Cost Allocation: Step Method with Analysis and Decision Making

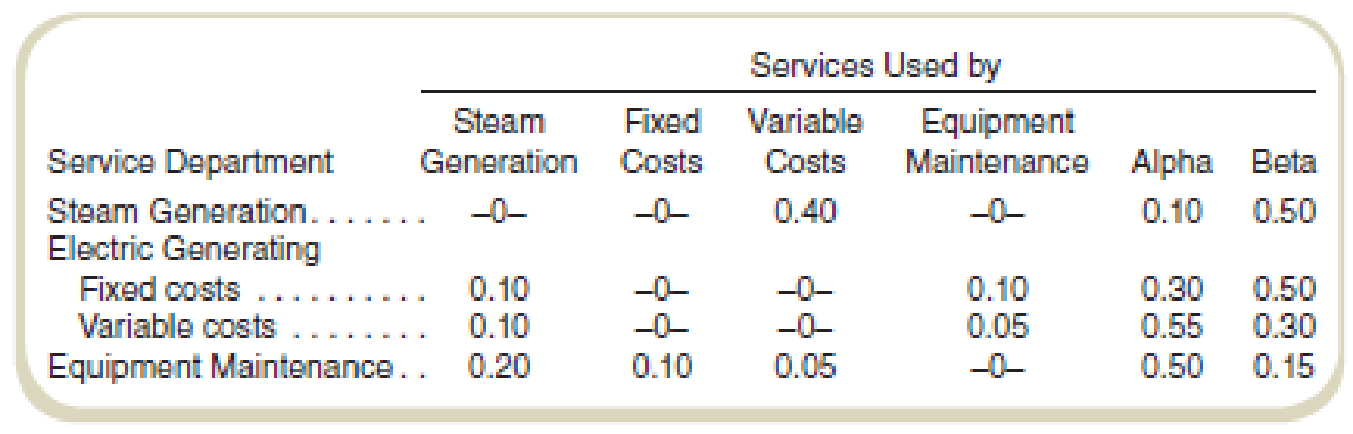

Steamco is reviewing its operations to see what additional energy-saving projects it might adopt. The company’s manufacturing plant generates its own electricity using a process capturing steam from its production processes. A summary of the use of service departments by other service departments as well as by the two producing departments at the plant follows:

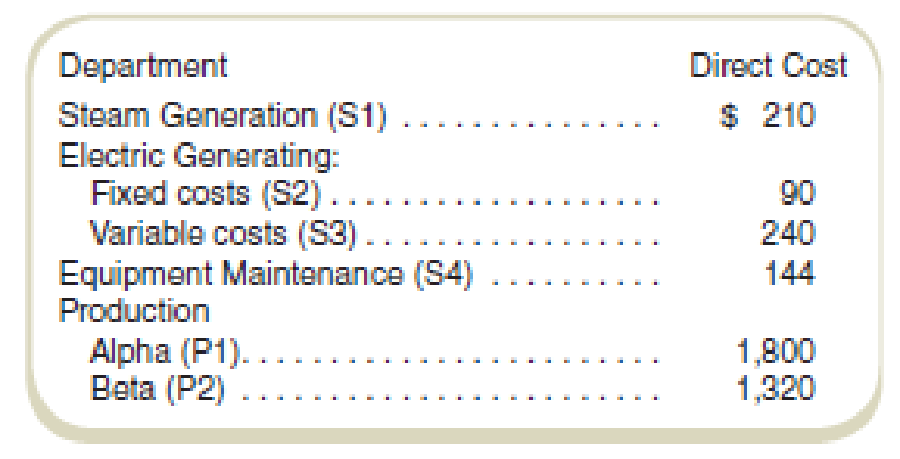

Direct costs (in thousands) in the various departments follow:

Steamco currently allocates costs of service departments to production departments using the step method. The local power company indicates that it would charge $480,000 per year for the electricity that Steamco now generates internally. Management rejected switching to the power company on the grounds that its rates would cost more than the $330,000 ($90,000 + $240,000) cost of the present, company-owned, system.

Required

- a. What costs of electric

service did management use to prepare the basis for its decision to continue generating power internally? - b. Prepare for management an analysis of the costs of the company’s own electric generating operations. (Use the step method.) The rank order of allocation is (1) S1, (2) S4, (3) S2, and (4) S3.

- c. Add a section to your analysis to management that you prepared for requirement (b) to indicate whether your answer there would change if the company could realize $174,000 per year from the sale of the steam now used for electric generating. (Assume no selling costs.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

COST ACCOUNTING W/CONNECT

- I don't need ai answer accounting questionsarrow_forwardLaws can be classified into several categories: criminal law versus civil law, substantive law versus procedural law, public versus private law, and law versus equity. Discuss one of these categories and the distinctions between the two types of laws.arrow_forwardDo fast answer of this accounting questionsarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning