a.

Prepare an income statement and the cost of unused books.

a.

Answer to Problem 29P

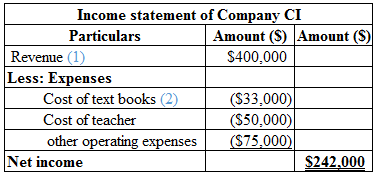

Calculation of income statement of the Company CI is as follows:

Table (1)

Hence, the net income is $242,000.

Calculation of cost of unused books is as follows:

Hence, the cost of waste associated with the unused books is $3,000.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Working notes:

Calculate the revenue:

Hence, the revenue is $400,000.

(1)

Calculate the total cost of textbooks:

Hence, the cost of textbooks is $33,000.

(2)

Note:

The company would normally make 10% more that the enrolled order.

Calculate the total number of books ordered:

Hence, the total number of books ordered is $220.

(3)

b.

Prepare an income statement and determine the amount of profit that is lost from the incapability of serving the 5 additional students.

b.

Answer to Problem 29P

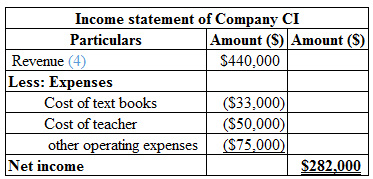

Calculation of income statement of the Company CI in case of 220 student is as follows:

Table (2)

Hence, the net income is $282,000.

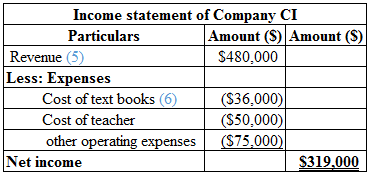

Calculation of income statement of the Company CI in case of 240 student is as follows:

Table (3)

Calculation of lost profit is as follows:

Hence, the lost profit by rejecting additional students is $37,000.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Working notes:

Note:

240 students attempted to register but only 220 students could be accepted.

Calculate the revenue for 220 students:

Hence, the revenue is $440,000.

(4)

Calculate the revenue for 240 students:

Hence, the revenue is $480,000.

(5)

Calculate the total cost of textbooks:

Hence, the cost of textbooks is $36,000.

(6)

c.

Prepare an income statement under the process of just in time system for 200 students, compare the income statement with requirement a., and comment how this system would affect the profitability.

c.

Answer to Problem 29P

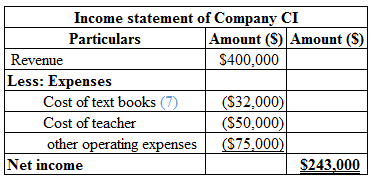

Calculation of income statement of the Company CI under just in time system for 200 students is as follows:

Table (4)

Hence, the net income is $243,000.

Comparison and comment on the income statement is as follows:

The expenses on the cost of textbooks will come down by using just in time inventory system than traditional inventory system used in requirement a. The revenue remains the same, but just in time inventory system will bring greater net income than traditional inventory system.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Just in time:

Just in time is a management strategy used by the organizations to decrease waste and increase the efficiency by receiving goods that are required for production which decreases the inventory cost.

Working notes:

Calculate the total cost of textbooks:

Hence, the cost of textbooks is $32,000.

(7)

d.

Prepare an income statement under the process of just in time system for 240 students, compare the income statement with requirement b., and comment how this system would affect the profitability.

d.

Answer to Problem 29P

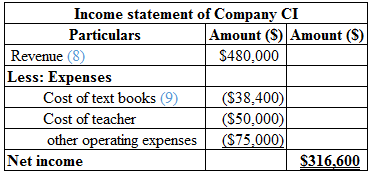

Calculation of income statement of the Company CI under just in time system for 240 students is as follows:

Table (5)

Hence, the net income is $243,000.

Comparison and comment on the income statement is as follows:

The extra revenue from 20 students would increase the cost of books under just in time inventory system. Therefore, it results in greater net income than the traditional inventory system.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Just in time:

Just in time is a management strategy used by the organizations to decrease waste and increase the efficiency by receiving goods that are required for production which decreases the inventory cost.

Working notes:

Calculate the revenue for 240 students:

Hence, the revenue is $480,000.

(8)

Calculate the total cost of textbooks:

Hence, the cost of textbooks is $38,400.

(9)

e.

Discuss the probable effects of the just in time inventory system on the level of customer satisfaction.

e.

Explanation of Solution

Just in time:

Just in time is a management strategy used by the organizations to decrease waste and increase the efficiency by receiving goods that are required for production which decreases the inventory cost.

The probable effect of just in time inventory system on the level of customer satisfaction is as follows:

Students who are deprived of from the enrollment might create a negative impression on the Company CI. This negative image can be spread easily among the public. The just in time system could help the company to improve the customer satisfaction level and increase their net income.

Want to see more full solutions like this?

Chapter 10 Solutions

Survey Of Accounting

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning