Concept explainers

LO 1-3

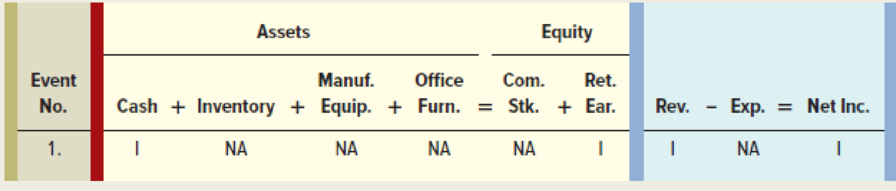

Exercise 1-7A Recording product versus SG&A costs in a financial statements model

Weib Manufacturing experienced the following events during its first accounting period:

1. Recognized revenue from cash sale of products.

2. Recognized cost of goods sold from sale referenced in Event 1.

3. Acquired cash by issuing common stock.

4. Paid cash to purchase raw materials that were used to make products.

5. Paid wages to production workers.

6. Paid salaries to administrative staff.

7. Recognized

8. Recognized depreciation on office furniture.

Required

Use the following horizontal financial statements model to show how each event affects the GAAP-based

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

SURVEY OF ACCOUNT.(LL)-W/ACCESS>CUSTOM<

- I am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forwardPlease provide the accurate answer to this financial accounting problem using valid techniques.arrow_forwardPlease provide the correct answer to this financial accounting problem using valid calculations.arrow_forward

- Please fill the empty cell in this problem. It is the only thing I need.arrow_forwardPlease explain the solution to this financial accounting problem with accurate principles.arrow_forwardWhat exactly are intangible assets and how are they defined? How are intangible assets different from plant assets?arrow_forward

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,