Stock Dividends and Stock Splits

The

Required:

- Assume that Castle issued 60,000 shares for cash at the inception of the corporation and that no new shares have been issued since. Determine how much cash was received for the shares issued at inception.

- Assume that Castle issued 30,000 shares for cash at the inception of the corporation and subsequently declared a 2-for-l stock split. Determine how much cash was received for the shares issued at inception.

- Assume that Castle issued 57,000 shares for cash at the inception of the corporation and that the remaining 3,000 shares were issued as the result of stock dividends when the stock was selling for $53 per share. Determine how much cash was received for the shares issued at inception.

(a)

Introduction:

Common stock is issued by the company to raise finance using equity. It isissued to the investors (who are regarded as stockholders or shareholders, once common stock are issued to them) with no obligation to pay dividend periodically. Common stock is also referred to as common shares.

To calculate:

Cash received on issue of shares.

Answer to Problem 72E

$491,800 was received as cash at the inception of corporation.

Explanation of Solution

Given:

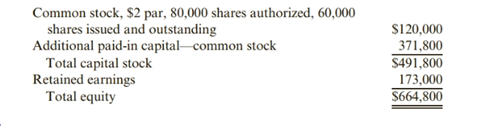

The following equity statement:

| Particulars | $ |

| Common stock, $2 par, 80,000 shares authorized, 60,000 issued and outstanding | 120,000 |

| (+) Additional Paid-in capital − common stock | 371,800 |

| Total Capital Stock | 491,800 |

| Retained Earnings | 173,000 |

| Total Stockholders’ equity | 664,800 |

At the time of inception:

No. of shares issued = 60,000

Par value = $2

Total Par Value of shares issued =

Total Par Value of shares issued =

Total Par Value of shares issued = $120,000

Additional Paid in capital −common stock = $371,800

Journal Entries

| Date | Particulars | Debit ($) | Credit ($) |

| No date given | Cash Dr. Common Stock Additional Paid in capital −common stock (Issue of shares at the inception of corporation.) |

491,800 | 120,000 371,800 |

(b)

Introduction:

A common stock is issued by the company to raise finance using equity. It is issued to the investors (who are regarded as stockholders or shareholders, once common stock is issued to them) with no obligation to pay dividend periodically. Common stock is also referred to as common shares.

To calculate:

Cash received on issue of shares and split stock.

Answer to Problem 72E

$467,210 was received as cash at the inception of corporation.

Explanation of Solution

Given:

The following equity statement:

| Particulars | $ |

| Common stock, $2 par, 80,000 shares authorized, 60,000 issued and outstanding | 120,000 |

| (+) Additional Paid-in capital − common stock | 371,800 |

| Total Capital Stock | 491,800 |

| Retained Earnings | 173,000 |

| Total Stockholders’ equity | 664,800 |

At the time of inception:

No. of shares issued = 60,000

Par value = $2

Total Par Value of shares issued =

Total Par Value of shares issued =

Total Par Value of shares issued = $120,000

Additional Paid in capital −common stock = $371,800

Journal Entries

| Date | Particulars | Debit ($) | Credit ($) |

| No date given | Cash Dr. Common Stock Additional Paid in capital −common stock (Issue of shares at the inception of corporation.) |

491,800 | 120,000 371,800 |

Before stock split:

No. of shares issued = 60,000

Par value = $2

After, 2-for1 stock split:

No. of shares issued =

No. of shares issued = 120,000

Par value =

Par value = $1

No journal entry is recorded on stock. Though,the common stock capital remains same, only its structure i.e. no. of shares outstanding and par value of shares change.

Thus, the cash received from issues of shares and immediate stock split will be same as the cash received from issues of shares.

(c)

Introduction:

A common stock is issued by the company to raise finance using equity. It is issued to the investors (who are regarded as stockholders or shareholders, once common stock is issued to them) with no obligation to pay dividend periodically. Common stock is also referred to as common shares.

To calculate:

Cash received on issues of shares and stock dividend thereof.

Answer to Problem 72E

$491,800 was received as cash at the inception of corporation.

Explanation of Solution

Given:

The following equity statement:

| Particulars | $ |

| Common stock, $2 par, 80,000 shares authorized, 60,000 issued and outstanding | 120,000 |

| (+) Additional Paid-in capital − common stock | 371,800 |

| Total Capital Stock | 491,800 |

| Retained Earnings | 173,000 |

| Total Stockholder’s equity | 664,800 |

At the time of inception:

No. of shares issued = 57,000

Par value = $2

Total Par Value of shares issued =

Total Par Value of shares issued =

Total Par Value of shares issued = $114,000

Additional Paid in capital (for 60,000) common stock = $371,800

Additional Paid in capital (for 57,000) common stock =

Additional Paid in capital (for 57,000) common stock = $353,210

Journal Entries

| Date | Particulars | Debit ($) | Credit ($) |

| No date given | Cash Dr. Common Stock Additional Paid in capital −common stock (Issue of shares at the inception of corporation.) |

467,210 | 114,000 353,210 |

Stock Dividend = 3,000 shares

Market Value of shares = $53

Par Value of shares = $2

Total Par value of stock dividend =

Total Par value of stock dividend =

Total Par value of stock dividend = $6,000

Total Market value of stock dividend =

Total Market value of stock dividend =

Total Market value of stock dividend = $159,000

Additional Paid in capital = Total Market value of stock dividend - Total Par value

Additional Paid in capital = $159,000 - $6,000

Additional Paid in capital = $153,000

Journal Entries

| Date | Particulars | Debit ($) | Credit ($) |

| No date given | Retained Earnings Dr. Common Stock Additional Paid in capital −common stock (Issue of shares at the inception of corporation.) |

159,000 | 6,000 153,000 |

The first effect of both dividends (cash and stock) is on Retained Earnings of the company. If stock dividend is paid then, the second effect is on common stock and additional paid in capital account as new shares are issued as dividends which further increase the balance of these accounts.

Thus, stock dividend don’t involve any cash transaction and the amount received at the time of inception remains $467,210 (i.e. the amount received on issues of shares).

Want to see more full solutions like this?

Chapter 10 Solutions

Cornerstones of Financial Accounting

- Answer this financial accounting problemarrow_forwardIn standard costing, a. the standards are developed only for overhead costs. b. the standards are developed primarily from past costs. c. comparisons with actual costs usually are not performed. d. debit and credit entries to inventory accounts are made at standard costs.arrow_forward# General Accountarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage