Concept explainers

Plantwide and Departmental

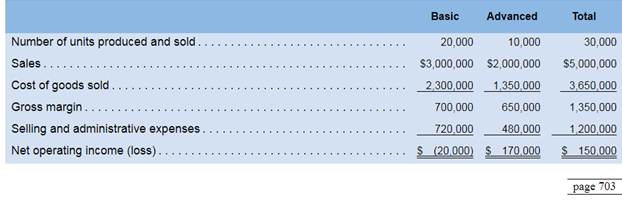

Koontz Company manufactures two models of industrial components−a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation based on direct labor-hours. Koontz's controller prepared the segmented income statement that is shown below for the most recent year (he allocated selling and administrative expenses to products based on sales dollars):

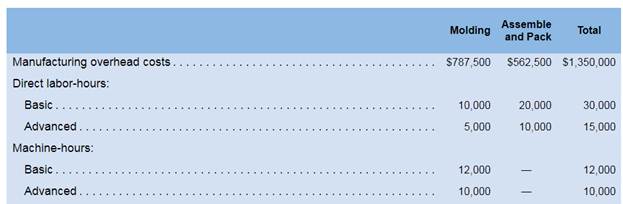

Direct laborers are paid S20 per hour. Direct materials cost $40 per unit for the Basic model and S60 per unit for the Advanced model. Koontz is considering a change from plantwide overhead allocation to a departmental approach. The overhead costs in the company's Molding Department would be allocated based on machine-hours and the overhead costs in its Assemble and Pack Department would be allocated based on direct labor-hours. To enable further analysis, the controller gathered the following information:

Required:

1. Using the plantwide approach:

a. Calculate the plantwide overhead rate.

b. Calculate the amount of overhead that would be assigned to each product.

2.Using a departmental approach:

a. Calculate the departmental overhead rates.

b.Calculate the total amount of overhead that would be assigned to each product.

c.Using your departmental overhead cost allocations, redo the controller's segmented income statement (continue to allocate selling and administrative expenses based on sales dollars).

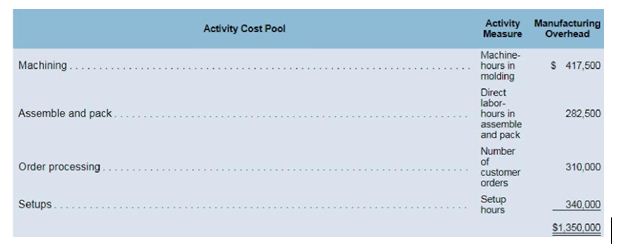

3.Koontz's production manager has suggested using activity-based costing instead of either the plantwide or departmental approaches. To facilitate the necessary calculations, she assigned the company's total manufacturing overhead cost to four activity cost pools as follows:

She also determined that the average order size for the Basic and Advanced models is 400 units and 50 units, respectively. The molding machines require a setup for each order. One setup hour is requited for each customer order of the Basic model and three hours are required to setup for an order of the Advanced model.

Using the additional information provided by the production manager calculate:

a, An activity rate for each activity cost pool.

b.The total manufacturing overhead cost allocated to the Basic model and the Advanced model using the activity-based approach.

4.The company pays a sales commissions of 5% for the Basic model and 10% for the Advanced model. Its traceable fixed advertising expenses include $150.000 for the Basic model and $200,000 for the Advanced model, The remainder of the company's selling and administrative costs are common fixed expenses.

Prepare a contribution format segmented income statement that is adapted from Exhibit 7-8. Organize all of the company's costs into three categories: variable expenses, traceable fixed expenses, and common fixed expenses. Use your activity-based cost assignments from requirement 3 to assign the

5. Using your contribution format segmented income statement from requirement 5, calculate the break-even point in dollar sales for the Advanced model.

6. Explain how Koontz's activity-based costing approach differs from its planrwide and departmental approaches. Also. explain how the controller's allocation of the selling and administrative expenses differs from how you accounted for these expenses within your contribution format segmented income statement.

Want to see the full answer?

Check out a sample textbook solution

Chapter IE Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

Additional Business Textbook Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Foundations of Financial Management

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

MARKETING:REAL PEOPLE,REAL CHOICES

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,