Concept explainers

Prepare comparative income statement and comparative schedule of cost of goods sold for each month under (1) absorption costing method and (2) variable costing method.

Explanation of Solution

Absorption costing: It refers to the method of product costing in which the price of the product is calculated considering all fixed as well as the variable or direct costs. The

Variable costing: It refers to the method of product costing in which the price of the product is calculated considering only the variable or direct costs or the cost that happened to occurred due to the product only. It also called as marginal costing as it takes marginal costs while calculating the product cost.

Prepare comparative income statement and comparative schedule of cost of goods sold for each month under (1) absorption costing method and (2) variable costing method as follows:

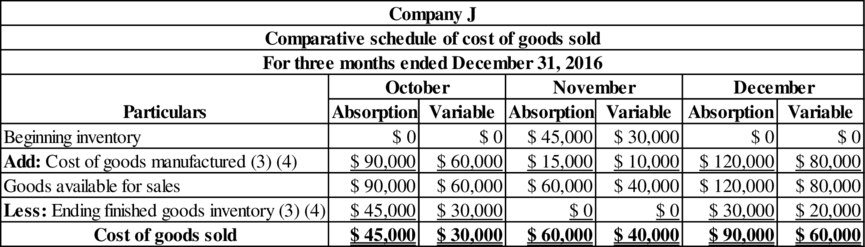

Comparative schedule of cost of goods sold for each month:

Table (1)

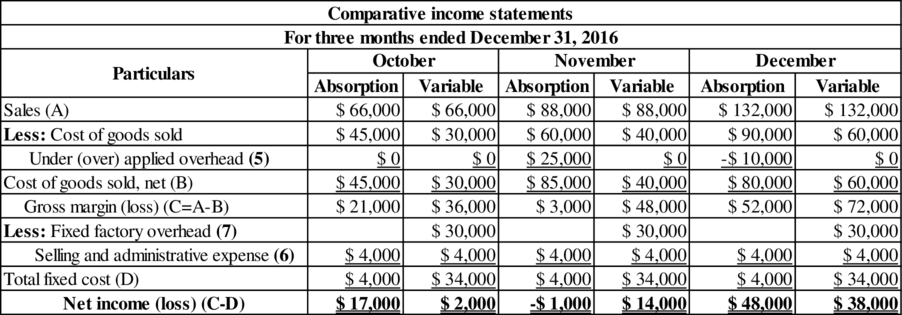

Comparative income statement for each month:

Table (2)

Working note (1):

Calculate the absorption costing per unit.

Working note (2):

Calculate the ending inventory units for each month.

| Particulars | October | November | December |

| Beginning inventory | 0 | 3,000 | 0 |

| Add: Number of units produced | 6,000 | 1,000 | 8,000 |

| Less: Number of units sold | 3,000 | 4,000 | 6,000 |

| Ending inventory | 3,000 | 0 | 2,000 |

Table (3)

Working note (3):

Calculate the cost of goods sold and ending inventory under absorption costing for each month.

| Particulars | October | November | December |

| Number of units produced (A) | 6,000 | 1,000 | 8,000 |

| Absorption cost per unit (B) (1) | $ 15 | $ 15 | $ 15 |

| Cost of goods manufactured | $ 90,000 | $ 15,000 | $ 120,000 |

| Ending inventories units (C) (2) | 3000 | 0 | 2000 |

| Absorption cost per unit (D) | $ 15 | $ 15 | $ 15 |

| Ending inventory | $ 45,000 | $ 0 | $ 30,000 |

| Beginning inventory units (E) (2) | 0 | 3,000 | 0 |

| Absorption cost per unit (F) | $ 15 | $ 15 | $ 15 |

| Beginning inventory | $ 0 | $ 45,000 | $ 0 |

Table (4)

Working note (4):

Calculate the cost of goods sold and ending inventory under variable costing for each month.

| Particulars | October | November | December |

| Number of units produced (A) | 6,000 | 1,000 | 8,000 |

| Variable cost per unit (B) | $ 10 | $ 10 | $ 10 |

| Cost of goods sold | $ 60,000 | $ 10,000 | $ 80,000 |

| Ending inventories units (C) (2) | 3000 | 0 | 2000 |

| Variable cost per unit (D) | $ 10 | $ 10 | $ 10 |

| Ending inventory | $ 30,000 | $ 0 | $ 20,000 |

| Beginning inventory units (E) (2) | 0 | 3,000 | 0 |

| Variable cost per unit (F) | $ 10 | $ 10 | $ 10 |

| Beginning inventory | $ 0 | $ 30,000 | $ 0 |

Table (5)

Working note (5):

Calculate the under or over applied fixed overhead.

October:

November:

December:

Working note (6):

Calculate the fixed selling and administrative expense per month.

Working note (7):

Calculate the fixed factory overhead per month.

Want to see more full solutions like this?

Chapter 10 Solutions

Principles of Cost Accounting

- Equipment with a cost of $2,340,000 has an estimated salvage value of $73,000 and an estimated life of 5 years or 62,000 hours. It is to be depreciated using the units-of-activity method. What is the amount of depreciation for the first full year, during which the equipment was used for 11,500 hours?arrow_forwardFelicity Systems has net income of $275,000, net sales of $1,950,000, and average total assets of $1,250,000. What is its return on total assets?arrow_forwardWhat is its return on total assets?arrow_forward

- Allowance for Doubtful Accounts has a debit balance of $1,800 at the end of the year, before adjustments. If an analysis of receivables indicates doubtful accounts of $29,500, what will be the amount of the appropriate adjusting entry?arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardFiona Industries plans to produce 30,000 units next period at a denominator activity of 60,000 direct labor hours. The direct labor wage rate is $16.50 per hour. The company's standards allow 2.2 yards of direct materials for each unit of product; the material costs $10.50 per yard. The company's budget includes a variable manufacturing overhead cost of $3.25 per direct labor hour and fixed manufacturing overhead of $285,000 per period. Using 60,000 direct labor hours as the denominator activity, compute the predetermined overhead rate and break it down into variable and fixed elements.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub