Please answer req part 4 and 5 in its entirety, per the images attached Problem 8-29 (Algo) Completing a Master Budget [LO8-2, LO8-4, LO8-7, LO8-8, LO8-9, LO8-10] The following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods: Current assets as of March 31: Cash $ 7,300 Accounts receivable $ 19,200 Inventory $ 38,400 Building and equipment, net $ 124,800 Accounts payable $ 22,800 Common stock $ 150,000 Retained earnings $ 16,900 The gross margin is 25% of sales. Actual and budgeted sales data: March (actual) $ 48,000 April $ 64,000 May $ 69,000 June $ 94,000 July $ 45,000 Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are a result of March credit sales. Each month’s ending inventory should equal 80% of the following month’s budgeted cost of goods sold. One-half of a month’s inventory purchases is paid for in the month of purchase; the other half is paid for in the following month. The accounts payable at March 31 are the result of March purchases of inventory. Monthly expenses are as follows: commissions, 12% of sales; rent, $2,100 per month; other expenses (excluding depreciation), 6% of sales. Assume that these expenses are paid monthly. Depreciation is $936 per month (includes depreciation on new assets). Equipment costing $1,300 will be purchased for cash in April. Management would like to maintain a minimum cash balance of at least $4,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $20,000. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter. Required: Using the preceding data: 1. Complete the schedule of expected cash collections. 2. Complete the merchandise purchases budget and the schedule of expected cash disbursements for merchandise purchases. 3. Complete the cash budget. 4. Prepare an absorption costing income statement for the quarter ended June 30. 5. Prepare a balance sheet as of June 30.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Please answer req part 4 and 5 in its entirety, per the images attached

Problem 8-29 (Algo) Completing a Master Budget [LO8-2, LO8-4, LO8-7, LO8-8, LO8-9, LO8-10]

The following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods:

| Current assets as of March 31: | |

|---|---|

| Cash | $ 7,300 |

| Accounts receivable | $ 19,200 |

| Inventory | $ 38,400 |

| Building and equipment, net | $ 124,800 |

| Accounts payable | $ 22,800 |

| Common stock | $ 150,000 |

| $ 16,900 |

-

The gross margin is 25% of sales.

-

Actual and budgeted sales data:

| March (actual) | $ 48,000 |

|---|---|

| April | $ 64,000 |

| May | $ 69,000 |

| June | $ 94,000 |

| July | $ 45,000 |

-

Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are a result of March credit sales.

-

Each month’s ending inventory should equal 80% of the following month’s budgeted cost of goods sold.

-

One-half of a month’s inventory purchases is paid for in the month of purchase; the other half is paid for in the following month. The accounts payable at March 31 are the result of March purchases of inventory.

-

Monthly expenses are as follows: commissions, 12% of sales; rent, $2,100 per month; other expenses (excluding

depreciation ), 6% of sales. Assume that these expenses are paid monthly. Depreciation is $936 per month (includes depreciation on new assets). -

Equipment costing $1,300 will be purchased for cash in April.

-

Management would like to maintain a minimum cash balance of at least $4,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $20,000. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter.

Required:

Using the preceding data:

1. Complete the schedule of expected cash collections.

2. Complete the merchandise purchases budget and the schedule of expected cash disbursements for merchandise purchases.

3. Complete the

4. Prepare an absorption costing income statement for the quarter ended June 30.

5. Prepare a balance sheet as of June 30.

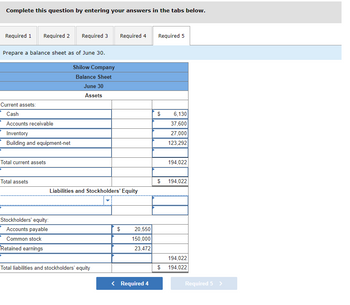

![The image outlines tasks related to financial preparation and displays a template of a balance sheet for educational purposes. Here is a detailed breakdown:

### Tasks:

1. **Complete the schedule of expected cash collections.**

2. **Complete the merchandise purchases budget and the schedule of expected cash disbursements for merchandise purchases.**

3. **Complete the cash budget.**

4. **Prepare an absorption costing income statement for the quarter ended June 30.**

5. **Prepare a balance sheet as of June 30.**

### Instructions:

The user is directed to answer by entering their information in various tabs associated with each required task.

### Balance Sheet Template:

The balance sheet is part of the task to prepare financial statements as of June 30 for Shilow Company.

#### **Shilow Company Balance Sheet**

- **Date:** June 30

#### **Structure of the Balance Sheet:**

1. **Assets:**

- **Current Assets:**

- [Blank for entry]

- [Blank for entry]

- [Blank for entry]

- [Blank for entry]

- **Total Current Assets:**

- [Blank for entry]

- **Total Assets:**

- [Blank for entry]

2. **Liabilities and Stockholders’ Equity:**

- **Liabilities:**

- [Blank for entry]

- [Blank for entry]

- **Stockholders’ Equity:**

- [Blank for entry]

- [Blank for entry]

- **Total Liabilities and Stockholders' Equity:**

- [Blank for entry]

The balance sheet tables have placeholders for users to input specific financial data to complete a balance sheet as part of learning or testing understanding of financial statement preparation.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F974c5538-3db8-4327-9554-477f1d67f083%2Fdd9f87b0-eaa2-4d52-9e47-980cf86fd84c%2Fsom68ym_processed.png&w=3840&q=75)

![### Task Instructions

1. **Complete the schedule of expected cash collections.**

2. **Complete the merchandise purchases budget and the schedule of expected cash disbursements for merchandise purchases.**

3. **Complete the cash budget.**

4. **Prepare an absorption costing income statement for the quarter ended June 30.**

5. **Prepare a balance sheet as of June 30.**

---

### Absorption Costing Income Statement Preparation

**Shilow Company**

**Income Statement**

*For the Quarter Ended June 30*

#### Cost of Goods Sold:

- [No specific values provided; placeholders for calculation]

#### Selling and Administrative Expenses:

- [No specific values provided; placeholders for calculation]

**Complete each section with the respective data to generate an accurate income statement.**

---

### Navigation

Use the tabs below to access different task requirements:

- **Required 1**

- **Required 2**

- **Required 3**

- **Required 4**

- **Required 5**

Navigate to each tab to input the necessary information for completing the tasks. Each section is essential for developing a comprehensive financial overview for Shilow Company.

To proceed, click "Required 5".](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F974c5538-3db8-4327-9554-477f1d67f083%2Fdd9f87b0-eaa2-4d52-9e47-980cf86fd84c%2Fefsxzc_processed.png&w=3840&q=75)

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

I think we're missing information. The system is telling me that my nswers are incomplete for req #5. I've attached an image and am hoping that you can provide the full and correct answer. Please highlight all the answers and make it easy to read/understand.

Problem 8-29 (Algo) Completing a Master Budget [LO8-2, LO8-4, LO8-7, LO8-8, LO8-9, LO8-10]

The following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods:

| Current assets as of March 31: | |

|---|---|

| Cash | $ 7,300 |

| Accounts receivable | $ 19,200 |

| Inventory | $ 38,400 |

| Building and equipment, net | $ 124,800 |

| Accounts payable | $ 22,800 |

| Common stock | $ 150,000 |

| $ 16,900 |

-

The gross margin is 25% of sales.

-

Actual and budgeted sales data:

| March (actual) | $ 48,000 |

|---|---|

| April | $ 64,000 |

| May | $ 69,000 |

| June | $ 94,000 |

| July | $ 45,000 |

-

Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are a result of March credit sales.

-

Each month’s ending inventory should equal 80% of the following month’s budgeted cost of goods sold.

-

One-half of a month’s inventory purchases is paid for in the month of purchase; the other half is paid for in the following month. The accounts payable at March 31 are the result of March purchases of inventory.

-

Monthly expenses are as follows: commissions, 12% of sales; rent, $2,100 per month; other expenses (excluding

depreciation ), 6% of sales. Assume that these expenses are paid monthly. Depreciation is $936 per month (includes depreciation on new assets). -

Equipment costing $1,300 will be purchased for cash in April.

-

Management would like to maintain a minimum cash balance of at least $4,000 at the end of each month. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $20,000. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter.

Required:

Using the preceding data:

1. Complete the schedule of expected cash collections.

2. Complete the merchandise purchases budget and the schedule of expected cash disbursements for merchandise purchases.

3. Complete the

4. Prepare an absorption costing income statement for the quarter ended June 30.

5. Prepare a