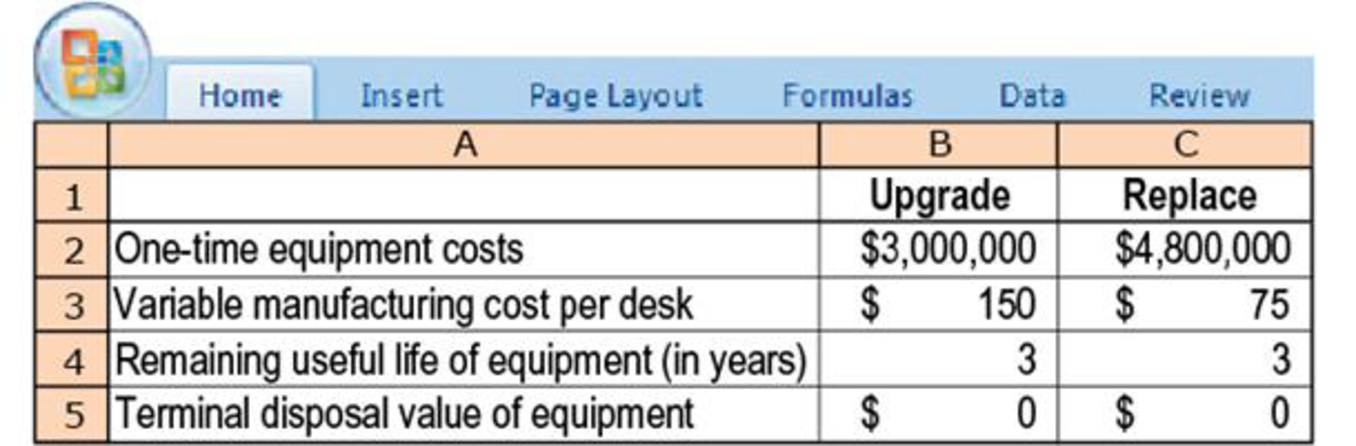

Equipment upgrade versus replacement. (A. Spero, adapted) The TechGuide Company produces and sells 7,500 modular computer desks per year at a selling price of $750 each. Its current production equipment, purchased for $1,800,000 and with a five-year useful life, is only two years old. It has a terminal disposal value of $0 and is

All equipment costs will continue to be depreciated on a straight-line basis. For simplicity, ignore income taxes and the time value of money.

- 1. Should TechGuide upgrade its production line or replace it? Show your calculations.

Required

- 2. Now suppose the one-time equipment cost to replace the production equipment is somewhat negotiable. All other data are as given previously. What is the maximum one-time equipment cost that TechGuide would be willing to pay to replace rather than upgrade the old equipment?

- 3. Assume that the capital expenditures to replace and upgrade the production equipment are as given in the original exercise, but that the production and sales quantity is not known. For what production and sales quantity would TechGuide (i) upgrade the equipment or (ii) replace the equipment?

- 4. Assume that all data are as given in the original exercise. Dan Doria is TechGuide’s manager, and his bonus is based on operating income. Because he is likely to relocate after about a year, his current bonus is his primary concern. Which alternative would Doria choose? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

- Financial Accounting Question please answerarrow_forwardHow much of every retail sales dollar is made up of merchandise cost on these general accounting question?arrow_forwardThe company where Daniel works produces skateboards locally but sells them globally for $60 each. Daniel is one of the production managers in a meeting to discuss preliminary results from the year just ended. Here is the information they had in front of them: Standard Quantity per Unit Standard Price Wood 2.50 feet $4.00 per foot Wheels 5.00 wheels $0.50 per wheel Direct labor 0.30 hours $14.00 per hour Actual results: . • Quantity of wood purchased, 225,000 feet; quantity of wood used, 220,000 feet. Quantity of wheels purchased, 418,800 wheels; quantity of wheels used, 400,800 wheels. Actual cost of the wood, $4.20 per foot. Actual cost of the wheels, $0.55 per wheel. • Quantity of DL hours used, 26,400 hours; actual cost of DL hours, $15.20 per hour. Actual units produced, 80,000 skateboards. (a) Complete a variance analysis for DM (both wood and wheels) and DL, determining the price and efficiency variances for each; be sure to specify the amount and sign of each variance. DM- Wood…arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning