Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 2MC

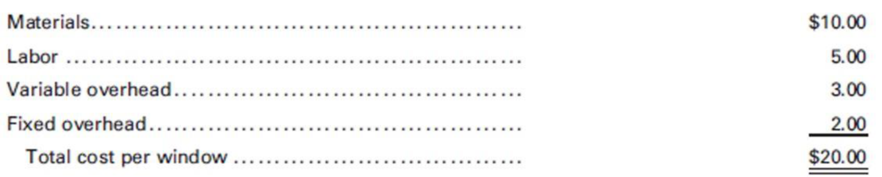

Denali Company manufactures household products such as windows, light fixtures, ladders, and work tables. During the year it produced 10,000 Model 10X windows but only sold 5,000 units at $40 each. The remaining units cannot be sold through normal channels. Cost for inventory purposes on December 31 included the following data on the unsold units:

Denali can sell the 5,000 windows at a liquidation price of $20.00 per window, but it will incur a packaging and shipping charge of $7.50 per window.

Required:

- 1. Identify the relevant costs and revenues for the liquidation sale alternative. Is Denali better off accepting the liquidation price rather than doing nothing?

- 2. Assume that Model 10X can be reprocessed to another size window, Model 20X, which will require the same amount of labor and

overhead as was required to initially produce, but sells for only $33. Determine the most profitable course of action—liquidate or reprocess.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the best estimate of the total monthly fixed manufacturing cost ?

Can you help me solve this financial accounting question using the correct accounting procedures?

Given solution for General accounting question not use ai

Chapter 10 Solutions

Principles of Cost Accounting

Ch. 10 - What is the difference between absorption costing...Ch. 10 - Distinguish between product costs and period...Ch. 10 - What effect will applying variable costing have on...Ch. 10 - What are the advantages and disadvantages of using...Ch. 10 - Prob. 5QCh. 10 - What is the difference between gross margin and...Ch. 10 - Why are there objections to using absorption...Ch. 10 - What are common costs?Ch. 10 - How is a contribution margin determined, and why...Ch. 10 - What are considered direct costs in segment...

Ch. 10 - What is cost-volume-profit analysis?Ch. 10 - Prob. 12QCh. 10 - What steps are required in constructing a...Ch. 10 - What is the difference between the contribution...Ch. 10 - What impact does income tax have on the break-even...Ch. 10 - Define differential analysis, differential...Ch. 10 - Prob. 17QCh. 10 - Prob. 18QCh. 10 - What are distribution costs?Ch. 10 - What is the purpose of the analysis of...Ch. 10 - In cost analysis, what determines which costs...Ch. 10 - Yellowstone Fabricators uses a process cost system...Ch. 10 - Using the information presented in E10-1, prepare...Ch. 10 - The chief executive officer of Acadia, Inc....Ch. 10 - The following production data came from the...Ch. 10 - A company had income of 50,000, using variable...Ch. 10 - The fixed overhead budgeted for Ranier Industries...Ch. 10 - Columbia Products Inc. has two divisions, Salem...Ch. 10 - The sales price per unit is 13 for the Voyageur...Ch. 10 - Teton, Inc. sells its only product for 50 per...Ch. 10 - A new product is expected to have sales of...Ch. 10 - Augusta Industries manufactures and sells two...Ch. 10 - A company has sales of 1,000,000, variable costs...Ch. 10 - Prob. 13ECh. 10 - A company has prepared the following statistics...Ch. 10 - Prob. 15ECh. 10 - Prob. 16ECh. 10 - Redwood Industries needs 20,000 units of a certain...Ch. 10 - Prob. 18ECh. 10 - Biscayne Industries has determined the cost of...Ch. 10 - Roosevelt Enterprises has determined the cost of...Ch. 10 - Prob. 3PCh. 10 - Prob. 4PCh. 10 - Prob. 5PCh. 10 - Arctic Software Inc. has two product lines. The...Ch. 10 - Prob. 7PCh. 10 - The production of a new product required Zion...Ch. 10 - Grand Canyon Manufacturing Inc. produces and sells...Ch. 10 - Prob. 10PCh. 10 - Emerald Island Company is considering building a...Ch. 10 - Royale Aluminum desires an after-tax income of...Ch. 10 - Deuce Sporting Goods manufactures a high-end model...Ch. 10 - Prob. 14PCh. 10 - Prob. 15PCh. 10 - Prob. 1MCCh. 10 - Denali Company manufactures household products...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need assistance with this general accounting question using appropriate principles.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardCould you explain the steps for solving this financial accounting question accurately?arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help with accounting questionarrow_forwardPrecisionCraft manufactures plastic components that require 3.2 kilograms of material at $2.50 per kilogram and 0.5 direct labor hours at $22.00 per hour. Overhead is assigned at the rate of $15 per direct labor hour. What is the total standard cost for one unit of product that would appear on a standard cost card?arrow_forward

- General accountingarrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardWhy does measurement attribute selection affect reporting quality? A. Standards fit everything B. Different value bases serve varying information needs C. Selection wastes time D. Single measures work universally need answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

What is liquidity?; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XtjS7CfUSsA;License: Standard Youtube License