Concept explainers

The

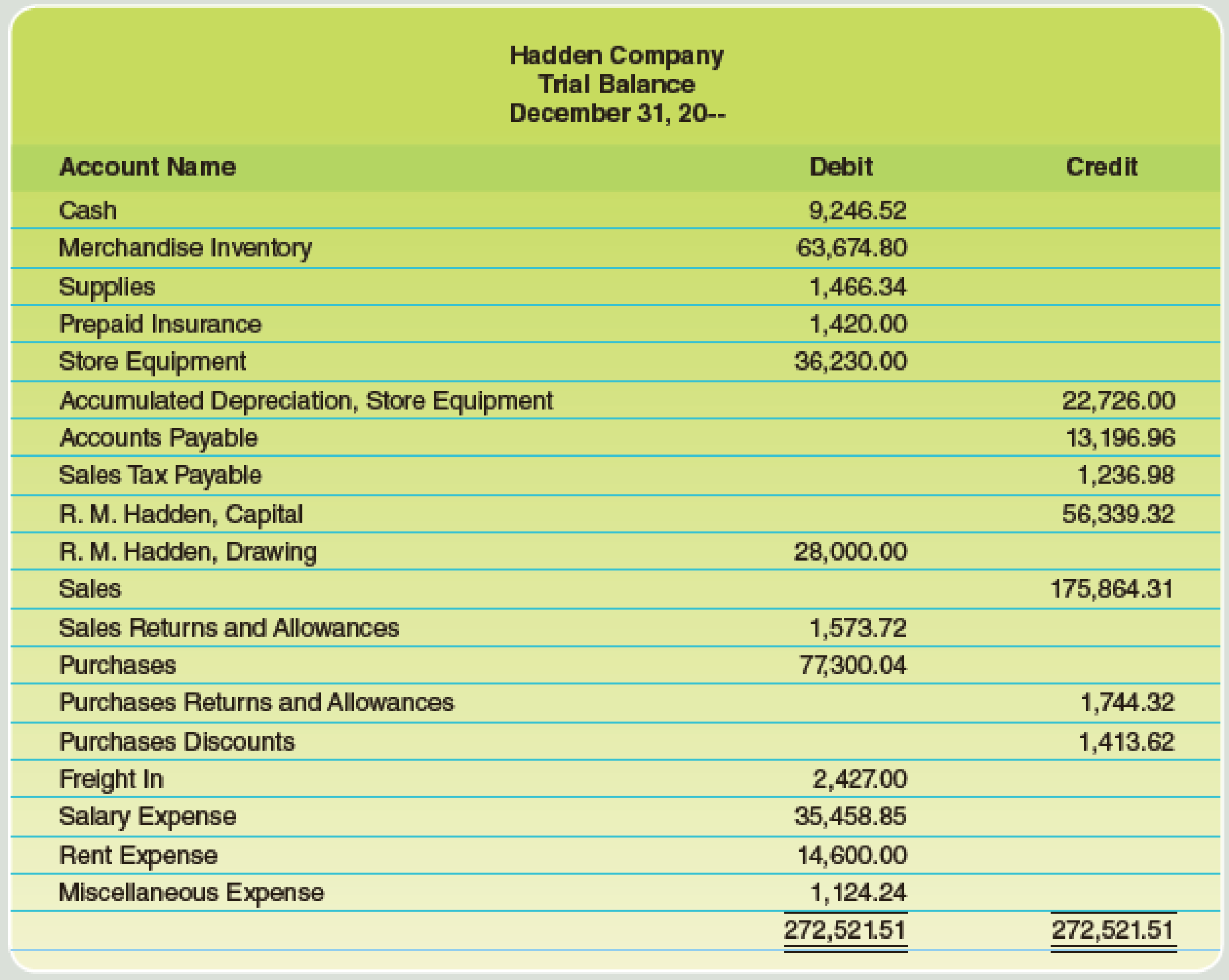

Here are the data for the adjustments.

a–b. Merchandise Inventory at December 31, $64,742.80.

c. Store supplies inventory (on hand), $420.20.

d. Insurance expired, $738.

e. Salaries accrued, $684.50.

f. Depreciation of store equipment, $3,620.

Required

Complete the work sheet after entering the account names and balances onto the work sheet.

Trending nowThis is a popular solution!

Chapter 11 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

MARKETING:REAL PEOPLE,REAL CHOICES

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Foundations of Financial Management

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Marketing: An Introduction (13th Edition)

- I want the correct answer with accounting questionarrow_forwardhelp me to solve this questionsarrow_forwardThe standard cost of Wonder Walkers includes 3 units of direct materials at $9.00 per unit. During July, the company buys 40,000 units of direct materials at $8.25 and uses those materials to produce 15,000 units. Compute the total, price, and quantity variances for materials.arrow_forward

- Branson paid $465,000 cash for all of the outstanding common stock of Wolfpack, Incorporated, on January 1, 2023. On that date, the subsidiary had a book value of $340,000 (common stock of $200,000 and retained earnings of $140,000), although various unrecorded royalty agreements (10-year remaining life) were assessed at a $100,000 fair value. Any remaining excess fair value was considered goodwill. In negotiating the acquisition price, Branson also promised to pay Wolfpack's former owners an additional $50,000 if Wolfpack's income exceeded $120,000 total over the first two years after the acquisition. At the acquisition date, Branson estimated the probability-adjusted present value of this contingent consideration at $35,000. On December 31, 2023, based on Wolfpack's earnings to date, Branson increased the value of the contingency to $40,000. During the subsequent two years, Wolfpack reported the following amounts for income and dividends: Dividends Declared Year Net Income $ 65,000…arrow_forwardAnswer? ? Financial accounting questionarrow_forwardCalculate the predetermined overhead tarearrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning