Managerial Accounting: Tools for Business Decision Making

7th Edition

ISBN: 9781118334331

Author: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1.9BE

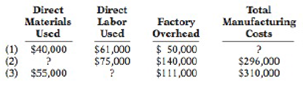

Presented below are incomplete manufacturing cost data. Determine the missing amounts for three different situations.

Determine missing amounts in computing total

(LO 3), AP

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I want to this question answer general accounting

help this answer.

What is the net income payable after the discount

Chapter 1 Solutions

Managerial Accounting: Tools for Business Decision Making

Ch. 1 - Prob. 1QCh. 1 - Distinguish between managerial and financial...Ch. 1 - How do the content of reports and the verification...Ch. 1 - Prob. 4QCh. 1 - Decision-making is managements most important...Ch. 1 - Explain the primary difference between line...Ch. 1 - Prob. 7QCh. 1 - Prob. 8QCh. 1 - How are manufacturing costs classified?Ch. 1 - Mel Finney claims that the distinction between...

Ch. 1 - Tina Burke is confused about the differences...Ch. 1 - Identify the differences in the cost of goods sold...Ch. 1 - The determination of the cost of goods...Ch. 1 - Sealy Company has beginning raw materials...Ch. 1 - Tate Inc. has beginning work in process 26,000,...Ch. 1 - Using the data in Question 15, what are (a) the...Ch. 1 - In what order should manufacturing inventories be...Ch. 1 - How does the output of manufacturing operations...Ch. 1 - Discuss whether the product costing techniques...Ch. 1 - What is the value chain? Describe, in sequence,...Ch. 1 - What is an enterprise resource planning (HRP)...Ch. 1 - Why is product quality important for companies...Ch. 1 - Explain what is meant by balanced in the balanced...Ch. 1 - In what ways can the budgeting process create...Ch. 1 - What new rules were enacted under the...Ch. 1 - What is activity-based costing, and what are its...Ch. 1 - Distinguish between managerial and financial...Ch. 1 - Prob. 1.2BECh. 1 - Determine whether each of the following costs...Ch. 1 - Prob. 1.4BECh. 1 - Identify whether each of the following costs...Ch. 1 - Presented below are Rook Companys monthly...Ch. 1 - Francum Company has the following data: direct...Ch. 1 - In alphabetical order below are current asset...Ch. 1 - Presented below are incomplete manufacturing cost...Ch. 1 - Use the same data from BE1-9 above and the data...Ch. 1 - Prob. 1.11BECh. 1 - Prob. 1.1DICh. 1 - Identify managerial cost classifications. (LO 2),...Ch. 1 - The following information is available for Tomlin...Ch. 1 - Match the descriptions that follow with the...Ch. 1 - Justin Bleeber has prepared the following list of...Ch. 1 - Presented below is a list of costs and expenses...Ch. 1 - Trak Corporation incurred the following costs...Ch. 1 - Determine the total amount of various types of...Ch. 1 - Gala Company is a manufacturer of laptop...Ch. 1 - Prob. 1.6ECh. 1 - National Express reports the following costs and...Ch. 1 - Lopez Corporation incurred the following costs...Ch. 1 - An incomplete cost of goods manufactured schedule...Ch. 1 - Manufacturing cost data for Copa Company are...Ch. 1 - Incomplete manufacturing cost data for Horizon...Ch. 1 - Cepeda Corporation has the following cost records...Ch. 1 - Keisha Tombert, the bookkeeper for Washington...Ch. 1 - The following information is available for Aikman...Ch. 1 - University Company produces collegiate apparel....Ch. 1 - An analysis of the accounts of Roberts Company...Ch. 1 - McQueen Motor Company manufactures automobiles....Ch. 1 - The following is a list of terms related to...Ch. 1 - Prob. 1.1APCh. 1 - Bell Company, a manufacturer of audio systems,...Ch. 1 - Incomplete manufacturing costs, expenses, and...Ch. 1 - Prepare a cost of goods manufactured schedule, a...Ch. 1 - Empire Company is a manufacturer of smart phones....Ch. 1 - Prob. 1.1WPCh. 1 - Prob. 1.1BYPCh. 1 - Tenrack is a fairly large manufacturing company...Ch. 1 - Prob. 1.4BYPCh. 1 - The primary purpose of managerial accounting is to...Ch. 1 - As noted in this chapter, because of global...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License