Comparison of Allocation Methods

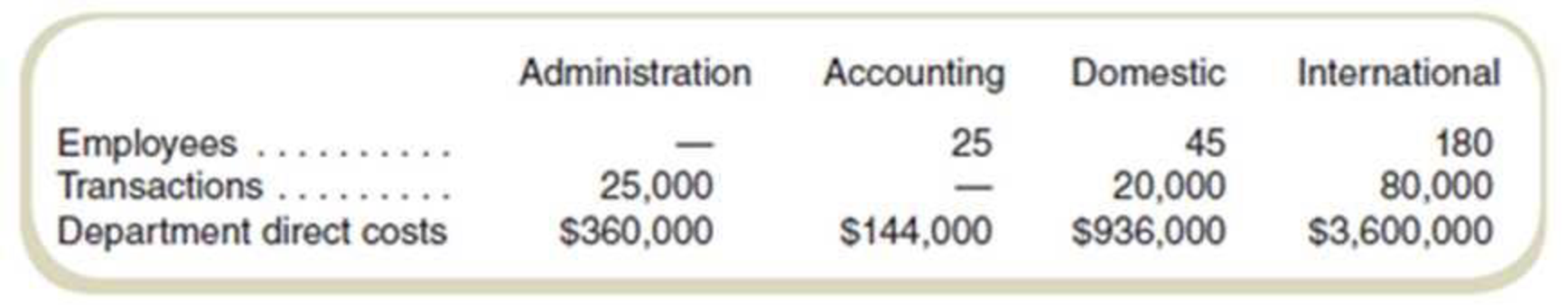

BluStar Company has two service departments, Administration and Accounting, and two operating departments, Domestic and International. Administration costs are allocated on the basis of employees, and Accounting costs are allocated on the basis of number of transactions. A summary of BluStar operations follows:

Required

- a. Allocate the cost of the service departments to the operating departments using the direct method.

- b. Allocate the cost of the service departments to the operating departments using the step method. Start with Administration.

- c. Allocate the cost of the service departments to the operating departments using the reciprocal method.

- d. Comment on the results.

a.

Allocate the cost of the service departments to the operating departments by using the direct method.

Answer to Problem 55P

The cost allocation to domestic unit is $1,036,800 and international unit is $4,003,200.

Explanation of Solution

Direct method:

Direct cost allocates cost directly to the production process of the business. This method assumes that the service department does not provide services to each other. So does not allocate cost to the service department of the business. All the service costs are directly charged to the end consumer by the way of allocating the cost to the production department.

Allocate the cost to the operating department:

| Department | ||||

| Amount | Administration | Accounting | Domestic | International |

| Department cost | $360,000 | $144,000 | $936,000 | $3,600,000 |

| Administration (1) | $(360,000) | - | $72,000 | $288,000 |

| Accounting (2) | - | $(144,000) | $28,800 | $115,200 |

| Total cost | $0 | $0 | $1,036,800 | $4,003,200 |

Table: (1)

Thus, the cost allocation to the domestic unit is $1,036,800, and the international unit is $4,003,200.

Working note 1:

Calculate the allocation of maintenance cost:

| Particulars |

Administration cost (a) |

Employees number (b) |

Amount |

| Allocation to administration cost : | |||

| Domestic | $360,000 | 45 | $72,000 |

| International | $360,000 | 180 | $288,000 |

| Total | $225 |

Table: (2)

Working note 2:

Calculate the allocation of accounting department:

| Particulars |

Accounting cost (a) |

Transactions number (b) |

Amount |

|

Allocation to accounting cost : | |||

| Domestic | $144,000 | 20,000 | $28,800 |

| International | $144,000 | 80,000 | $115,200 |

| Total | 100,000 |

Table: (3)

b.

Allocate the cost of the service departments to the operating departments by using the step method by starting with the Administration.

Answer to Problem 55P

The cost allocation to domestic unit is $1,036,800 and international unit is $4,003,200.

Explanation of Solution

Step method:

Step method allows the allocation of the cost to the production department and service departments. Unlike the direct method, it also allocates the cost of the service to various service departments. Allocation of the cost starts from the department that has provided the highest proposition of service to the department that has provided the least service. Step method allows only one-way allocation of cost among service departments.

Allocate the cost to the operating department:

| Department | ||||

| Particulars | Administration | Accounting | Domestic | International |

| Department cost | $360,000 | $144,000 | $936,000 | $3,600,000 |

| Administration (1) | $(360,000) | $36,000 | $64,800 | $259,200 |

| Accounting (2) | - | $(180,000) | $36,000 | $144,000 |

| Total cost | $0 | $0 | $1,036,800 | $4,003,200 |

Table: (4)

Thus, the cost allocation to the domestic unit is $1,036,800, and the international unit is $4,003,200.

Working note 3:

Calculate the allocation of maintenance cost:

| Particulars |

Administration cost (a) |

Employees number (b) |

Amount |

| Allocation to administration cost : | |||

| Accounting | $360,000 | 25 | $36,000 |

| Domestic | $360,000 | 45 | $64,800 |

| International | $360,000 | 180 | $259,200 |

| Total | $250 |

Table: (5)

Working note 4:

Calculate the allocation of accounting department:

| Particulars |

Accounting cost (a) |

Transactions number (b) |

Amount |

| Allocation to accounting cost : | |||

| Domestic | $180,000 | 20,000 | $36,000 |

| International | $180,000 | 80,000 | $144,000 |

| Total | 100,000 |

Table: (6)

c.

Allocate the cost of the service departments to the operating departments by using the reciprocal method.

Answer to Problem 55P

The cost allocation to domestic unit is $1,036,800 and international unit is $4,003,200.

Explanation of Solution

Reciprocal method:

The reciprocal method recognizes the cost allocation to the service departments like step method. It allocates cost to the service department and production department of the business. Unlike the step method, the reciprocal method allows the two-way allocation of cost among the service department

Allocate the cost to the operating department:

| Department | ||||

| Amount | Administration | Accounting | Domestic | International |

| Department cost | $360,000 | $144,000 | $936,000 | $3,600,000 |

| Administration (1) | $(396,735) | $39,674 | $71,412 | $285,649 |

| Accounting (2) | $36,735 | $(183,674) | $29,388 | $117,551 |

| Total cost | $0 | $0 | $1,036,800 | $4,003,200 |

Table: (7)

Thus, the cost allocation to the domestic unit is $1,036,800, and the international unit is $4,003,200.

Working note 5:

Calculate the allocation of maintenance cost:

| Particulars |

Administration cost (a) |

Employees number (b) |

Amount |

| Allocation to administration cost : | |||

| Accounting | $396,735 | 25 | $39,674 |

| Domestic | $396,735 | 45 | $71,412 |

| International | $396,735 | 180 | $285,649 |

| Total | $250 |

Table: (8)

Working note 6:

Calculate the allocation of accounting department:

| Particulars |

Accounting cost (a) |

Transactions number (b) |

Amount |

|

Allocation to accounting cost : | |||

| Administration | $183,674 | 25,000 | $36,735 |

| Domestic | $183,674 | 20,000 | $29,388 |

| International | $183,674 | 80,000 | $117,551 |

| Total | $125,000 |

Table: (9)

Working note 7:

Calculate the value of accounting and administration cost;

Set up a cost equation:

Let,

Administration cost: S1

Accounting cost: S2

Total service cos will be equal to the direct cost of the service department and cost allocated to the service department.

Putting the value of S1 in S2:

Calculate the value of S1:

Thus, administration costs and accounting costs are $396,735 and $183,637 respectively.

d.

Comment on the results.

Explanation of Solution

Comment on the cost allocation:

The allocation of the cost may differ, but the total allocated cost to the domestic and international department is the same.

So selecting a method will not result in the financial management of the business. The cost allocation will help the divisional manager to manage the cost of the division for the better performance of the division.

Want to see more full solutions like this?

Chapter 11 Solutions

COST ACCOUNTING W/CONNECT

- Compute Lexington taxable income for the yeararrow_forwardEV Corporation reported its financial results for the year ended December 31, 2023. The company generated $320,000 in sales revenue, while the cost of goods sold amounted to $140,000. The company also incurred operating expenses of $92,000 and reported a net income of $88,000. Additionally, the company’s net cash provided by operating activities was $112,500. Based on this information, what was EV Corporation’s profit margin ratio?arrow_forwardI want to this question answer general accountingarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning