Concept explainers

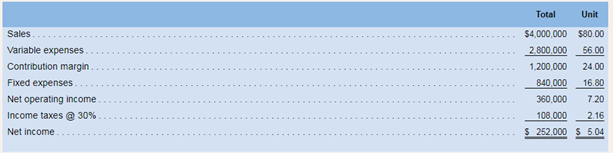

The -contribution format income statement for Huerra Company for last year is given below:

The company Lad average operating assets of $2,000,000 during the year.

Required:

1. Compute the company's return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover.

For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROE figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above.

2. Using Lean Production, the company is able to reduce the average level of inventory" by $400,000. (The released funds are used to pay off short-term creditors.)

3. The company achieves a cost savings of $32:000 per year by using less costly materials.

4. The company issues bonds and uses the proceeds to purchase machinery and equipment that increases average operating assets by $500:000. Interest on the bonds is $60,000 per year. Sales remain unchanged. The new, more efficient equipment reduces production costs by 520,000 per year.

5. As a result of a more intense effort by salespeople, sales are increased by 20%; operating assets remain unchanged.

6. At the beginning of the year obsolete inventory carried on the books at a cost of $40,000 is scrapped and written off as a loss.

7. At the beginning of the year the company uses $200,000 of cash (received on

- 1)

Return on Investment, Margin and Turnover:

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 4.5%

Explanation of Solution

- Given:

Sales = $4,000,000

Variable Expense = $2,800,000

Fixed Expenses=$840,000

Average Operating Assets = $2,000,000

- Formulae used:

- Calculations:

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 3.6%

Explanation of Solution

- Given:

Sales = $4,000,000

Variable Expense = $2,800,000

Fixed Expenses=$840,000

Average Operating Assets = $1,600,000

- Formulae used:

- Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

- Since the average level of inventory is reduced, the average operating assets for the year will also reduce by $400,000.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover and reduces when the average operating assets decrease and turnover increases.

3)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 4.9%

Explanation of Solution

- Given: Sales = $4,000,000

Variable Expense = $3,168,000

Fixed Expenses=$840,000

Average Operating Assets = $2,000,000

- Formulae used:

- Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

- Since the cost savings take place for the company, the value of variable expenses will reduce $32,000.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover and increases when there is a reduction in expenses.

4)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 5%

Explanation of Solution

- Given:

Sales = $4,000,000

Variable Expense = $2,780,000 [$2,800,000 - $20,000]

Fixed Expenses=$900,000 [$840,000 + $60,000]

Average Operating Assets = $2,500,000 [$2,000,000 + $500,000]

- Formulae used:

- Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

- Since the new plant and equipment is purchased, the average operating assets for the year will increase by $500,000.

- The cost of interest on bonds will increase the fixed expenses by $60,000 and the production cost savings will reduce variable costs by $20,000.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover and increases when the average operating assets increases.

5)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 10.071%

Explanation of Solution

- Given: Sales = $4,800,000 [$4000000 + $800000]

Variable Expense = $2,800,000

Fixed Expenses=$840,000

Average Operating Assets = $2,000,000

- Formulae used:

- Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

- Sales increase by 20% i.e. $800,000.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover and increases with an increase in the sale value.

6)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 3.92%

Explanation of Solution

- Given:

Sales = $4,000,000

Variable Expense = $2,840,000

Fixed Expenses=$840,000

Average Operating Assets = $1,960,000

- Formulae used:

Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

- Since the average level of inventory is scrapped, the average operating assets for the year will also reduce by $40,000 and variable expenses will increase by $40,000 to book loss on scrapping of assets.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover and reduces when the average operating assets decrease and expenses increase.

7)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 20P

Solution:

The Return on Investment for the year is 4.05%

Explanation of Solution

- Given:

Sales = $4,000,000

Variable Expense = $2,800,000

Fixed Expenses=$840,000

Average Operating Assets = $1,800,000

- Formulae used:

Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

- Since cash which is received from accounts receivable, is used to purchase common stock, the value of average operating assets will reduce

- Hence there is no impact on the balance of average operating assets and return on investment.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover and reduces when the average operating assets decrease.

Want to see more full solutions like this?

Chapter 10 Solutions

INTRO MGRL ACCT LL W CONNECT

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,