a.

The total amount of upstream cost.

a.

Explanation of Solution

Upstream cost: This cost is incurred before starting the manufacturing process such as research and development, and product design.

The given information:

- Fashion design cost is $20,000.

- Research and development cost is $30,000.

The calculation of upstream cost is as follows:

Hence, the upstream cost is $50,000.

b.

The total amount of downstream cost.

b.

Explanation of Solution

Downstream: This cost is incurred after starting the manufacturing process such as marketing, distribution, and customer service

The given information:

- Advertisement cost is $25,000.

- Administrative cost is $45,000.

The calculation of downstream cost is as follows:

Hence, the downstream cost is $70,000.

c.

The total amount of midstream cost.

c.

Explanation of Solution

Mid-stream: It is a cost incurred in making a product. It includes direct labor, direct materials, and manufacturing

The given information:

- Direct materials are $15.

- Direct labor is $17

- Manufacturing overheads are $8.

- Total production is 4,000 units.

The calculation of midstream cost is as follows:

Hence, the midstream cost is $160,000.

d.

The total amount of sales price.

d.

Explanation of Solution

The given information:

- Direct materials are $15.

- Direct labor is $17

- Manufacturing overheads are $8.

- Total production is 4,000 units.

- 150% on GAPP defined product.

The calculation of sales price is as follows:

Hence, the sales price is $60.

e.

The income statement based on GAPP.

e.

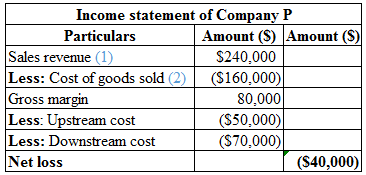

Answer to Problem 25P

The calculation of income statement of Company D is as follows:

Hence, the company has a net loss of $40,000.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

The given information:

- Direct materials are $15.

- Direct labor is $17

- Manufacturing overheads are $8.

- Total production is 4,000 units.

- Fashion design cost is $20,000.

- Research and development cost is $30,000.

- Advertisement cost is $25,000.

- Administrative cost is $45,000.

The sales revenue is calculated as follows:

Hence, the sales revenue is $240,000.

(1)

The cost of goods sold is calculated as follows:

Hence, the cost of goods sold is $160,000.

(2)

f.

Explain the reason for the net loss.

f.

Explanation of Solution

The management failed to consider the cost of downstream and upstream while pricing the product. Only the cost of GAPP based prices were considered. The selling price of the product is $60 and the total cost price of the product is $70 (3). Therefore, the selling price is less than the cost per unit and this explains why the company is facing loss.

Working notes:

The total cost per unit is calculated as follows:

Hence, the total cost per unit is $70.

Want to see more full solutions like this?

Chapter 10 Solutions

Survey Of Accounting

- Compute the manufacturing overhead rate for the year.arrow_forwardPortman Solutions paid out $42.5 million in total common dividends and reported $150.3 million of retained earnings at year-end. The prior year's retained earnings were $104.8 million. Assume that all dividends declared were actually paid. What was the net income for the year?arrow_forwardPlease need help with this general accounting questionarrow_forward

- Nonearrow_forwardCrimson Technologies had $3,200,000 in sales for the 2023 year. The company earned 7% on each dollar of sales. The company turned over its assets 3.5 times in 2023. The firm had a debt ratio of 40% during the year. What was the return on stockholders' equity for 2023? Answerarrow_forwardAccurate answerarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning