SURVEY OF ACCOUNT.(LL)-W/ACCESS>CUSTOM<

5th Edition

ISBN: 9781260222326

Author: Edmonds

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 14E

Cost of goods manufactured and sold

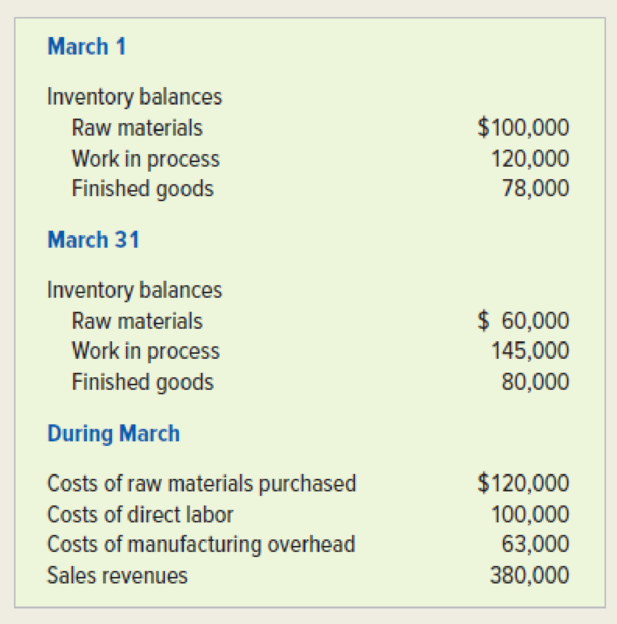

The following information pertains to Flaxman Manufacturing Company for March 2018. Assume actual

Required

- a. Prepare a schedule of cost of goods manufactured and sold.

- b. Calculate the amount of gross margin on the income statement.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

ACCOUNTING?

Accounting?

Can you help me solve this general accounting problem with the correct methodology?

Chapter 10 Solutions

SURVEY OF ACCOUNT.(LL)-W/ACCESS>CUSTOM<

Ch. 10 - 1. What are some differences between financial and...Ch. 10 - 2. What does the value-added principle mean as it...Ch. 10 - 4. How does product costing used in financial...Ch. 10 - 5. What does the statement costs can be assets or...Ch. 10 - 6. Why are the salaries of production workers...Ch. 10 - 7. How do product costs affect the financial...Ch. 10 - 8. What is an indirect cost? Provide examples of...Ch. 10 - 9. How does a product cost differ from a selling,...Ch. 10 - 10. Why is cost classification important to...Ch. 10 - 11. What is cost allocation? Give an example of a...

Ch. 10 - 13. What are some of the common ethical conflicts...Ch. 10 - 14. What costs should be considered in determining...Ch. 10 - 15. What is a just-in-time (JIT) inventory system?...Ch. 10 - Prob. 14QCh. 10 - Prob. 15QCh. 10 - Prob. 16QCh. 10 - Prob. 17QCh. 10 - Prob. 18QCh. 10 - Prob. 19QCh. 10 - Prob. 1ECh. 10 - Exercise 1-2A Identifying product versus selling,...Ch. 10 - Prob. 3ECh. 10 - Prob. 4ECh. 10 - Prob. 5ECh. 10 - Exercise 1-6A Identifying product versus SGA costs...Ch. 10 - LO 1-3 Exercise 1-7A Recording product versus SGA...Ch. 10 - Prob. 8ECh. 10 - LO 1-4 Exercise 1-9A Upstream, midstream, and...Ch. 10 - Prob. 10ECh. 10 - Prob. 11ECh. 10 - Prob. 12ECh. 10 - Prob. 13ECh. 10 - Cost of goods manufactured and sold The following...Ch. 10 - Prob. 15ECh. 10 - Exercise 1-14A Using JIT to minimize waste and...Ch. 10 - Prob. 17ECh. 10 - Prob. 18ECh. 10 - Prob. 19ECh. 10 - Prob. 20ECh. 10 - Problem 1-19A Characteristics of financial versus...Ch. 10 - Prob. 22PCh. 10 - Problem 1-21A Effect of product versus period...Ch. 10 - Problem 1-22A Product versus SGA costs The...Ch. 10 - Prob. 25PCh. 10 - Prob. 26PCh. 10 - Prob. 27PCh. 10 - Prob. 28PCh. 10 - Prob. 29PCh. 10 - Prob. 30PCh. 10 - Prob. 31PCh. 10 - Prob. 32PCh. 10 - Prob. 1ATCCh. 10 - Prob. 2ATCCh. 10 - Prob. 3ATCCh. 10 - Prob. 4ATCCh. 10 - Ethical Dilemma Product cost versus selling and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you help me solve this financial accounting problem using the correct accounting process?arrow_forwardPlease provide the accurate answer to this financial accounting problem using valid techniques.arrow_forwardI need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License