Managerial Accounting: Tools for Business Decision Making

7th Edition

ISBN: 9781118334331

Author: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 1.3E

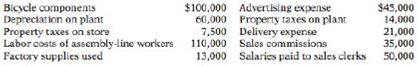

Trak Corporation incurred the following costs while manufacturing its bicycles.

Instructions

(a) Identify each of the above costs as direct materials, direct labor, manufacturing

(b) Explain the basic difference in accounting for product costs and period costs.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Don't use ai to answer I will report you answer

You are the owner of Veiled Wonders, a firm that makes window treatments. Some merchandise is custom-made to customer specifications, and some are mass-produced in standardized measurements. There are production workers who work primarily on standardized blinds and some employees who work on custom products on an as-needed basis. How should you structure the pay methods for these production workers?

General Accounting question

Chapter 1 Solutions

Managerial Accounting: Tools for Business Decision Making

Ch. 1 - Prob. 1QCh. 1 - Distinguish between managerial and financial...Ch. 1 - How do the content of reports and the verification...Ch. 1 - Prob. 4QCh. 1 - Decision-making is managements most important...Ch. 1 - Explain the primary difference between line...Ch. 1 - Prob. 7QCh. 1 - Prob. 8QCh. 1 - How are manufacturing costs classified?Ch. 1 - Mel Finney claims that the distinction between...

Ch. 1 - Tina Burke is confused about the differences...Ch. 1 - Identify the differences in the cost of goods sold...Ch. 1 - The determination of the cost of goods...Ch. 1 - Sealy Company has beginning raw materials...Ch. 1 - Tate Inc. has beginning work in process 26,000,...Ch. 1 - Using the data in Question 15, what are (a) the...Ch. 1 - In what order should manufacturing inventories be...Ch. 1 - How does the output of manufacturing operations...Ch. 1 - Discuss whether the product costing techniques...Ch. 1 - What is the value chain? Describe, in sequence,...Ch. 1 - What is an enterprise resource planning (HRP)...Ch. 1 - Why is product quality important for companies...Ch. 1 - Explain what is meant by balanced in the balanced...Ch. 1 - In what ways can the budgeting process create...Ch. 1 - What new rules were enacted under the...Ch. 1 - What is activity-based costing, and what are its...Ch. 1 - Distinguish between managerial and financial...Ch. 1 - Prob. 1.2BECh. 1 - Determine whether each of the following costs...Ch. 1 - Prob. 1.4BECh. 1 - Identify whether each of the following costs...Ch. 1 - Presented below are Rook Companys monthly...Ch. 1 - Francum Company has the following data: direct...Ch. 1 - In alphabetical order below are current asset...Ch. 1 - Presented below are incomplete manufacturing cost...Ch. 1 - Use the same data from BE1-9 above and the data...Ch. 1 - Prob. 1.11BECh. 1 - Prob. 1.1DICh. 1 - Identify managerial cost classifications. (LO 2),...Ch. 1 - The following information is available for Tomlin...Ch. 1 - Match the descriptions that follow with the...Ch. 1 - Justin Bleeber has prepared the following list of...Ch. 1 - Presented below is a list of costs and expenses...Ch. 1 - Trak Corporation incurred the following costs...Ch. 1 - Determine the total amount of various types of...Ch. 1 - Gala Company is a manufacturer of laptop...Ch. 1 - Prob. 1.6ECh. 1 - National Express reports the following costs and...Ch. 1 - Lopez Corporation incurred the following costs...Ch. 1 - An incomplete cost of goods manufactured schedule...Ch. 1 - Manufacturing cost data for Copa Company are...Ch. 1 - Incomplete manufacturing cost data for Horizon...Ch. 1 - Cepeda Corporation has the following cost records...Ch. 1 - Keisha Tombert, the bookkeeper for Washington...Ch. 1 - The following information is available for Aikman...Ch. 1 - University Company produces collegiate apparel....Ch. 1 - An analysis of the accounts of Roberts Company...Ch. 1 - McQueen Motor Company manufactures automobiles....Ch. 1 - The following is a list of terms related to...Ch. 1 - Prob. 1.1APCh. 1 - Bell Company, a manufacturer of audio systems,...Ch. 1 - Incomplete manufacturing costs, expenses, and...Ch. 1 - Prepare a cost of goods manufactured schedule, a...Ch. 1 - Empire Company is a manufacturer of smart phones....Ch. 1 - Prob. 1.1WPCh. 1 - Prob. 1.1BYPCh. 1 - Tenrack is a fairly large manufacturing company...Ch. 1 - Prob. 1.4BYPCh. 1 - The primary purpose of managerial accounting is to...Ch. 1 - As noted in this chapter, because of global...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Joint costs and byproducts. (W. Crum adapted) Royston, Inc., is a large food-processing company. It processes 1...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

15-18 Societal moral issue: Although enforcement of worker safety in Bangladesh is clearly lax, government offi...

Fundamentals of Management (10th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Using the numbers in the preceding question, what is the size of Ectenias labor force? a. 50 b. 60 c. 70 d. 80

Principles of Economics (MindTap Course List)

To assess the risk of investment opportunity from pooled residential mortgages. Introduction: The securities th...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

1.Which account does a merchandiser use that a service company does not use?

Learning Objective 1

cost of G...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wilson Corporation acquires Greatbatch Company for $80 million cash in a merger. The balance sheets of both companies at the date of acquisition are as follows: Balance Sheet (in millions) Wilson Greatbatch Current assets $96 $8 Property and equipment 800 144 Intangibles 32 4.8 Total assets $928 $156.8 Current liabilities $40 $3.2 Long-term debt 640 104 Capital stock 80 19.2 Retained earnings 192 24 Accumulated other comprehensive income (loss) (24) 6.4 Total liabilities and equity $928 $156.8 Greatbatch's property and equipment is overvalued by $48 million, its reported intangibles are undervalued by $32 million, and it has unreported intangibles, in the form of customer databases and marketing agreements, valued at $11.2 million. Required Prepare Wilson's balance sheet immediately following the merger. Use a negative sign with your answer for AOCI if the balance is a loss.arrow_forwardNot use ai solution given correct answerarrow_forwardGeneral Accounting questionarrow_forward

- Provide answer general Accountingarrow_forwardCompare and contrast experiences you have had with your own and other people’s monochromic time orientation and polychronic time orientation and how you can account for any differences in time orientation in your workplace communications in the future.arrow_forwardI need this question answer general Accountingarrow_forward

- Financial accounting questionarrow_forwardAns?? Financial accounting questionarrow_forwardYour career is expanding with an opportunity to support your company's growth in a non-U.S. country. Choose a country that you believe is a viable expansion option. Support your choice for this country by learning about the country's political, economic, and legal system. Share this information with your classmates by summarizing how these areas would contribute to the successful expansion project.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License