INTRO MGRL ACCT LL W CONNECT

8th Edition

ISBN: 9781266376771

Author: BREWER

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 4F15

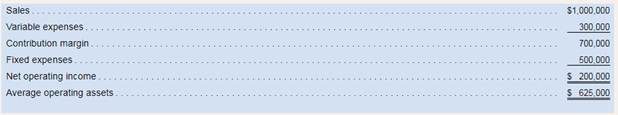

Westerville Company reported the following result from last year’s operations:

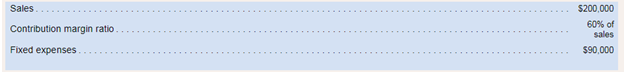

At the beginning of this year, the company has a $120,000 investment opportunity with following cost and revenue characteristics: The company’s minimum required

The company’s minimum required

Required:

15. What is the margin related to this year’s investment opportunity?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Accounting question and solution

What is the return on equity of this general accounting question?

general accounting

Chapter 10 Solutions

INTRO MGRL ACCT LL W CONNECT

Ch. 10 - What is meant by the term decentralization?Ch. 10 - What benefits result from decentralization?Ch. 10 - Distinguish between a cost center, a profit...Ch. 10 - What is meant by the terms margin and turnover in...Ch. 10 - Prob. 5QCh. 10 - In what way can the use of ROI as a performance...Ch. 10 - What is the difference between delivery cycle tame...Ch. 10 - What does a manufacturing cycle efficiency (MCE)...Ch. 10 - Prob. 9QCh. 10 - Prob. 10Q

Ch. 10 - Prob. 1AECh. 10 - Prob. 2AECh. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Prob. 6F15Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Prob. 9F15Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Westerville Company reported the following result...Ch. 10 - Compute the Return or Investment (ROI) Alyeska...Ch. 10 - Residual Income Jumper Design Lid of Manchester....Ch. 10 - Measures of Internal Business Process Performance...Ch. 10 - Building a Balanced Scorecard Lost Peak ski resort...Ch. 10 - Return on Investment (ROI) Provide the missing...Ch. 10 - Prob. 6ECh. 10 - Creating a Balanced Scorecard Ariel Tax Services...Ch. 10 - Computing and Interpreting Return on Investment...Ch. 10 - Return on Investment (ROI) and Residual Income...Ch. 10 - Cost-Volume-Profit Analysis and Return on...Ch. 10 - Effects of Charges in Profits arid Assets on...Ch. 10 - Prob. 12ECh. 10 - Effects of Changes in Sales, Expenses, and Assets...Ch. 10 - Measures of Internal Business Process Performance...Ch. 10 - Prob. 15PCh. 10 - Creating a Balanced Scorecard Mason Paper Company...Ch. 10 - Comparison of Performance Using Return on...Ch. 10 - Return on Investment (ROI) and Residual Income "I...Ch. 10 - Internal Business Process Performance Measures...Ch. 10 - Return on Investment (ROI) Analysis The...Ch. 10 - Creating Balanced Scorecards that Support...Ch. 10 - Prob. 22P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What are the structural deficit and the cyclical deficit?arrow_forwardWhat is the estimated overhead cost?arrow_forwardThe estimated allocation base is 39,800 machine hours and the estimated total manufacturing overhead cost is $96,300. The predetermined overhead rate to be applied to the jobs is? Give me Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License