COST ACCOUNTING W/CONNECT

6th Edition

ISBN: 9781264022021

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 71P

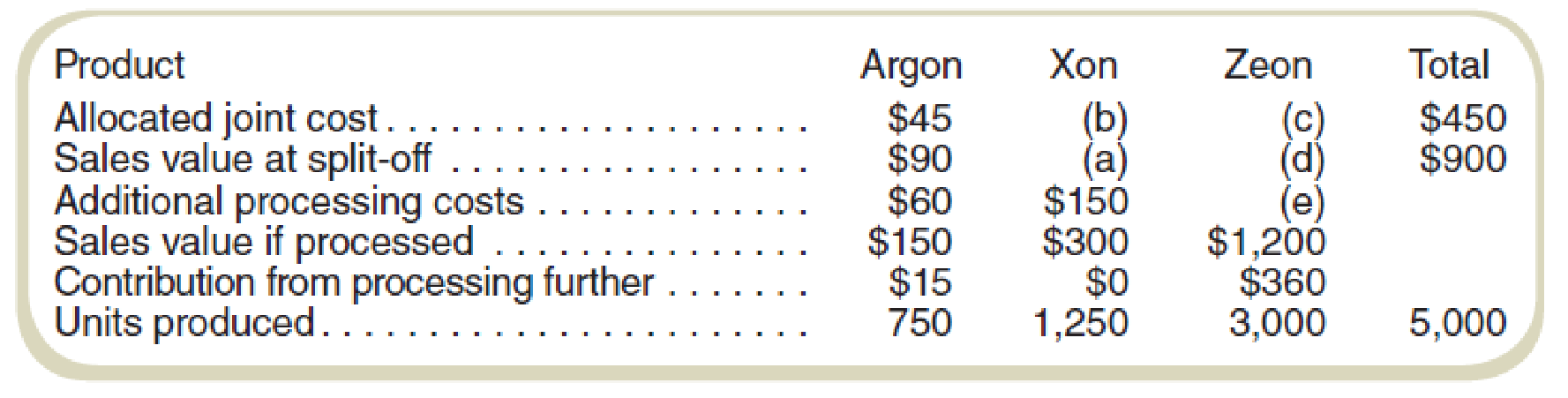

Finding Missing Data: Net Realizable Value

Blaine, Inc., produces three products. Argon, Xon, and Zeon, from a joint production process. Data on the process are as follows:

Required

Determine the value for each lettered item.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Define in detail the following in relation to Organizational Ethics.

The Ethical Culture of an organization.

Define these Five Signs of Ethical Collapse

a) Pressure to maintain the numbers

b) Fear of reprisals

c) Loyalty to the boss

d) Innovations

e) Goodness in some areas, atones for evil in others

Calculate the stock in the beginning

I need help with this problem and accounting

Chapter 11 Solutions

COST ACCOUNTING W/CONNECT

Ch. 11 - Why do companies allocate costs? What are some of...Ch. 11 - What are the three methods of allocating service...Ch. 11 - What are the similarities and differences among...Ch. 11 - What criterion should be used to determine the...Ch. 11 - What is a limitation of the direct method of...Ch. 11 - What is a limitation of the step method of...Ch. 11 - Prob. 7RQCh. 11 - Why would a number of accountants express a...Ch. 11 - Prob. 9RQCh. 11 - What is the basic difference between the...

Ch. 11 - Prob. 11RQCh. 11 - If cost allocations arc arbitrary and potentially...Ch. 11 - Prob. 13CADQCh. 11 - Prob. 14CADQCh. 11 - Prob. 15CADQCh. 11 - Prob. 16CADQCh. 11 - Prob. 17CADQCh. 11 - Prob. 18CADQCh. 11 - What are some of the factors that a company needs...Ch. 11 - Prob. 20CADQCh. 11 - Prob. 21CADQCh. 11 - Prob. 22CADQCh. 11 - How is joint cost allocation like service...Ch. 11 - Prob. 24CADQCh. 11 - In what ways is joint cost allocation similar to...Ch. 11 - Why Are Costs Allocated?Ethical Issues You are the...Ch. 11 - Cost Allocation: Direct Method Caro Manufacturing...Ch. 11 - Allocating Service Department Costs First to...Ch. 11 - Cost Allwat ion: Direct Method University Printers...Ch. 11 - Prob. 30ECh. 11 - Cost Allocation: Step Method

Refer to the data for...Ch. 11 - Cost Allocation: Reciprocal Method

Refer to the...Ch. 11 - Cost Allocation: Reciprocal Method, Two Service...Ch. 11 - Cost Allocation: Reciprocal Method

Refer to the...Ch. 11 - Prob. 35ECh. 11 - Prob. 36ECh. 11 - Prob. 37ECh. 11 - Prob. 38ECh. 11 - Prob. 39ECh. 11 - Prob. 40ECh. 11 - Net Realizable Value Method: Multiple Choice

Oak...Ch. 11 - Sell or Process Further: Multiple Choice

Refer to...Ch. 11 - Net Realizable Value Method Euclid Corporation...Ch. 11 - Estimated Net Realizable Value Method Blasto,...Ch. 11 - Net Realizable Value Method to Solve for Unknowns...Ch. 11 - Net Realizable Value Method Bixel Components...Ch. 11 - Net Realizable Value Method with By-Products...Ch. 11 - Net Realizable Value Method Deming Sons...Ch. 11 - Physical Quantities Method

Refer to the facts in...Ch. 11 - Sell or Process Further

Refer to the facts in...Ch. 11 - Physical Quantities Method The following questions...Ch. 11 - Physical Quantities Method; Sell or Process...Ch. 11 - Physical Quantities Method with By-Product...Ch. 11 - Step Method with Three Service Departments Model,...Ch. 11 - Comparison of Allocation Methods BluStar Company...Ch. 11 - Solve for Unknowns: Direct Method Franks Foods has...Ch. 11 - Solve for Unknowns: Step Method RT Renovations is...Ch. 11 - Cost Allocation: Step Method with Analysis and...Ch. 11 - Prob. 59PCh. 11 - Prob. 60PCh. 11 - Direct, Step, and Reciprocal Methods:...Ch. 11 - Cost Allocation: Step and Reciprocal Methods...Ch. 11 - Allocate Service Department Costs: Direct and Step...Ch. 11 - Prob. 64PCh. 11 - Prob. 65PCh. 11 - Prob. 66PCh. 11 - Prob. 67PCh. 11 - Prob. 68PCh. 11 - Fletcher Fabrication, Inc., produces three...Ch. 11 - Findina Missing Data: Net Realizable Value Spartan...Ch. 11 - Finding Missing Data: Net Realizable Value Blaine,...Ch. 11 - Joint Costing in a Process Costing Context:...Ch. 11 - Find Maximum Input Price: Estimated Net Realizable...Ch. 11 - Effect of By-Product versus Joint Cost Accounting...Ch. 11 - Prob. 75PCh. 11 - Prob. 76P

Additional Business Textbook Solutions

Find more solutions based on key concepts

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

There is a huge demand in the United States and elsewhere for affordable women’s clothing. Low-cost clothing re...

Operations Management

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide correct solution and accountingarrow_forwardWhat is its DOL? Accounting questionarrow_forwardThe following data were selected from the records of Fluwars Company for the year ended December 31, current year: Balances at January 1, current year: Accounts receivable (various customers) $ 111,500 Allowance for doubtful accounts 11,200 The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return. The following transactions occurred during the current year: Sold merchandise for cash, $252,000. Sold merchandise to Abbey Corp; invoice amount, $36,000. Sold merchandise to Brown Company; invoice amount, $47,600. Abbey paid the invoice in (b) within the discount period. Sold merchandise to Cavendish Inc.; invoice amount, $50,000. Collected $113,100 cash from customers for credit sales made during the year, all within the discount periods. Brown paid its account in full within the discount period. Sold merchandise to Decca Corporation; invoice amount, $42,400. Cavendish paid its account in full after the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY