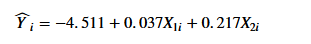

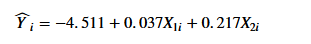

Profitability remains a challenge for banks and thrifts with less than $2 billion of assets. The business problem facing a bank analyst relates to the factors that affect return on average assets (ROAA), an indicator of how profitable a company is relative to its total assets. Data collected from a sample of 20 community banks resulted in the regression model Y₁ = -4.511 +0.037X₁ +0.217X2, where Y is the ROAA (%), X₁ is the efficiency ratio (%), and X₂ is the total risk-based capital (%). Complete parts (a) through (d) below. b. Plot the residuals versus X₁₁. Choose the correct graph below. O A. Q B. Q D. Q

Profitability remains a challenge for banks and thrifts with less than $2 billion of assets. The business problem facing a bank analyst relates to the factors that affect return on average assets (ROAA), an indicator of how profitable a company is relative to its total assets. Data collected from a sample of 20 community banks resulted in the regression model Y₁ = -4.511 +0.037X₁ +0.217X2, where Y is the ROAA (%), X₁ is the efficiency ratio (%), and X₂ is the total risk-based capital (%). Complete parts (a) through (d) below. b. Plot the residuals versus X₁₁. Choose the correct graph below. O A. Q B. Q D. Q

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:The table below presents financial metrics, including Return on Average Assets (ROAA), Efficiency Ratio, and Total Risk-Based Capital for various entities. These metrics are critical for assessing the financial health and performance of institutions. The ROAA (%) indicates how efficient a company is at using its assets to generate earnings. A higher ROAA suggests better performance. The Efficiency Ratio (%) reflects how well a company manages its expenses; lower values are preferred as they indicate better efficiency. Total Risk-Based Capital (%) evaluates the capital adequacy, ensuring the financial stability of the institution.

| ROAA (%) | Efficiency Ratio (%) | Total Risk-Based Capital (%) |

|----------|----------------------|------------------------------|

| 1.04 | 39.93 | 17.04 |

| 0.68 | 57.75 | 13.88 |

| 7.27 | 81.4 | 27.77 |

| 1.08 | 53.49 | 18.31 |

| 0.72 | 71.08 | 14.66 |

| 0.92 | 65.41 | 14.04 |

| 0.79 | 68.07 | 13.38 |

| 1.04 | 68.14 | 16.8 |

| 1.76 | 68.1 | 16.69 |

| 1.07 | 64.82 | 13.86 |

| 1.37 | 48.58 | 12 |

| 0.93 | 63.1 | 18.65 |

| 0.66 | 59.16 | 19.76 |

| 1.72 | 49.93 | 17.69 |

| 1.5 | 54.7 | 26.6 |

| 0.59 | 81.6 | 15.08 |

| 2.12 | 75.21 | 14.55 |

| 1.11 | 69.82 | 17.5 |

| 1.45 | 49.47 | 16.03 |

| 1.06 |

![**Understanding Bank Profitability in Relation to ROAA**

Profitability remains a challenge for banks and thrifts with less than $2 billion of assets. The main question for bank analysts is what factors affect the return on average assets (ROAA), an important measure of how profitable a company is in relation to its total assets. Here, data was collected from a sample of 20 community banks leading to the development of a specific regression model:

\[

\hat{Y} = -4.511 + 0.037X_{1i} + 0.217X_{2i}

\]

Where:

- \( Y \) = ROAA (%)

- \( X_1 \) = Efficiency ratio (%)

- \( X_2 \) = Total risk-based capital (%)

**Instructions:**

Complete the following steps to analyze the data:

**b. Plot the Residuals versus \( X_{1i} \). Choose the correct graph below:**

You are provided with four graphs labeled A, B, C, and D. Each graph plots the residuals against \( X_1 \) (Efficiency ratio), ranging from 25 to 100 on the \( X \)-axis, while the \( Y \)-axis represents the residuals ranging from -3 to 3. Select the graph that correctly displays the data distribution.

**c. Plot the Residuals versus \( X_{2i} \). Choose the correct graph below:**

Select the graph that accurately represents residuals plotted against \( X_2 \) (Total risk-based capital). Similar to the previous graphs, choose the one that reflects the correct pattern of data.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fc91d435c-8a20-4fa9-b80f-5aaeb9e13244%2F0e714288-f608-4486-b58f-b1f867644bd3%2Fzgx837_processed.png&w=3840&q=75)

Transcribed Image Text:**Understanding Bank Profitability in Relation to ROAA**

Profitability remains a challenge for banks and thrifts with less than $2 billion of assets. The main question for bank analysts is what factors affect the return on average assets (ROAA), an important measure of how profitable a company is in relation to its total assets. Here, data was collected from a sample of 20 community banks leading to the development of a specific regression model:

\[

\hat{Y} = -4.511 + 0.037X_{1i} + 0.217X_{2i}

\]

Where:

- \( Y \) = ROAA (%)

- \( X_1 \) = Efficiency ratio (%)

- \( X_2 \) = Total risk-based capital (%)

**Instructions:**

Complete the following steps to analyze the data:

**b. Plot the Residuals versus \( X_{1i} \). Choose the correct graph below:**

You are provided with four graphs labeled A, B, C, and D. Each graph plots the residuals against \( X_1 \) (Efficiency ratio), ranging from 25 to 100 on the \( X \)-axis, while the \( Y \)-axis represents the residuals ranging from -3 to 3. Select the graph that correctly displays the data distribution.

**c. Plot the Residuals versus \( X_{2i} \). Choose the correct graph below:**

Select the graph that accurately represents residuals plotted against \( X_2 \) (Total risk-based capital). Similar to the previous graphs, choose the one that reflects the correct pattern of data.

Expert Solution

Step 1

Given regression equation is,

| Y | X1 | X2 |  |

Residual=Y−Yˆ |

| 1.04-0.66409=0.37591 | ||||

| 0.68 | 57.75 | 13.88 | 0.63771 | 0.04229 |

| 7.27 | 81.4 | 27.77 | 4.52689 | 2.74311 |

| 1.08 | 53.49 | 18.31 | 1.4414 | -0.3614 |

| 0.72 | 71.08 | 14.66 | 1.30018 | -0.58018 |

| 0.92 | 65.41 | 14.04 | 0.95585 | -0.03585 |

| 0.79 | 68.07 | 13.38 | 0.91105 | -0.12105 |

| 1.04 | 68.14 | 16.8 | 1.65578 | -0.61578 |

| 1.76 | 68.1 | 16.69 | 1.63043 | 0.12957 |

| 1.07 | 64.82 | 13.86 | 0.89496 | 0.17504 |

| 1.37 | 48.58 | 12 | -0.10954 | 1.47954 |

| 0.93 | 63.1 | 18.65 | 1.87075 | -0.94075 |

| 0.66 | 59.16 | 19.76 | 1.96584 | -1.30584 |

| 1.72 | 49.93 | 17.69 | 1.17514 | 0.54486 |

| 1.5 | 54.7 | 26.6 | 3.2851 | -1.7851 |

| 0.59 | 81.6 | 15.08 | 1.78056 | -1.19056 |

| 2.12 | 75.21 | 14.55 | 1.42912 | 0.69088 |

| 1.11 | 69.82 | 17.5 | 1.86984 | -0.75984 |

| 1.45 | 49.47 | 16.03 | 0.7979 | 0.6521 |

| 1.06 | 57.09 | 14.62 | 0.77387 | 0.28613 |

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman