Concept explainers

Normal Costing versus Actual Costing

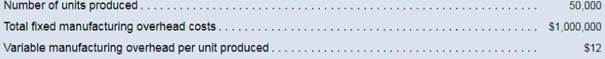

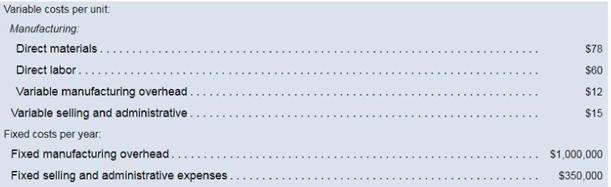

Darwin Company manufactures only one product that it sells for $200 per unit. The company uses plantwide

During the year, the company had no beginning inventories of any kind and no ending raw materials or work in process inventories. All raw materials were used in production as direct materials. An unexpected business downturn caused annual sales to drop to 38,000 units. In response to the decline in sales. Darwin decreased its annual production, to 40,000 units. The company's actual costs for the year were as follows:

Required:

1. Assuming the company uses normal costing (as described in Chapters 2 and 3):

a. Compute the plantwide predetermined overhead rate.

b. Compute the unit product cost for each unit produced during the year.

c. Prepare a schedule of cost of good; manufactured and a schedule of cost of goods sold. Assume that any underapplied or overapplied overhead is closed entirely to cost of goods sold.

d.Compute absorption costing net operating income for the year.

2.Assuming the company uses actual costing (as described in Chapter 7):

a, Compute the unit product cost for each unit produced during the year.

b. Compute absorption costing net operating income for the year.

3. Are your normal costing and actual costing net operating incomes the same? Why? Support your answer with computations.

Want to see the full answer?

Check out a sample textbook solution

Chapter IE Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- Fresh Foods has sales of $216,500, total assets of $196,200, a debt-equity ratio of 2.15, and a profit margin of 2.9 percent. What is the equity multiplier? Don't Use Aiarrow_forwardGive this question general accountingarrow_forwardFresh Foods has sales of $216,500, total assets of $196,200, a debt-equity ratio of 2.15, and a profit margin of 2.9 percent. What is the equity multiplier? I want answerarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning