Bell Company, a manufacturer of audio systems, started its production in October 2017. For the preceding 3 years. Bell had been a retailer of audio systems After a thorough survey of audio system markets, Bell decided to turn its retail store into an audio equipment factory.

Raw materials cost for an audio system will total $74 per unit. Workers on the production lines are on average paid $12 per hour. An audio system usually takes 5 hours to complete. In addition, the rent on the equipment used to assemble audio systems amounts to $4,900 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,000.

Instructions

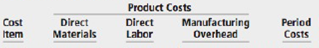

(a) Prepare an answer sheet with the following column headings.

Assuming that Bell manufactures, on average, 1,500 audio systems per month, enter each cost item on your answer sheet, placing the dollar amount per month under the appropriate headings. Total the dollar amounts in each of the columns.

(b) Compute the cost to produce one audio system.

(a) DM $111,000

DL $ 90,000

M0 $ 18,100

PC $ 9,500

Classify manufacturing costs into different categories and compute the unit cost.

(LO 2), AP

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Managerial Accounting: Tools for Business Decision Making

- How does stewardship accounting differ from traditional ownership accounting? a) Management decisions have no impact b) Legal ownership determines all treatments c) Resource management priorities supersede ownership rights d) Only shareholders matterarrow_forwardWhat are total assets at the end of the year on these financial accounting question?arrow_forwardCan you help me with accounting questionsarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning