Concept explainers

a.

The

a.

Answer to Problem 26P

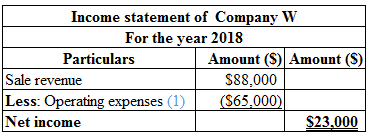

The calculation of income statement of Company W is as follows:

Table (1)

Hence, the net income of Company W is $23,000.

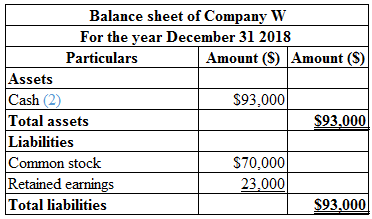

The calculation of balance sheet of Company W is as follows:

Table (2)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The entire $65,000 is treated as operating expenses.

(1)

The total cash is calculated as follows:

Hence, the total cash is $93,000.

(2)

b.

The balance sheet and income statement of Company W according to GAAP.

b.

Answer to Problem 26P

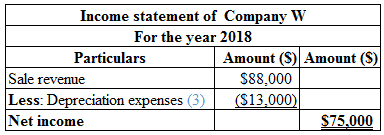

The calculation of income statement of Company W is as follows:

Table (3)

Hence, the net income of Company W is $75,000.

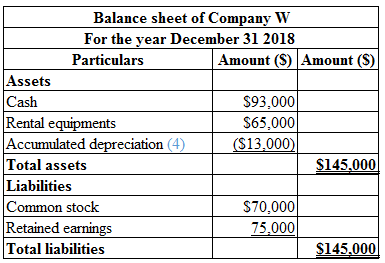

The calculation of balance sheet of Company W is as follows:

Table (4)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The

Hence, the depreciation is $13,000.

(3)

The depreciation amount $13,000 must be adjusted in the balance sheet as

(4)

c.

The balance sheet and income statement of Company W according to GAAP.

c.

Answer to Problem 26P

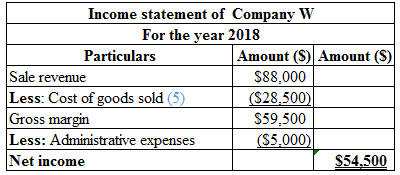

The calculation of income statement of Company W is as follows:

Table (5)

Hence, the net income of Company W is $54,500.

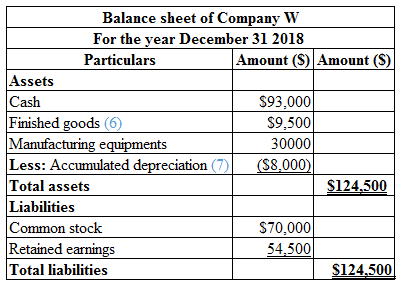

The calculation of balance sheet of Company W is as follows:

Table (6)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The depreciation on the manufacturing equipment is calculated as follows:

Hence, the depreciation cost is $8,000.

The cost per unit is calculated as follows:

Hence, the cost per unit is $19.

Calculate the cost of goods sold:

Hence, the cost of goods sold is $28,500.

(5)

The total finished goods are calculated as follows:

Hence, the finished goods are $9,500.

(6)

The depreciation on the manufacturing equipment is calculated as follows:

Hence, the accumulated depreciation cost is $8,000.

(7)

d.

Explain the reason why management might be more interested in average cost than the actual cost.

d.

Explanation of Solution

The exact cost of the product cannot be determined because the labor and material usage will differ among the same products. Cost average is an element that smoothens these differences.

Want to see more full solutions like this?

Chapter 10 Solutions

SURVEY OF ACCOUNT.(LL)-W/ACCESS>CUSTOM<

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning