Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 4E

Differential analysis for a discontinued product

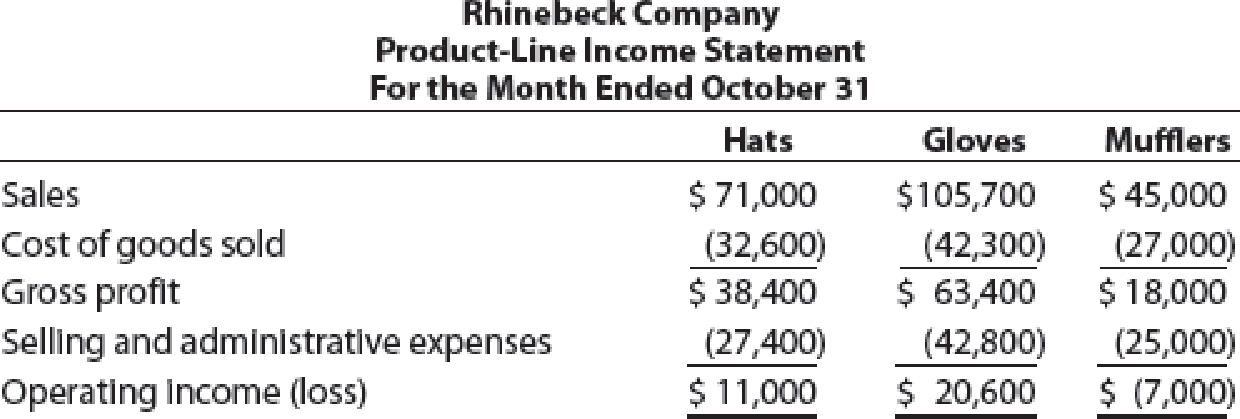

The condensed product-line income statement for Rhinebeck Company for the month of October is as follows:

Fixed costs are 20% of the cost of goods sold and 30% of the selling and administrative expenses. Rhinebeck Company assumes that fixed costs would not be materially affected if the Gloves line were discontinued.

- a. Prepare a differential analysis dated October 31 to determine if Mufflers should be continued (Alternative 1) or discontinued (Alternative 2).

- b. Should the Mufflers line be retained? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

SteelForm Ltd. produces steel fixtures that require 3 meters of material at $1.50 per meter and 0.4 direct labor hours at $20.00 per hour. Overhead is applied at the rate of $10 per direct labor hour. What is the total standard cost for one unit of product that would appear on a standard cost card?Help

Can you explain this general accounting question using accurate calculation methods?

Please explain the accurate process for solving this financial accounting question with proper principles.

Chapter 11 Solutions

Managerial Accounting

Ch. 11 - Explain the meaning of (A) differential revenue,...Ch. 11 - A company could sell a building for 250,000 or...Ch. 11 - A chemical company has a commodity-grade and...Ch. 11 - A company accepts incremental business at a...Ch. 11 - Prob. 5DQCh. 11 - Prob. 6DQCh. 11 - Prob. 7DQCh. 11 - Although the cost-plus approach to product pricing...Ch. 11 - How does the target cost method differ from...Ch. 11 - Prob. 10DQ

Ch. 11 - Lease or sell Plymouth Company owns equipment with...Ch. 11 - Prob. 2BECh. 11 - Make or buy A company manufactures various-sized...Ch. 11 - Replace equipment A machine with a book value of...Ch. 11 - Prob. 5BECh. 11 - Prob. 6BECh. 11 - Prob. 7BECh. 11 - Prob. 8BECh. 11 - Differential analysis for a lease or sell decision...Ch. 11 - Prob. 2ECh. 11 - Differential analysis for a discontinued product A...Ch. 11 - Differential analysis for a discontinued product...Ch. 11 - Prob. 5ECh. 11 - Prob. 6ECh. 11 - Make-or-buy decision Somerset Computer Company has...Ch. 11 - Prob. 8ECh. 11 - Machine replacement decision A company is...Ch. 11 - Differential analysis for machine replacement...Ch. 11 - Sell or process further Calgary Lumber Company...Ch. 11 - Sell or process further Dakota Coffee Company...Ch. 11 - Prob. 13ECh. 11 - Accepting business at a special price Box Elder...Ch. 11 - Prob. 15ECh. 11 - Prob. 16ECh. 11 - Product cost method of product costing Smart...Ch. 11 - Target costing Toyota Motor Corporation (TM) uses...Ch. 11 - Prob. 19ECh. 11 - Prob. 20ECh. 11 - Prob. 21ECh. 11 - Total cost method of product pricing Based on the...Ch. 11 - Variable cost method of product pricing Based on...Ch. 11 - Differential analysis involving opportunity costs...Ch. 11 - Differential analysis for machine replacement...Ch. 11 - Differential analysis for sales promotion proposal...Ch. 11 - Prob. 4PACh. 11 - Product pricing and profit analysis with...Ch. 11 - Product pricing using the cost-plus approach...Ch. 11 - Prob. 1PBCh. 11 - Differential analysis for machine replacement...Ch. 11 - Prob. 3PBCh. 11 - Prob. 4PBCh. 11 - Prob. 5PBCh. 11 - Prob. 6PBCh. 11 - Analyze Pacific Airways Pacific Airways provides...Ch. 11 - Service yield pricing and differential equations...Ch. 11 - Prob. 3MADCh. 11 - Prob. 4MADCh. 11 - Aaron McKinney is a cost accountant for Majik...Ch. 11 - Prob. 3TIFCh. 11 - Decision on accepting additional business A...Ch. 11 - Accepting service business at a special price If...Ch. 11 - Identifying product cost distortion Peachtree...Ch. 11 - Prob. 1CMACh. 11 - Prob. 2CMACh. 11 - Aril Industries is a multiproduct company that...Ch. 11 - Oakes Inc. manufactured 40,000 gallons of Mononate...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardWhat is the estimated overhead cost if 180 direct labor hours are expected to be used in the upcoming period ?arrow_forward

- See an attachment for details General accounting question not need ai solutionarrow_forwardWilson Electronics manufactures smart speakers at a variable cost of $42.50 per unit. Fixed manufacturing overhead totals $185,000 per month, while fixed selling and administrative expenses are $96,000 per month. Each speaker sells for $85, with variable selling expenses of $8.75 per unit. What is Wilson's contribution margin ratio, monthly break-even point in units, and how many units must they sell each month to earn a profit of $135,000?arrow_forwardgeneral accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License