Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 1E

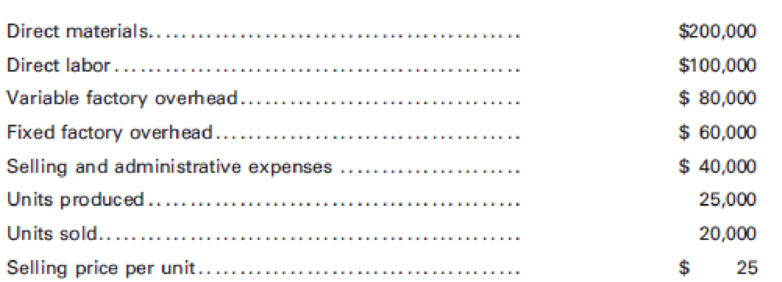

Yellowstone Fabricators uses a

There were no beginning inventories and no ending work in process inventory.

From the information presented, compute the following:

- 1. Unit cost of production under absorption costing and variable costing.

- 2. Cost of the ending inventory under absorption costing and variable costing.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

????

Solve this Accounting problem

Answer the below Questions

Chapter 10 Solutions

Principles of Cost Accounting

Ch. 10 - What is the difference between absorption costing...Ch. 10 - Distinguish between product costs and period...Ch. 10 - What effect will applying variable costing have on...Ch. 10 - What are the advantages and disadvantages of using...Ch. 10 - Prob. 5QCh. 10 - What is the difference between gross margin and...Ch. 10 - Why are there objections to using absorption...Ch. 10 - What are common costs?Ch. 10 - How is a contribution margin determined, and why...Ch. 10 - What are considered direct costs in segment...

Ch. 10 - What is cost-volume-profit analysis?Ch. 10 - Prob. 12QCh. 10 - What steps are required in constructing a...Ch. 10 - What is the difference between the contribution...Ch. 10 - What impact does income tax have on the break-even...Ch. 10 - Define differential analysis, differential...Ch. 10 - Prob. 17QCh. 10 - Prob. 18QCh. 10 - What are distribution costs?Ch. 10 - What is the purpose of the analysis of...Ch. 10 - In cost analysis, what determines which costs...Ch. 10 - Yellowstone Fabricators uses a process cost system...Ch. 10 - Using the information presented in E10-1, prepare...Ch. 10 - The chief executive officer of Acadia, Inc....Ch. 10 - The following production data came from the...Ch. 10 - A company had income of 50,000, using variable...Ch. 10 - The fixed overhead budgeted for Ranier Industries...Ch. 10 - Columbia Products Inc. has two divisions, Salem...Ch. 10 - The sales price per unit is 13 for the Voyageur...Ch. 10 - Teton, Inc. sells its only product for 50 per...Ch. 10 - A new product is expected to have sales of...Ch. 10 - Augusta Industries manufactures and sells two...Ch. 10 - A company has sales of 1,000,000, variable costs...Ch. 10 - Prob. 13ECh. 10 - A company has prepared the following statistics...Ch. 10 - Prob. 15ECh. 10 - Prob. 16ECh. 10 - Redwood Industries needs 20,000 units of a certain...Ch. 10 - Prob. 18ECh. 10 - Biscayne Industries has determined the cost of...Ch. 10 - Roosevelt Enterprises has determined the cost of...Ch. 10 - Prob. 3PCh. 10 - Prob. 4PCh. 10 - Prob. 5PCh. 10 - Arctic Software Inc. has two product lines. The...Ch. 10 - Prob. 7PCh. 10 - The production of a new product required Zion...Ch. 10 - Grand Canyon Manufacturing Inc. produces and sells...Ch. 10 - Prob. 10PCh. 10 - Emerald Island Company is considering building a...Ch. 10 - Royale Aluminum desires an after-tax income of...Ch. 10 - Deuce Sporting Goods manufactures a high-end model...Ch. 10 - Prob. 14PCh. 10 - Prob. 15PCh. 10 - Prob. 1MCCh. 10 - Denali Company manufactures household products...

Additional Business Textbook Solutions

Find more solutions based on key concepts

There is a huge demand in the United States and elsewhere for affordable women’s clothing. Low-cost clothing re...

Operations Management

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

Describe and evaluate what Pfizer is doing with its PfizerWorks.

Management (14th Edition)

Real options and its types. Introduction: The net present value is the variation between present cash inflows v...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY