A bridge is to be constructed now as part of a new road. Engineers have determined that traffic density on the new road will justify a two-lane road and a bridge at the present time. Because of uncertainty regarding future use of the road, the time at which an extra two lanes will be required is currently being studied.

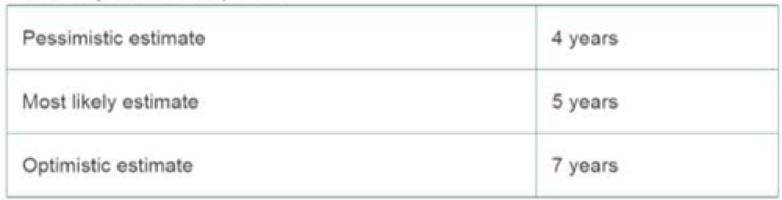

The two-lane bridge will cost $200,000 and the four- lane bridge, if built initially, will cost $350,000. The future cost of widening a two-lane bridge to four lanes will be an extra $200,000 plus $25,000 for every year that widening is delayed. The MARR used by the highway department is 12% per year. The following estimates have been made of the times at which the four-lane bridge will be required:

In view of these estimates, what would you recommend? What difficulty, if any, do you have in interpreting your results? List some advantages and disadvantages of this method of preparing estimates.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Engineering Economy

- An airline is considering two types of engine systems for use in its planes. Each has the same life and the same maintenance and repair record. System A costs 5 million and uses 48,000 liters per 1,000 hours of operation at the average load encountered in passenger service. System B costs 10 million and uses 38,400 liters per 1,000 hours of operation at the same level. Both engine systems have 3-year lives before any major overhaul. Based on the initial investment, the systems have 10% salvage values. If jet fuel costs 108 a liter, and fuel consumption is expected to increase at the rate of 6% each year due to degrading engine efficiency, which engine system should the firm install? Assume 2,000 hours of operation per year, and a MARR of 10%.arrow_forwardWaller County is planning to construct a Dam some tens of miles away from the Hempstead Recreation center to facilitate fishing in the El Manny River Basin and Power Generation. The first cost for the Dam will amount to $6,500,000. Annual maintenance and repairs will amount to $24,000 for the first four years, to $28,000 for each year in the next eight years, and to $32,000 per year for the next four years. At the end of the 16th year, $25,000 is estimated to be deposited into Waller county account as tax credits earned for its environmental compliance in the construction and operation of the Dam. In addition a major overhaul costing $650,000 will be required at the end of the seventh year. Use an interest rate of 10% and : a) Determine the engineering economy symbols and their value for each option. b) Construct the cash flow diagram c) Calculate the Capital Recovery for the projectarrow_forward. A construction company is considering two possibilities for warehouse operations. Proposal 1 would require the purchase of a forklift for $5,000 and 500 pallets that cost $5 each. The average life of a pallet is assumed to be 2 years. If the forklift is purchased, the company must hire an operator for $9,000 annually and spend $600 per year on maintenance and operation. The life of the forklift is expected to be 12 years with a $700 salvage value. Alternatively, proposal 2 requires that the company hire 2 men to operate power driven hand trucks at a cost of $7,500 per man. One hand truck will be required at a cost of $900. The hand truck will have a life of 6 years with no salvage value. If the company's minimum attractive rate of return is 12%, which alternative should be selected? Use the annual equivalent method.arrow_forward

- An integrated, combined cycle power plant produces 285 MW of electricity by gasifying coal. The capital investment for the plant is $450 million, spread evenly over two years. The operating life of the plant is expected to be 18 years. Additionally, the plant will operate at full capacity 76% of the time (downtime is 24% of any given year). The MARR is 10% per year. a. If this plant will make a profit of two cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? b. What is the IRR for the plant? Is it profitable? a. The simple payback period of the plant is years. (Round up to one decimal place.) It's a venture. b. The IRR for the plant is%. (Round to one decimal place.) The plant isarrow_forwardTo remedy the traffic situation at a busy intersection in Quezon City, two plans are being considered. Plan A is to build a cloverleaf costing P 9,200,000 which would provide all the needs during the next 30 years. Maintenance costs are estimated to be P 24,000 a year for the first 15 years and P 42,000 a year for the second 15 years. Plan B is to build a partial clover-leaf at a costs of P 6,500,000 which would be sufficient for the next 15 years. At the end of 15 years, the cloverleaf will be completed at an estimated cost o P 7,500,000. Maintenance would cost P 16,800 a year during the first 15 years and P 36,000 a year for the second 15 years. If money is worth 18%, which of the two plans would you recommend?arrow_forward! Required information In order to provide drinking water as part of its 50-year plan, a west coast city is considering constructing a pipeline for importing water from a nearby community that has a plentiful supply of brackish ground water. A full-sized pipeline can be constructed at a cost of $105 million now. Alternatively, a smaller pipeline can be constructed now for $85 million and enlarged 20 years from now for another $90 million. The pumping cost will be $25,000 per year higher for the smaller pipeline during the first 20 years, but it will be approximately the same thereafter. Both pipelines are expected to have the same useful life with no salvage value. At an interest rate of 10% per year, which alternative is more economical? The present worth of the full-sized pipeline is determined to be $ The small pipeline is the most economical pipeline. and that of the small-sized pipeline is $arrow_forward

- Nowadays it is very important to reduce one's carbon footprint" (how much carbon we produce in our daily lifestyles). Minimizing the use of fossil fuels and instead resorting to renewable sources of energy (e.g., solar energy) are vital to a "sustainable" lifestyle and a lower carbon footprint. Let's consider solar panels that prewarm the water fed to a conventional home water heater. The solar panels have an installed cost of $2,436, and they reduce the homeowner's energy bill by $30.5 per month. The residual value of the solar panels is negligible at the end of their 8-year life. What is the annual effective IRR of this investment? The annual effective IRR of this investment is%. (Round to two decimal places.) please explain using excelarrow_forwardTwo traffic signal systems are being considered for an intersection. One system costs $33,000 for installation and has an efficiency rating of 81%, requires 30 kW power (output), incurs a user cost of $0.24 per vehicle, and has a life of 12 years. A second system costs $46,000 to install, has an efficiency rating of 88%, requires 36 kW power (output), has a user cost of $0.19 per vehicle, and has a life of 15 years. Annual maintenance costs are $70 and $90, respectively. MARR = 9% per year. How many vehicles must use the intersection to justify the second system when electricity costs $0.08/kWh? Assume salvage value for each system equals zero. Project the difference in the user cost as savings for the second system. There are approximately 8,760 hours/year. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 9% per year. (..... At least vehicles per day must use the intersection to justify the second system. (Round up to the nearest whole…arrow_forwardAn integrated, combined cycle power plant produces 295 MW of electricity by gasifying coal. The capital investment for the plant is $450 million, spread evenly over two years. The operating life of the plant is expected to be 15 years. Additionally, the plant will operate at full capacity 72% of the time (downtime is 28% of any given year). The MARR is 8% per year. a. If this plant will make a profit of two cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? b. What is the IRR for the plant? Is it profitable? a. The simple payback period of the plant is 12.1 years. (Round up to one decimal place.) It's a high-risk venture. b. The IRR for the plant is %. (Round to one decimal place.)arrow_forward

- NPVs and IRRs for Mutually Exclusive Projects Davis Industries must choose between a gas-powered and an electric-powered forklift truck for moving materials in its factory. Because both forklifts perform the same function, the firm will choose only one. (They are mutually exclusive investments.) The electric-powered truck will cost more, but it will be less expensive to operate; it will cost $21,500, whereas the gas-powered truck will cost $17,960. The cost of capital that applies to both investments is 13%. The life for both types of truck is estimated to be 6 years, during which time the net cash flows for the electric-powered truck will be $6,860 per year, and those for the gas-powered truck will be $4,600 per year. Annual net cash flows include depreciation expenses. Calculate the NPV and IRR for each type of truck, and decide which to recommend. Do not round intermediate calculations. Round the monetary values to the nearest dollar and percentage values to two decimal places.…arrow_forwardThe Oklahoma City Zoo has proposed adding to their Web site a major segment providing a virtual tour of the grounds and animals, suitable for both routine enjoyment and educational purposes in classrooms. Survey data indicate that this will have either a neutral or positive effect upon actual zoo attendance. The Web site will be professionally done and have an initial cost of $325,000. Upkeep, refreshing the videos, and developing videos for scientific research and entertainment will cost another $80,000 per year. The zoo is expected to be in operation for an indefinite period; however, a study period of only 10 years for the Web site is to be assumed, with only a residual (salvage) value of $60,000 for the archival value being anticipated. Interest is 7%. An estimated 100,000 persons will visit the e-zoo in the first year, increasing by 30,000 each year, and they will receive, on the average, an additional $0.80 of benefit per visit when the new area is complete. On the basis of…arrow_forwardThe Oklahoma City Zoo has proposed adding to their Web site a major segment providing a virtual tour of the grounds and animals, suitable for both routine enjoyment and educational purposes in classrooms. Survey data indicate that this will have either a neutral or positive effect upon actual zoo attendance. The Web site will be professionally done and have an initial cost of $325,000. Upkeep, refreshing the videos, and developing videos for scientific research and entertainment will cost another $80,000 per year. The zoo is expected to be in operation for an indefinite period; however, a study period of only 10 years for the Web site is to be assumed, with only a residual (salvage) value of 560,000 for the archival value being anticipated. Interest is 7%. An estimated 100,000 persons will visit the e-zoo in the first year, increasing by 30,000 each year, and they will receive, on the average, an additional 50.80 of benefit per visit when the new area is complete. Determine the…arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education