Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 7E

Make-or-buy decision

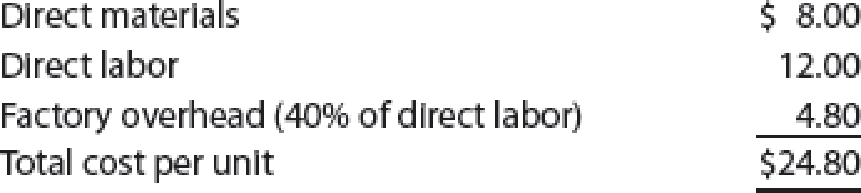

Somerset Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $24 per unit. The company, which is currently operating below full capacity, charges factory

If Somerset Computer Company manufactures the carrying cases, fixed

- a. Prepare a differential analysis dated April 30 to determine whether the company should make (Alternative 1) or buy (Alternative 2) the carrying case.

- b. On the basis of the data presented, would it be advisable to make the carrying cases or to continue buying them? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Hii ticher given correct answer general accounting question

Financial accounting question

The following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production.

Date

Item

Debit

Credit

BalanceDebit

BalanceCredit

August 1

Bal., 6,300 units, 4/5 completed

16,884

31

Direct materials, 113,400 units

226,800

243,684

31

Direct labor

64,390

308,074

31

Factory overhead

36,212

344,286

31

Goods finished, 114,900 units

332,958

11,328

31

Bal., ? units, 2/5 completed

11,328

a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent.

Line Item Description

Amount

1. Direct materials cost per equivalent unit

$fill in the blank 1

2. Conversion cost per equivalent unit

$fill in the blank 2

3. Cost of the beginning work in process completed during August

$fill in the blank 3

4. Cost of units started and completed during August

$fill in the blank 4

5. Cost of the ending work in…

Chapter 11 Solutions

Managerial Accounting

Ch. 11 - Explain the meaning of (A) differential revenue,...Ch. 11 - A company could sell a building for 250,000 or...Ch. 11 - A chemical company has a commodity-grade and...Ch. 11 - A company accepts incremental business at a...Ch. 11 - Prob. 5DQCh. 11 - Prob. 6DQCh. 11 - Prob. 7DQCh. 11 - Although the cost-plus approach to product pricing...Ch. 11 - How does the target cost method differ from...Ch. 11 - Prob. 10DQ

Ch. 11 - Lease or sell Plymouth Company owns equipment with...Ch. 11 - Prob. 2BECh. 11 - Make or buy A company manufactures various-sized...Ch. 11 - Replace equipment A machine with a book value of...Ch. 11 - Prob. 5BECh. 11 - Prob. 6BECh. 11 - Prob. 7BECh. 11 - Prob. 8BECh. 11 - Differential analysis for a lease or sell decision...Ch. 11 - Prob. 2ECh. 11 - Differential analysis for a discontinued product A...Ch. 11 - Differential analysis for a discontinued product...Ch. 11 - Prob. 5ECh. 11 - Prob. 6ECh. 11 - Make-or-buy decision Somerset Computer Company has...Ch. 11 - Prob. 8ECh. 11 - Machine replacement decision A company is...Ch. 11 - Differential analysis for machine replacement...Ch. 11 - Sell or process further Calgary Lumber Company...Ch. 11 - Sell or process further Dakota Coffee Company...Ch. 11 - Prob. 13ECh. 11 - Accepting business at a special price Box Elder...Ch. 11 - Prob. 15ECh. 11 - Prob. 16ECh. 11 - Product cost method of product costing Smart...Ch. 11 - Target costing Toyota Motor Corporation (TM) uses...Ch. 11 - Prob. 19ECh. 11 - Prob. 20ECh. 11 - Prob. 21ECh. 11 - Total cost method of product pricing Based on the...Ch. 11 - Variable cost method of product pricing Based on...Ch. 11 - Differential analysis involving opportunity costs...Ch. 11 - Differential analysis for machine replacement...Ch. 11 - Differential analysis for sales promotion proposal...Ch. 11 - Prob. 4PACh. 11 - Product pricing and profit analysis with...Ch. 11 - Product pricing using the cost-plus approach...Ch. 11 - Prob. 1PBCh. 11 - Differential analysis for machine replacement...Ch. 11 - Prob. 3PBCh. 11 - Prob. 4PBCh. 11 - Prob. 5PBCh. 11 - Prob. 6PBCh. 11 - Analyze Pacific Airways Pacific Airways provides...Ch. 11 - Service yield pricing and differential equations...Ch. 11 - Prob. 3MADCh. 11 - Prob. 4MADCh. 11 - Aaron McKinney is a cost accountant for Majik...Ch. 11 - Prob. 3TIFCh. 11 - Decision on accepting additional business A...Ch. 11 - Accepting service business at a special price If...Ch. 11 - Identifying product cost distortion Peachtree...Ch. 11 - Prob. 1CMACh. 11 - Prob. 2CMACh. 11 - Aril Industries is a multiproduct company that...Ch. 11 - Oakes Inc. manufactured 40,000 gallons of Mononate...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Relevant Costing Explained; Author: Kaplan UK;https://www.youtube.com/watch?v=hnsh3hlJAkI;License: Standard Youtube License