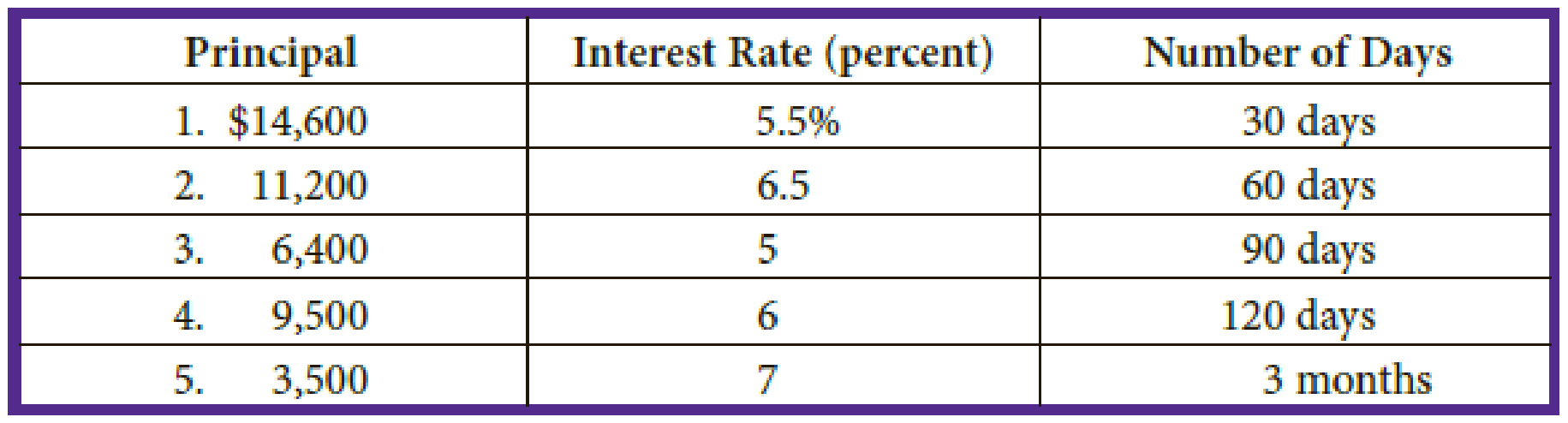

Part A: Calculate the interest on the following notes:

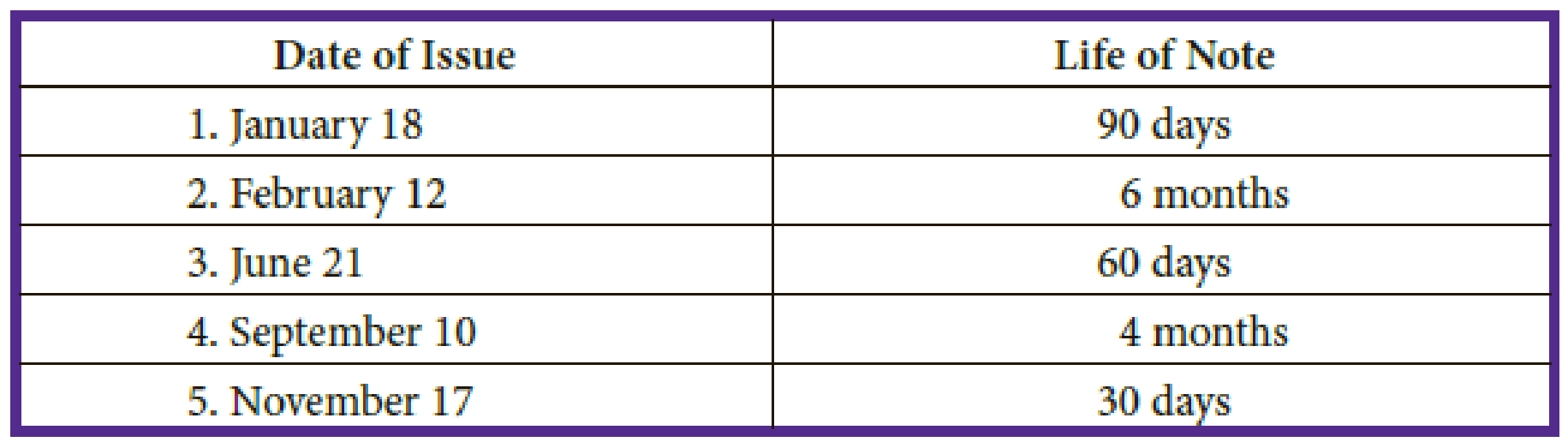

Part B: Determine the maturity dates on the following notes:

Check Figure

1. Interest, $66.92

A.

Compute the interest for the given notes.

Explanation of Solution

Interest: The money charged by the lender for using lender’s funds is referred to as interest. So, interest is an expense for the borrower and revenue for the lender. The interest is generally, computed as a percentage of the money borrowed.

Compute the interest for the given notes.

| Principal | × | Rate of Interest | × | Time of Note | = | Interest | |

| 1. | $14,600 | × | 5.5% | × | = | $66.92 | |

| 2. | 11,200 | × | 6.5% | × | = | 121.33 | |

| 3. | 6,400 | × | 5.0% | × | = | 80.00 | |

| 4. | 9,500 | × | 6.0% | × | = | 190.00 | |

| 5. | 3,500 | × | 7.0% | × | = | 61.25 | |

Table (1)

B.

Compute the maturity dates.

Explanation of Solution

Maturity date: The date on which the borrower should pay the principal amount of loan, or bond, is referred to as maturity date.

Compute the maturity date for the note issued on January 18 with the life of note for 90 days.

| Description | Count |

| Number of days left in January (From 18th to 31st) | 13 days |

| Number of days in February | 28 days |

| Number of days in March | 31 days |

| 72 days | |

| Number of days required in April to total 90 days (90 days–72 days) | 18 days |

| Total days of the term | 90 days |

Table (2)

Hence, the maturity date is 18th April.

Compute the maturity date for the note issued on February 12 with the life of note for 6 months.

| Description | Count |

| Number of months from February 12 to March 12 | 1 month |

| Number of months from March 12 to April 12 | 1 month |

| Number of months from April 12 to May 12 | 1 month |

| Number of months from May 12 to June 12 | 1 month |

| Number of months from June 12 to July 12 | 1 month |

| Number of months from July 12 to August 12 | 1 month |

| Total months of the term | 6 months |

Table (3)

Hence, the maturity date is 12th August.

Compute the maturity date for the note issued on June 21 with the life of note for 60 days.

| Description | Count |

| Number of days left in June (From 21st to 30th) | 9 days |

| Number of days in July | 31 days |

| 40 days | |

| Number of days required in August to total 60 days (60 days–40 days) | 20 days |

| Total days of the term | 60 days |

Table (4)

Hence, the maturity date is 20th August.

Compute the maturity date for the note issued on September 10 with the life of note for 4 months.

| Description | Count |

| Number of months from September 10 to October 10 | 1 month |

| Number of months from October 10to November 10 | 1 month |

| Number of months from November 10 to December 10 | 1 month |

| Number of months from December 10 to January 10 | 1 month |

| Total months of the term | 4 months |

Table (5)

Hence, the maturity date is 10th January.

Compute the maturity date for the note issued on November 17 with the life of note for 30 days.

| Description | Count |

| Number of days left in November (From 17th to 30th) | 13 days |

| Number of days required in December to total 30 days (30 days–13 days) | 17 days |

| Total days of the term | 30 days |

Table (6)

Hence, the maturity date is 17th December.

Want to see more full solutions like this?

Chapter D Solutions

Bundle: College Accounting: A Career Approach (with QuickBooks Online), Loose-leaf Version,13th + CengageNOWV2, 1 term (6 months) Printed Access

Additional Business Textbook Solutions

Fundamentals of Management (10th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- What is the gross profit rate ?arrow_forwardWhitney received $75,200 of taxable income in 2024. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations. She is married but files a separate tax return. Her taxable income is $75,200. What is her income tax liability?arrow_forwardLacy is a single taxpayer. In 2024, her taxable income is $56,000. What is her tax liability in each of the following alternative situations.Her $56,000 of taxable income includes $10,000 of qualified dividends. What is her tax liability?arrow_forward

- Please help me with part B of this problem. I am having trouble. Fill all necessary cells as shown. I have provided the dropdown that includes the accounts.arrow_forwardWhat is a good response to this post? My chosen product is an ergonomic pet bed similar to a large bean bag called a Pooch Poof. And my proposed markets are the United States, as it currently has the largest share of pet product sales, Europe as the pet population is 324.4 million currently, and South America, as this country is expected to be one of the fastest growing markets for pet accessories and food (Shahbandeh, 2024). With my product in two stable markets, and one emerging market, financial risks will be minimized as much as possible when expanding into the emerging market of South America by the stability of the American and European markets that are established. My slogan will be “Pamper your pooch with softness and watch your worries about your pup’s good night sleep go “Poof”. A “poofed” pet is a proper pet!” This slogan works as in the United States and Europe, dogs are generally considered family members, and allowed in public spaces, and socialization, training, health…arrow_forwardWhat is its debt to equity ratio for WACC purposes?arrow_forward

- What is its debt to equity ratio for WACC purposes? Accountingarrow_forwardWhat is a good response to this post? In this week’s discussion, we will consider product slogans and expansion into other countries. For my post, I will be focusing on make-up brand Merit Beauty. It is a vegan beauty brand that focuses on minimalist beauty and offers kits that have all five pieces for ease of application and enhances the natural beauty of the wearer (Fallon, 2024). My slogan: “Where less is more and looking good is easy” The countries I would like to expand marketing to are: Singapore: The country focuses on health and beauty with emphasis on wellbeing and the country has a comprehensive offering of insurance, both private and national insurance, along with initiatives to promote wellbeing (GCPIT, n.d.). Additionally, the makeup market had total revenues of $221.4 million in 2023 which was an annual growth rate of 3.7% between 2018 and 2023 (Marketline, 2024). France: France too has a commitment to offering clean products to their citizens and have been know as one…arrow_forwardPlease find the interest revenue HELParrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College