HORNGRENS COST ACCOUNTING W/ACCESS

16th Edition

ISBN: 9781323687604

Author: Datar

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 11.28E

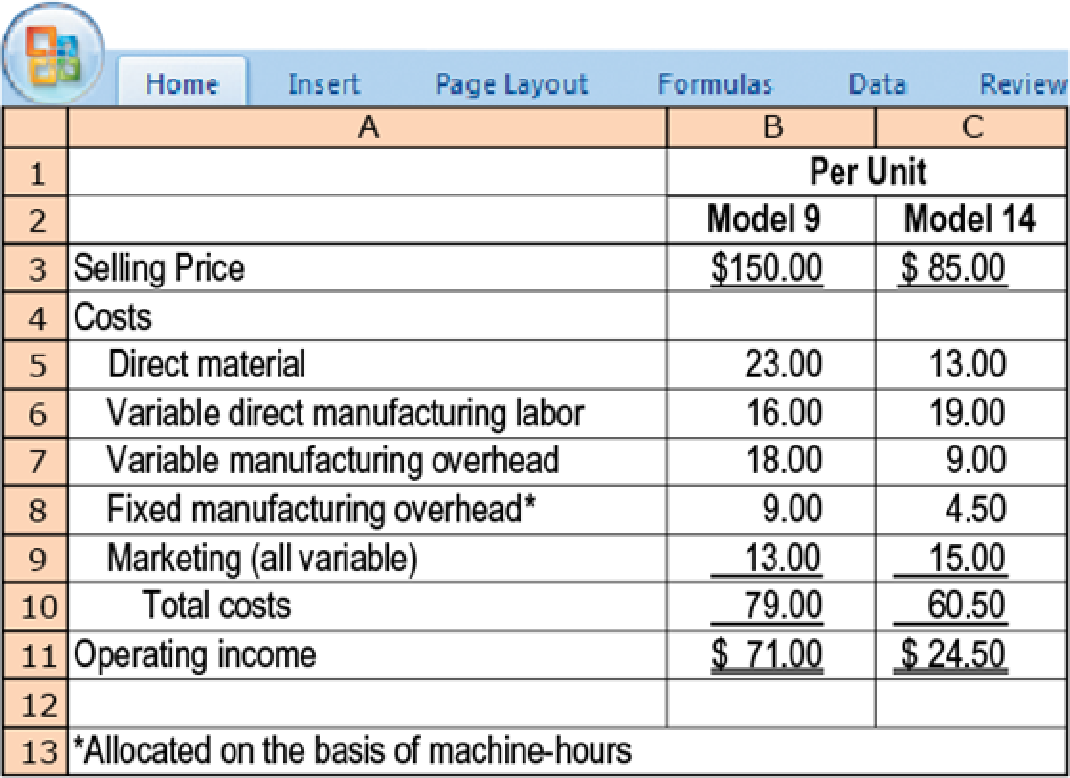

Selection of most profitable product. Body Image, Inc., produces two basic types of weight-lifting equipment, Model 9 and Model 14. Pertinent data are as follows:

The weight-lifting craze suggests that Body Image can sell enough of either Model 9 or Model 14 to keep the plant operating at full capacity. Both products are processed through the same production departments. Which product should the company produce? Briefly explain your answer.

Expert Solution & Answer

Learn your wayIncludes step-by-step video

schedule01:09

Students have asked these similar questions

hello tutor provide correct answer General accounting question

hi teacher please solve questions

Please given correct answer

Chapter 11 Solutions

HORNGRENS COST ACCOUNTING W/ACCESS

Ch. 11 - Prob. 11.1QCh. 11 - Define relevant costs. Why are historical costs...Ch. 11 - All future costs are relevant. Do you agree? Why?Ch. 11 - Distinguish between quantitative and qualitative...Ch. 11 - Describe two potential problems that should be...Ch. 11 - Variable costs are always relevant, and fixed...Ch. 11 - A component part should be purchased whenever the...Ch. 11 - Prob. 11.8QCh. 11 - Managers should always buy inventory in quantities...Ch. 11 - Management should always maximize sales of the...

Ch. 11 - Prob. 11.11QCh. 11 - Cost written off as depreciation on equipment...Ch. 11 - Managers will always choose the alternative that...Ch. 11 - Prob. 11.14QCh. 11 - Prob. 11.15QCh. 11 - Qualitative and quantitative factors. Which of the...Ch. 11 - Special order, opportunity cost. Chade Corp. is...Ch. 11 - Prob. 11.18MCQCh. 11 - Keep or drop a business segment. Lees Corp. is...Ch. 11 - Relevant costs. Ace Cleaning Service is...Ch. 11 - Disposal of assets. Answer the following...Ch. 11 - Relevant and irrelevant costs. Answer the...Ch. 11 - Multiple choice. (CPA) Choose the best answer. 1....Ch. 11 - Special order, activity-based costing. (CMA,...Ch. 11 - Make versus buy, activity-based costing. The...Ch. 11 - Inventory decision, opportunity costs. Best Trim,...Ch. 11 - Relevant costs, contribution margin, product...Ch. 11 - Selection of most profitable product. Body Image,...Ch. 11 - Theory of constraints, throughput margin, relevant...Ch. 11 - Closing and opening stores. Sanchez Corporation...Ch. 11 - Prob. 11.31ECh. 11 - Relevance of equipment costs. Janets Bakery is...Ch. 11 - Equipment upgrade versus replacement. (A. Spero,...Ch. 11 - Special order, short-run pricing. Diamond...Ch. 11 - Short-run pricing, capacity constraints. Fashion...Ch. 11 - International outsourcing. Riverside Clippers Corp...Ch. 11 - Relevant costs, opportunity costs. Gavin Martin,...Ch. 11 - Opportunity costs and relevant costs. Jason Wu...Ch. 11 - Opportunity costs. (H. Schaefer, adapted) The Wild...Ch. 11 - Make or buy, unknown level of volume. (A....Ch. 11 - Make versus buy, activity-based costing,...Ch. 11 - Prob. 11.42PCh. 11 - Product mix, special order. (N. Melumad, adapted)...Ch. 11 - Theory of constraints, throughput margin, and...Ch. 11 - Theory of constraints, contribution margin,...Ch. 11 - Closing down divisions. Ainsley Corporation has...Ch. 11 - Dropping a product line, selling more tours....Ch. 11 - Prob. 11.48PCh. 11 - Dropping a customer, activity-based costing,...Ch. 11 - Equipment replacement decisions and performance...

Additional Business Textbook Solutions

Find more solutions based on key concepts

15-18 Societal moral issue: Although enforcement of worker safety in Bangladesh is clearly lax, government offi...

Fundamentals of Management (10th Edition)

CT4-9 Companies prepare balance sheets in order to know their financial position at a specific point in time. T...

Financial Accounting: Tools for Business Decision Making, 8th Edition

Determining Acquisition Cost. Haply, Inc. incurred the following expenditures when acquiring a new assembly mac...

Intermediate Accounting (2nd Edition)

Determine the price elasticity of demand if, in response to an increase in price of 10 percent, quantity demand...

Microeconomics

What is costing system refinement? Describe three guidelines for refinement.

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Accounting question is correct answer with solutionarrow_forwardThe industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero. For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017. As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device. The company also paid €5,000 to an…arrow_forwardprovide correct answer of this General accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY