Concept explainers

a.

The

a.

Answer to Problem 26P

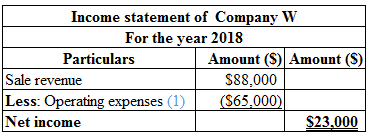

The calculation of income statement of Company W is as follows:

Table (1)

Hence, the net income of Company W is $23,000.

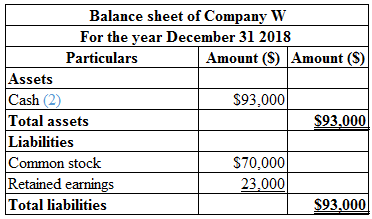

The calculation of balance sheet of Company W is as follows:

Table (2)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The entire $65,000 is treated as operating expenses.

(1)

The total cash is calculated as follows:

Hence, the total cash is $93,000.

(2)

b.

The balance sheet and income statement of Company W according to GAAP.

b.

Answer to Problem 26P

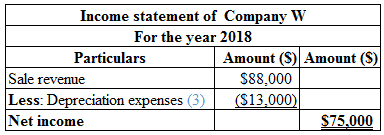

The calculation of income statement of Company W is as follows:

Table (3)

Hence, the net income of Company W is $75,000.

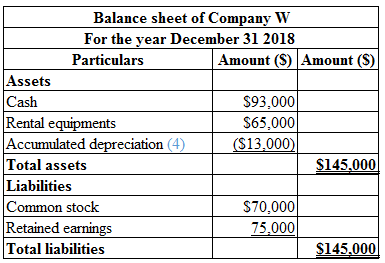

The calculation of balance sheet of Company W is as follows:

Table (4)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The

Hence, the depreciation is $13,000.

(3)

The depreciation amount $13,000 must be adjusted in the balance sheet as

(4)

c.

The balance sheet and income statement of Company W according to GAAP.

c.

Answer to Problem 26P

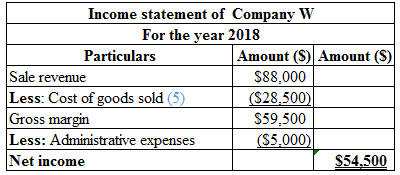

The calculation of income statement of Company W is as follows:

Table (5)

Hence, the net income of Company W is $54,500.

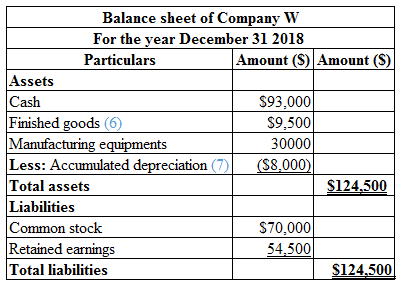

The calculation of balance sheet of Company W is as follows:

Table (6)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarize the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

The depreciation on the manufacturing equipment is calculated as follows:

Hence, the depreciation cost is $8,000.

The cost per unit is calculated as follows:

Hence, the cost per unit is $19.

Calculate the cost of goods sold:

Hence, the cost of goods sold is $28,500.

(5)

The total finished goods are calculated as follows:

Hence, the finished goods are $9,500.

(6)

The depreciation on the manufacturing equipment is calculated as follows:

Hence, the accumulated depreciation cost is $8,000.

(7)

d.

Explain the reason why management might be more interested in average cost than the actual cost.

d.

Explanation of Solution

The exact cost of the product cannot be determined because the labor and material usage will differ among the same products. Cost average is an element that smoothens these differences.

Want to see more full solutions like this?

Chapter 10 Solutions

Survey Of Accounting

- Compute Sunrise Enterprises' return on investment (ROI) for 2023.arrow_forwardThe estimated amount of ending inventory would bearrow_forwardCrystal Enterprises incurred manufacturing overhead costs of $275,000. Total overhead applied to jobs was $282,000. What was the amount of overapplied or underapplied overhead?arrow_forward

- Calculate the amountarrow_forwardSolve this questions accountingarrow_forwardWatson Industries has a predetermined overhead rate of 65% of direct labor cost. During the month, $420,000 of factory labor costs are incurred, of which $120,000 is indirect labor. Actual overhead incurred was $250,000. What would be the amount debited to the Work in Process Inventory? Find outarrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning