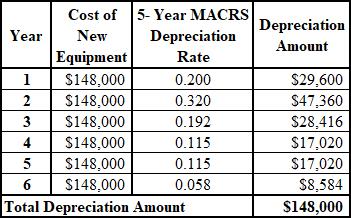

To prepare: The depreciation schedule of new equipment.

Introduction:

Depreciation schedule:

A table that shows the amount of depreciation of a particular asset over the years of its usage is termed as depreciation schedule.

MACRS depreciation method:

MACRS stands for modified accelerated cost recovery system, which is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with pre-specified depreciation periods.

Answer to Problem 33P

The depreciation schedule of new equipment is shown below:

Explanation of Solution

The formulae used for the preparation of the depreciation schedule of new equipment are shown below:

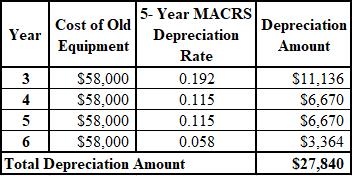

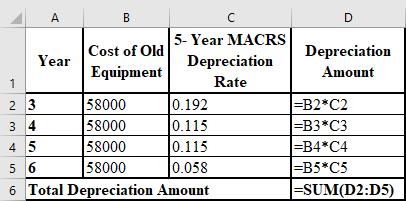

g.

To prepare: The depreciation schedule of remaining years of the old equipment.

Introduction:

Depreciation schedule:

A table that shows the amount of depreciation of a particular asset over the years of its usage is termed as depreciation schedule.

MACRS depreciation method:

MACRS stands for modified accelerated cost recovery system, which is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with pre-specified depreciation periods.

Answer to Problem 33P

The depreciation schedule of remaining years of the old equipment is shown below:

Explanation of Solution

The formulae used for the preparation of the depreciation schedule of remaining years of the old equipment are shown below:

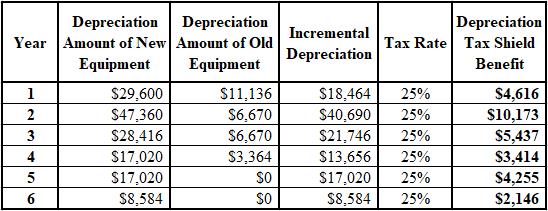

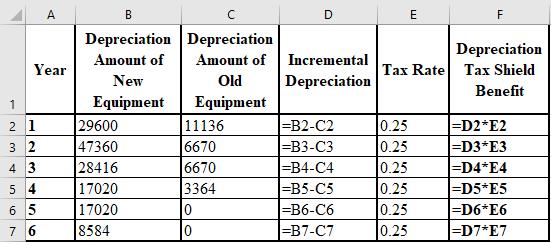

h.

To calculate: The incremental depreciation of old and new equipment and the depreciation tax shield benefit.

Introduction:

MACRS depreciation method:

MACRS stands for modified accelerated cost recovery system, which is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with pre-specified depreciation periods.

Depreciation tax shield:

It is a particular kind of a tax shield provided to an individual or corporations in which depreciation as an expense is deducted from the taxable income.

Answer to Problem 33P

The calculation of the incremental depreciation of old and new equipment and the tax shield benefit is shown below:

Explanation of Solution

The formulae used for the calculation of the incremental depreciation of old and new equipment and the tax shield benefit are shown below:

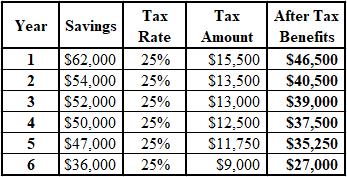

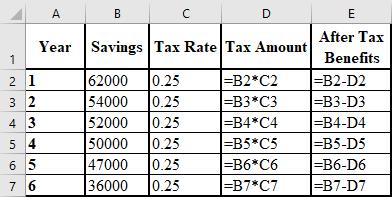

i.

To calculate: The after tax benefits of the cost savings.

Introduction:

After tax benefits:

After tax benefits are those deductions for which the individuals are eligible post the income tax is calculated.

Answer to Problem 33P

The calculation of the after tax benefits of the cost savings is shown below:

Explanation of Solution

The formulae used for the calculation of the after tax benefits of the cost savings are shown below:

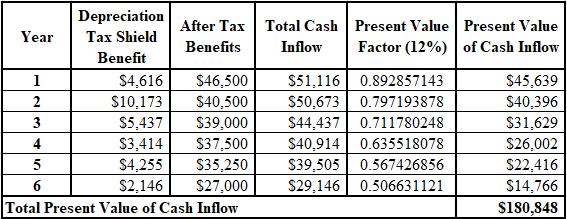

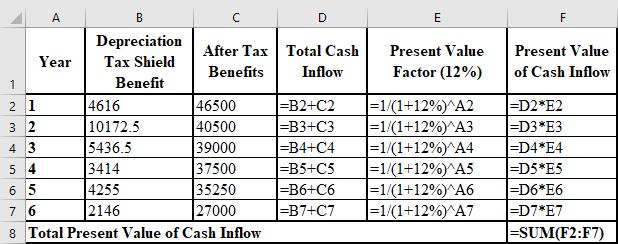

j.

To calculate: The present value of the total cash inflow (sum of depreciation tax shield and after tax benefits).

Introduction:

Present value (PV):

The current value of an investment or an asset is termed as its present value. It is calculated by discounting the future value of the investment or asset.

Cash inflow:

It is the money received by the firm as the result of its operating, investing, and financing activities. It is the money which is received in the business and recorded in the cash flow statement.

Answer to Problem 33P

The calculation of the PV of the total cash inflow is shown below:

Explanation of Solution

The formulae used for the calculation of the PV of the total cash inflow are shown below:

k.

To determine: Whether the replacement shall be undertaken or not.

Introduction:

Net present value (NPV):

It is the difference between the PV (present value) of cash inflows and the cash outflows. It is used in capital budgeting and planning of investment to assess the benefits and losses of any project or investment.

Answer to Problem 33P

The replacement should be undertaken because the NPV of the project is $58,408 and the positive NPV indicates that the replacement is beneficial for the corporation.

Explanation of Solution

The calculation of the NPV of the replacement is as follows:

Want to see more full solutions like this?

Chapter 12 Solutions

FOUND.OF FINANCIAL MANAGEMENT-ACCESS

- Answer in step by step with explanation. Don't use Ai and chatgpt.arrow_forwardArticle: Current Bank Problem Statement The general problem to be surveyed is that leaders lack an understanding of how to address job demands, resulting in an increase in voluntary termination, counterproductive workplace outcomes, and a loss of customers. Bank leaders discovered from customer surveys that customers are closing accounts because their rates are not competitive with area credit unions. Job demands such as a heavy workload interfered with employee performance, leading to decreased job performance. Healthcare employees who felt the organization’s benefits were not competitive were more likely to quit without notice, resulting in retention issues for the organization. Information technology leaders who provide job resources to offset job demand have seen an increase in (a) new accounts, (b) employee productivity, (c) positive workplace culture, and (d) employee retention. The specific problem to be addressed is that IT technology leaders in the information technology…arrow_forwardHow to rewrite the problem statement, correcting the identified errors of the Business Problem Information and the current Bank Problem Statement (for the discussion: Evaluating a Problem Statement)arrow_forward

- Don't used hand raiting and don't used Ai solutionarrow_forward3 years ago, you invested $9,200. In 3 years, you expect to have $14,167. If you expect to earn the same annual return after 3 years from today as the annual return implied from the past and expected values given in the problem, then in how many years from today do you expect to have $28,798?arrow_forwardPlease Don't use Ai solutionarrow_forward

- Ends Feb 2 Discuss and explain in detail the "Purpose of Financial Analysis" as well as the two main way we use Financial Ratios to do this.arrow_forwardWhat is the key arguments of the supporters of the EITC? Explain.arrow_forwardWhat is the requirements to be eligible to receive the EITC? Explain.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT