College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 5PA

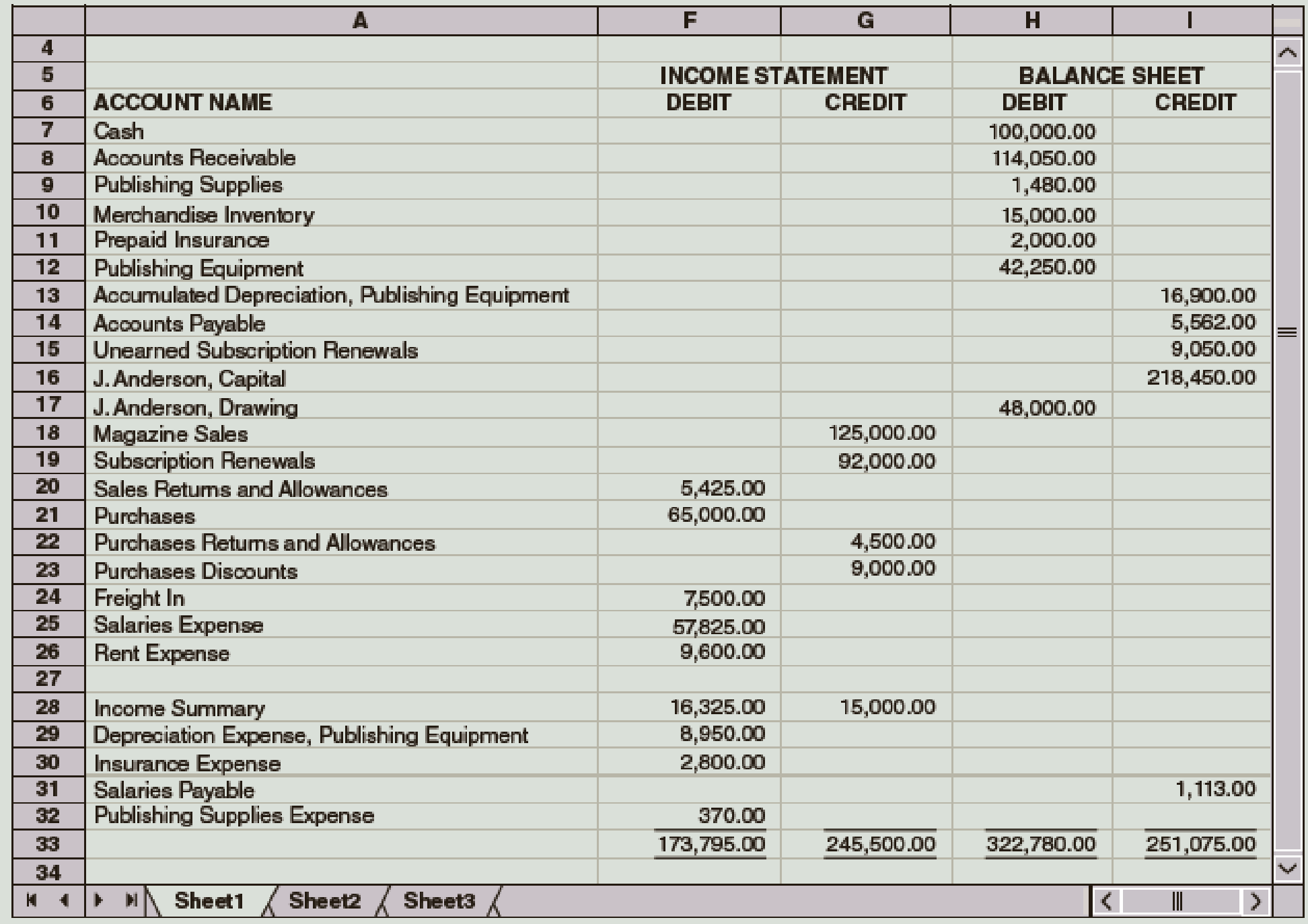

A portion of Anderson Publishing’s work sheet for the year ended December 31 follows:

Required

- 1. Determine the entries that appeared in the Adjustments columns and prepare the general

journal entries for the adjustments. If using Working Papers, start on page 120 in the general journal. - 2. Determine the net income for the year.

- 3. What is the amount of ending capital?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the amount of straight line depreciation for each year of this financial accounting question?

Do fast answer of this accounting questions

The stock P/E ratio

Chapter 11 Solutions

College Accounting (Book Only): A Career Approach

Ch. 11 - Which of the following is the adjusting entry for...Ch. 11 - The adjusting entry for unearned revenue pertains...Ch. 11 - An account that has unearned in its name is...Ch. 11 - This type of inventory system does not require an...Ch. 11 - The Supplies account has a 1,400 balance. A...Ch. 11 - Prob. 6QYCh. 11 - Prob. 7QYCh. 11 - What is a physical inventory? What does the word...Ch. 11 - Prob. 2DQCh. 11 - Using the perpetual inventory system, what account...

Ch. 11 - Prob. 4DQCh. 11 - Prob. 5DQCh. 11 - Why is it necessary to adjust the Merchandise...Ch. 11 - A merchandising company shows 8,842 in the...Ch. 11 - Prob. 8DQCh. 11 - Prob. 1ECh. 11 - On October 31, the Vermillion Igloos Hockey Club...Ch. 11 - Basga Company uses the periodic inventory system....Ch. 11 - Prob. 4ECh. 11 - Journalize the required adjusting entries for the...Ch. 11 - On December 31, the end of the year, the...Ch. 11 - On December 31, Marchant Company took a physical...Ch. 11 - The trial balance of Hadden Company as of December...Ch. 11 - The balances of the ledger accounts of Beldren...Ch. 11 - Prob. 3PACh. 11 - Here are the accounts in the ledger of Mishas...Ch. 11 - A portion of Anderson Publishings work sheet for...Ch. 11 - The trial balance of Jillson Company as of...Ch. 11 - The balances of the ledger accounts of Pelango...Ch. 11 - Prob. 3PBCh. 11 - The accounts and their balances in the ledger of...Ch. 11 - A portion of Johnsons Farm Supply work sheet for...Ch. 11 - BURTS BEES, Durham, North Carolina Burts Bees...Ch. 11 - Prob. 2ACh. 11 - Prob. 3ACh. 11 - Prob. 4ACh. 11 - Prob. 5ACh. 11 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

• Illustrate and interpret shifts in the short-run and long-run aggregate supply curves.

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY