HORNGRENS COST ACCOUNTING W/ACCESS

16th Edition

ISBN: 9781323687604

Author: Datar

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 11.45P

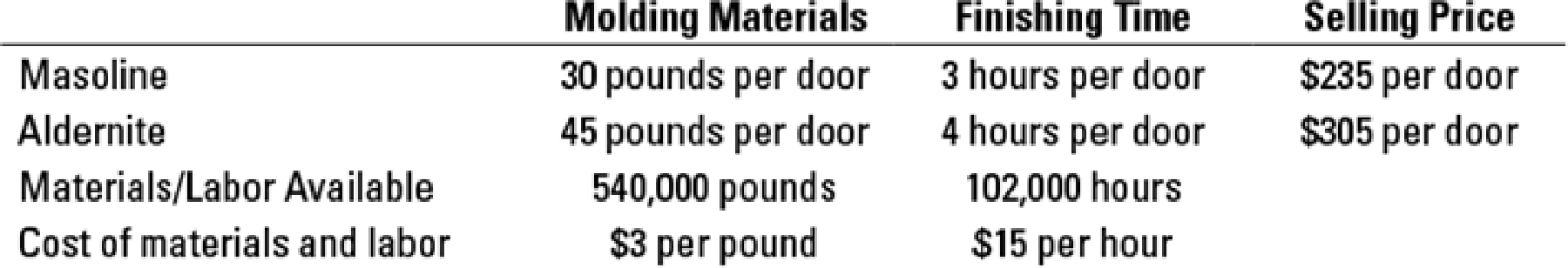

Theory of constraints, contribution margin, sensitivity analysis. Damon Furniture (DF) produces fiberglass doors in two processes: molding and finishing. DF is currently producing two models: Masoline and Aldernite. Production in the molding department is limited by the amount of materials available. Production in the finishing department is limited by the amount of trained labor available. The only variable costs are materials in the molding department and labor in the finishing department. Following are the requirements and limitations by model and department:

The following requirements refer only to the preceding data. There is no connection between the requirements.

- 1. If there were enough demand for either door, which door would DF produce? How many of these doors would it make and sell?

- 2. If DF sells three Masoline for each Aldernite, how many doors of each type would it produce and sell? What would be the total contribution margin?

- 3. If DF sells three Masoline for each Aldernite, how much would production and contribution margin increase if the molding department could buy 9,000 more pounds of materials for $3 per pound?

- 4. If DF sells three Masoline for each Aldernite, how much would production and contribution margin increase if the assembly department could get 780 more labor hours at $15 per hour?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the return on assets on this general accounting question?

Richard has the following potential liabilities:

William, a former employee, has sued Richard for $880,000. Richard contacted his attorney, and the case is believed to be

frivolous.

Carter sued Richard for an undisclosed amount for a class action lawsuit. Richard thinks it's frivolous, but his attorneys

indicate a loss is probable for $88,000.

Charles sued Richard because he slipped outside of Richard's store. The claim is $264,000 and Richard is certain he will lose

the case but believes Charles will settle. The attorneys agree and based on conversations with Charles's attorneys, have stated

that it is remote the claim will be settled for $255,200. Charles's attorneys indicated he would be willing to accept either cash

of $242,000 or shares of Richard's closely-held common stock currently valued at $233,200. Richard would prefer not to

settle in cash.

Richard is suing William for $264,000 because William is in violation of a non-compete agreement he has with Richard.

Richard is…

Need answer the financial accounting question not use ai

Chapter 11 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

Ch. 11 - Prob. 11.1QCh. 11 - Define relevant costs. Why are historical costs...Ch. 11 - All future costs are relevant. Do you agree? Why?Ch. 11 - Distinguish between quantitative and qualitative...Ch. 11 - Describe two potential problems that should be...Ch. 11 - Variable costs are always relevant, and fixed...Ch. 11 - A component part should be purchased whenever the...Ch. 11 - Prob. 11.8QCh. 11 - Managers should always buy inventory in quantities...Ch. 11 - Management should always maximize sales of the...

Ch. 11 - Prob. 11.11QCh. 11 - Cost written off as depreciation on equipment...Ch. 11 - Managers will always choose the alternative that...Ch. 11 - Prob. 11.14QCh. 11 - Prob. 11.15QCh. 11 - Qualitative and quantitative factors. Which of the...Ch. 11 - Special order, opportunity cost. Chade Corp. is...Ch. 11 - Prob. 11.18MCQCh. 11 - Keep or drop a business segment. Lees Corp. is...Ch. 11 - Relevant costs. Ace Cleaning Service is...Ch. 11 - Disposal of assets. Answer the following...Ch. 11 - Relevant and irrelevant costs. Answer the...Ch. 11 - Multiple choice. (CPA) Choose the best answer. 1....Ch. 11 - Special order, activity-based costing. (CMA,...Ch. 11 - Make versus buy, activity-based costing. The...Ch. 11 - Inventory decision, opportunity costs. Best Trim,...Ch. 11 - Relevant costs, contribution margin, product...Ch. 11 - Selection of most profitable product. Body Image,...Ch. 11 - Theory of constraints, throughput margin, relevant...Ch. 11 - Closing and opening stores. Sanchez Corporation...Ch. 11 - Prob. 11.31ECh. 11 - Relevance of equipment costs. Janets Bakery is...Ch. 11 - Equipment upgrade versus replacement. (A. Spero,...Ch. 11 - Special order, short-run pricing. Diamond...Ch. 11 - Short-run pricing, capacity constraints. Fashion...Ch. 11 - International outsourcing. Riverside Clippers Corp...Ch. 11 - Relevant costs, opportunity costs. Gavin Martin,...Ch. 11 - Opportunity costs and relevant costs. Jason Wu...Ch. 11 - Opportunity costs. (H. Schaefer, adapted) The Wild...Ch. 11 - Make or buy, unknown level of volume. (A....Ch. 11 - Make versus buy, activity-based costing,...Ch. 11 - Prob. 11.42PCh. 11 - Product mix, special order. (N. Melumad, adapted)...Ch. 11 - Theory of constraints, throughput margin, and...Ch. 11 - Theory of constraints, contribution margin,...Ch. 11 - Closing down divisions. Ainsley Corporation has...Ch. 11 - Dropping a product line, selling more tours....Ch. 11 - Prob. 11.48PCh. 11 - Dropping a customer, activity-based costing,...Ch. 11 - Equipment replacement decisions and performance...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Give me true answer this financial accounting questionarrow_forwardI cannot figure out the account of "Goodwill" or "APIC from Pushdown Accounting." I thought APIC should be $285,000, but it didn't work for some reason. And I didn't know we had goodwill, but we do, and I can't figure out how to get the correct answer. I tried $350,000 for APIC, but that also doesn't work, and I am at a loss of what to do next. Please explain as clearly as possible how to do Goodwill and the APIC from Pushdown Accounting. Thanks so much! :)arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY