Concept explainers

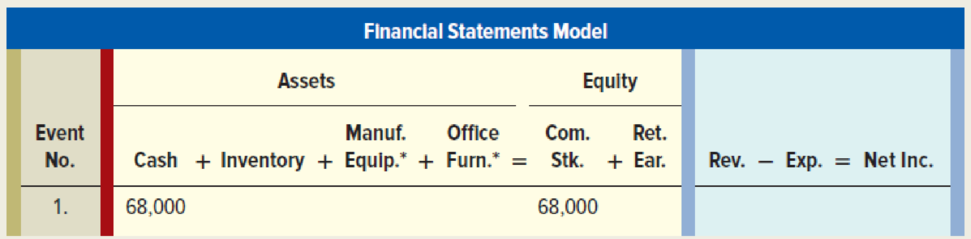

Problem 1-21A Effect of product versus period costs on financial statements

Sinclair Manufacturing Company experienced the following accounting events during its first year of operation. With the exception of the

1. Acquired $68,000 cash by issuing common stock.

2. Paid $8,700 for the materials used to make its products, all of which were started and completed during the year.

3. Paid salaries of $4,500 to selling and administrative employees.

4. Paid wages of $10,000 to production workers.

5. Paid $9,600 for furniture used in selling and administrative offices. The furniture was acquired on January 1. It had a $1,600 estimated salvage value and a four-year useful life.

6. Paid $16,000 for manufacturing equipment. The equipment was acquired on January 1. It had a $1,000 estimated salvage value and a five-year useful life.

7. Sold inventory to customers for $35,000 that had cost $14,000 to make.

Required

Explain how these events would affect the

*Record

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Survey Of Accounting

- helparrow_forwardBansai, age 66, retires and receives a $1,450 per month annuity from his employer's qualified pension plan. Bansai made $87,600 of after-tax contributions to the plan before retirement. Under the simplified method, Bansai's number of anticipated payments is 240. What is the amount includible in income in the first year of withdrawals assuming 12 monthly payments? A. $10,560 B. $12,540 C. $17,400 D. $8,220arrow_forwardWhat is the cost of goods sold?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education