Derivatives; interest rate swap; fixed rate debt; extended method

(Note: This is a variation of P A–1, modified to consider the extended method demonstrated in Illustration A–3.)

On January 1, 2018, Labtech Circuits borrowed $100,000 from First Bank by issuing a three-year, 8% note, payable on December 31, 2020. Labtech wanted to hedge the risk that general interest rates will decline, causing the fair value of its debt to increase. Therefore, Labtech entered into a three-year interest rate swap agreement on January 1, 2018, and designated the swap as a fair value hedge. The agreement called for the company to receive payment based on an 8% fixed interest rate on a notional amount of $100,000 and to pay interest based on a floating interest rate tied to LIBOR. The contract called for cash settlement of the net interest amount on December 31 of each year.

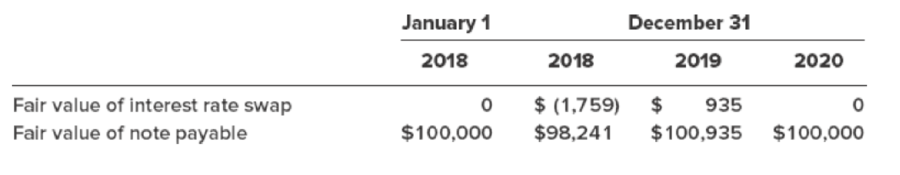

Floating (LIBOR) settlement rates were 8% at inception and 9%, 7%, and 7% at the end of 2018, 2019, and 2020, respectively. The fair values of the swap are quotes obtained from a derivatives dealer. Those quotes and the fair values of the note are as follows:

Required:

Use the extended method demonstrated in Illustration A–3.

- 1. Calculate the net cash settlement at the end of 2018, 2019, and 2020.

- 2. Prepare the

journal entries during 2018 to record the issuance of the note, interest, and necessary adjustments for changes in fair value. - 3. Prepare the journal entries during 2019 to record interest, net cash interest settlement for the interest rate swap, and necessary adjustments for changes in fair value.

- 4. Prepare the journal entries during 2020 to record interest, net cash interest settlement for the interest rate swap, necessary adjustments for changes in fair value, and repayment of the debt.

- 5. Calculate the book values of both the swap account and the note in each of the three years.

- 6. Calculate the net effect on earnings of the hedging arrangement in each of the three years. (Ignore income taxes.)

- 7. Suppose the fair value of the note at December 31, 2018, had been $97,000 rather than $98,241, with the additional decline in fair value due to investors’ perceptions that the creditworthiness of Labtech was worsening. How would that affect your entries to record changes in the fair values?

(1)

Derivatives: Derivatives are some financial instruments which are meant for managing risk and safeguard the risk created by other financial instruments. These financial instruments derive the values from the future value of underlying security or index. Some examples of derivatives are forward contracts, interest rate swaps, futures, and options.

Interest rate swap: This is a type of derivative used by two parties under a contract to exchange the consequences (net cash difference between interest payments) of fixed interest rate for floating interest rate, or vice versa, without exchanging the principal or notional amounts.

To determine: The net cash settlement as at December 31, 2018, 2019, and 2020

Explanation of Solution

Determine the net cash settlement as at December 31, 2018.

| Particulars | Amount ($) |

| Fixed interest payments | $8,000 |

| Floating interest payments | (9,000) |

| Net interest receipts (payments) | $(1,000) |

Table (1)

Working Notes:

Compute fixed interest receipts.

| Computation of Fixed Interest Receipts | ||||||

| Notional Amount ($) | Fixed Interest Rate | Time Period | = | Fixed Interest Receipts (S) | ||

| $100,000 | 8% | 1 year | = | $8,000 | ||

Table (2)

Compute floating interest payments.

| Computation of Floating Interest Payments | ||||||

| Notional Amount ($) | Floating Interest Rate | Time Period | = | Floating Interest Payments (S) | ||

| $100,000 | 9% | 1 year | = | $9,000 | ||

Table (3)

Determine the net cash settlement as at December 31, 2019.

| Particulars | Amount ($) |

| Fixed interest payments | $8,000 |

| Floating interest payments | (7,000) |

| Net interest receipts (payments) | $1,000 |

Table (4)

Working Notes:

Refer to Table (2) for value and computation of fixed interest payments.

Compute floating interest payments.

| Computation of Floating Interest Payments | ||||||

| Notional Amount ($) | Floating Interest Rate | Time Period | = | Floating Interest Payments (S) | ||

| $100,000 | 7% | 1 year | = | $7,000 | ||

Table (5)

Determine the net cash settlement as at December 31, 2020.

| Particulars | Amount ($) |

| Fixed interest payments | $8,000 |

| Floating interest payments | (7,000) |

| Net interest receipts (payments) | $1,000 |

Table (6)

Working Notes:

Refer to Table (2) for value and computation of fixed interest payments.

Compute floating interest payments.

| Computation of Floating Interest Payments | ||||||

| Notional Amount ($) | Floating Interest Rate | Time Period | = | Floating Interest Payments (S) | ||

| $100,000 | 7% | 1 year | = | $7,000 | ||

Table (7)

(2)

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

To journalize: The entries of issue of note, interest payments, and adjustment entries to reflect fair value during 2018.

Explanation of Solution

Entry for issuance of note:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2018 | |||||

| January | 1 | Cash | 100,000 | ||

| Notes Payable | 100,000 | ||||

| (To record issuance of note) | |||||

Table (8)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Notes Payable is a liability account. Since obligation to pay the note increased, liability increased, and an increase in liability is credited.

Entry for interest expense payment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2018 | |||||

| December | 31 | Interest Expense | 8,000 | ||

| Cash | 8,000 | ||||

| (To record interest expense payment) | |||||

Table (9)

- Interest Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Entry for net interest receipt and accrued interest:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2018 | |||||

| December | 31 | Interest Expense | 0 | ||

| Holding Loss–Interest Rate Swap | 2,759 | ||||

| Interest Rate Swap | 1,759 | ||||

| Cash | 1,000 | ||||

| (To record net cash settlement, accrued interest, and decrease in fair value) | |||||

Table (10)

- Interest Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited. (Since opening balance of fair value of interest rate swap is $0, the expense paid would be $0).

- Holding Loss–Interest Rate Swap is an expense account. Since interest rate increased causing holding loss increase, which decrease equity, so equity value is decreased, and a decrease in equity is debited.

- Interest Rate Swap is a liability account because the fair value of derivative has increased, and an increase in liability is credited.

- Cash is an asset account. Since cash (net cash settlement) is paid, asset account decreased, and a decrease in asset is credited.

Entry for changes in fair value of note:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2018 | |||||

| December | 31 | Notes Payable | 1,759 | ||

| Holding Gain–Hedged Note | 1,759 | ||||

| (To record decrease in fair value from $100,000 to $98,241) | |||||

Table (11)

- Notes Payable is a liability account. Since fair value of the note decreased, liability decreased, and a decrease in liability is debited.

- Holding Gain–Hedged Note is a revenue account. The fair value of hedged liability has decreased causing a holding gain. Since holding gains increase equity, equity value is increased, and an increase in equity is credited.

(3)

To journalize: The entries of issue of note, interest payments, and adjustment entries to reflect fair value during 2019.

Explanation of Solution

Entry for interest expense payment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2019 | |||||

| December | 31 | Interest Expense | 8,842 | ||

| Notes Payable | 842 | ||||

| Cash | 8,000 | ||||

| (To record interest expense payment) | |||||

Table (12)

- Interest Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Notes Payable is a liability account. Since part of principal amount of the note has increased, liability increased, and an increase in liability is credited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Notes:

Refer to Table (2) for value and computation of interest expense value at fixed interest rate.

Compute notes payable value.

Step 1: Compute floating interest payment.

| Computation of Floating Interest Payment | ||||||

| Fair Value of Note ($) | Floating Interest Rate | Time Period | = | Floating Interest Payments (S) | ||

| $98,241 | 9% | 1 year | = | $8,842 | ||

Table (13)

Step 2: Compute notes payable value.

| Particulars | Amount ($) |

| Interest expense amount | $8,842 |

| Cash paid | (8,000) |

| Notes payable amount | $842 |

Table (14)

Note: Refer to Table (2) for value and computation of interest expense value at fixed interest rate, and Table (13) for interest expense amount.

Entry for net interest receipt and accrued interest:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2019 | |||||

| December | 31 | Cash | 1,000 | ||

| Interest rate Swap | 2,694 | ||||

| Interest Expense | 158 | ||||

| Holding Gain–Interest Rate Swap | 3,852 | ||||

| (To record net cash settlement and increase in fair value of swap from $(1,759) to $935) | |||||

Table (15)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Interest Rate Swap is an asset account because the fair value has increased from $(1,759) to $935 causing an increase of $2,694, and an increase in asset is debited.

- Interest Expense is an expense account. Since fixed interest payment is received as per the agreement, the expense value increased, and an increase in expense is debited.

- Holding Gain–Interest Rate Swap is a revenue account. Since holding gains increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute interest revenue from interest rate swap.

| Computation of Floating Interest Payment | ||||||

| Fair Value of Swap ($) | Floating Interest Rate | Time Period | = | Interest Received (S) | ||

| $1,759 | 9% | 1 year | = | $159 | ||

Table (16)

Compute holding gain on interest rate swap value.

| Particulars | Amount ($) |

| Cash receipt | $1,000 |

| Interest rate swap value | 2,694 |

| Interest revenue | 159 |

| Holding gain value | $3,852 |

Table (17)

Entry for changes in fair value of note:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2019 | |||||

| December | 31 | Holding Loss–Hedged Note | 1,852 | ||

| Note Payable | 1,852 | ||||

| (To record increase in fair value from $98,241 to $100,935) | |||||

Table (18)

- Holding Loss–Hedged Note is a loss account. The fair value of hedged liability has increased causing a holding loss. Since holding losses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Notes Payable is a liability account. Since fair value of the note increased, liability increased, and an increase in liability is credited.

Working Notes:

Compute notes payable value.

| Particulars | Amount ($) |

| Fair value of note in 2019 | 100,935 |

| Fair value of note in 2018 | (98,241) |

| Interest on note | (842) |

| Holding gain value | $1,852 |

Table (19)

(4)

To journalize: The entries of issue of note, interest payments, and adjustment entries to reflect fair value during 2020.

Explanation of Solution

Entry for interest expense payment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2020 | |||||

| December | 31 | Interest Expense | 7,065 | ||

| Notes Payable | 935 | ||||

| Cash | 8,000 | ||||

| (To record interest expense payment) | |||||

Table (20)

- Interest Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Notes Payable is a liability account. Since part of principal amount of the note is paid, liability decreased, and a decrease in liability is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Notes:

Refer to Table (2) for value and computation of interest expense value at fixed interest rate.

Compute notes payable value.

Step 1: Compute floating interest payment.

| Computation of Floating Interest Payment | ||||||

| Fair Value of Note ($) | Floating Interest Rate | Time Period | = | Floating Interest Payments (S) | ||

| $100935 | 7% | 1 year | = | $7,065 | ||

Table (21)

Step 2: Compute notes payable value.

| Particulars | Amount ($) |

| Cash paid (fixed interest) | $8,000 |

| Interest expense amount | (7,065) |

| Notes payable amount | $935 |

Table (22)

Note: Refer to Table (2) for value and computation of interest expense value at fixed interest rate, and Table (21) for interest expense amount.

Entry for net interest receipt and accrued interest:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2020 | |||||

| December | 31 | Cash | 1,000 | ||

| Holding Loss–Interest Rate Swap | 0 | ||||

| Interest rate Swap | 935 | ||||

| Interest Revenue | 65 | ||||

| (To record net interest settlement and decrease in fair value of swap from $935 to $0) | |||||

Table (23)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Holding Loss–Interest Rate Swap is an expense account. Since interest rate increased causing holding loss increase, which decrease equity, so equity value is decreased, and a decrease in equity is debited.

- Interest Rate Swap is a liability account because the fair value of derivative has increased, and an increase in liability is credited.

- Interest Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute interest rate swap value.

| Particulars | Amount ($) |

| Fair value of interest rate swap in 2018 | $0 |

| Fair value of interest rate swap in 2017 | 935 |

| Interest rate swap value | $(935) |

Table (24)

Compute interest revenue from interest rate swap.

| Computation of Floating Interest Payment | ||||||

| Fair Value of Swap ($) | Floating Interest Rate | Time Period | = | Interest Received (S) | ||

| $935 | 7% | 1 year | = | $65 | ||

Table (25)

Compute holding loss on interest rate swap value.

| Particulars | Amount ($) |

| Cash receipt | $1,000 |

| Interest rate swap value | (935) |

| Interest revenue | (65) |

| Holding gain (loss) value | $0 |

Table (26)

Entry for repayment of note:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2020 | |||||

| December | 31 | Notes Payable | 100,000 | ||

| Cash | 100,000 | ||||

| (To record note being paid) | |||||

Table (27)

- Notes Payable is a liability account. Since obligation to pay the note is decreased, liability decreased, and a decrease in liability is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

(5)

Explanation of Solution

Determine the book value of swap in the years 2018, 2019, and 2020.

| Interest Rate Swap | ||||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| 2018 | 2018 | |||||

| January 1 | December 31 | Holding loss | 1,759 | |||

| Total | $0 | Total | $1,759 | |||

| December 31 | Balance | $1,759 | ||||

| 2019 | 2019 | |||||

| December 31 | Holding gain | 2,694 | January 1 | Balance | $1,759 | |

| Total | 2,694 | Total | $1,759 | |||

| December 31 | Balance | $935 | ||||

| 2020 | 2020 | |||||

| January 1 | Balance | 935 | December 31 | Holding loss | 935 | |

| Total | 935 | Total | 935 | |||

| December 31 | Balance | $0 | ||||

Table (28)

Note: Refer to Requirements 2, 3, and 4 for values and computation of all values.

Determine the book value of note in the years 2018, 2019, and 2020.

| Note Payable | ||||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| 2018 | 2018 | |||||

| December 31 | Holding gain | 1,759 | January 1 | Cash | 100,000 | |

| Total | $0 | Total | 100,000 | |||

| December 31 | Balance | $98,241 | ||||

| 2019 | 2019 | |||||

| December 31 | January 1 | Balance | $98,241 | |||

| Holding loss | 2,694 | |||||

| Total | 0 | Total | $100,935 | |||

| December 31 | Balance | $100,935 | ||||

| 2020 | 2020 | |||||

| December 31 | Holding gain | 935 | January 1 | Balance | 100,935 | |

| Cash | 100,000 | |||||

| Total | 100,935 | Total | 100,935 | |||

| December 31 | Balance | $0 | ||||

Table (29)

Note: Refer to requirements 2, 3, and 4 for values and computation of all values.

(6)

Explanation of Solution

Determine the net effect of fair value hedge on earnings for the years 2018, 2019, and 2020.

| L Circuits | |||

| Income Statement | |||

| For the Years Ended December 31, 2018, 2019, and 2020 | |||

| 2018 | 2019 | 2020 | |

| Interest expense (Fixed receipts) | (8,000) | (8,842) | (7,065) |

| Interest revenue (expense) | (158) | 65 | |

| Holding gain (loss)–Interest rate swap | (2,759) | 3,852 | (0) |

| Holding gain (loss)–Hedged note | 1,759 | (1,852) | 0 |

| Net effect on earnings (Floating interest payment on swap) | (9,000) | (7,000) | (7,000) |

Table (30)

Note: Refer to Requirements 1, 2, 3, and 4 for values and computation of all values.

(7)

To journalize: The entries of issue of note, interest payments, and adjustment entries to reflect fair value during 2018, if fair value would have been $97,000 rather than $98,241.

Explanation of Solution

The additional decline in fair value from $98,241 to $97,000 would not make any difference in the entries because the reason for decline is not related to interest rate.

Entry for interest expense payment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2018 | |||||

| December | 31 | Interest Expense | 8,000 | ||

| Cash | 8,000 | ||||

| (To record interest expense payment) | |||||

Table (31)

- Interest Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Entry for net interest receipt and accrued interest:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2018 | |||||

| December | 31 | Interest Expense | 0 | ||

| Holding Loss–Interest Rate Swap | 2,759 | ||||

| Interest Rate Swap | 1,759 | ||||

| Cash | 1,000 | ||||

| (To record net cash settlement, accrued interest, and decrease in fair value) | |||||

Table (32)

- Interest Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited. (Since opening balance of fair value of interest rate swap is $0, the expense paid would be $0).

- Holding Loss–Interest Rate Swap is an expense account. Since interest rate increased causing holding loss increase, which decrease equity, so equity value is decreased, and a decrease in equity is debited.

- Interest Rate Swap is a liability account because the fair value of derivative has increased, and an increase in liability is credited.

- Cash is an asset account. Since cash (net cash settlement) is paid, asset account decreased, and a decrease in asset is credited.

Entry for changes in fair value of note:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | |

| 2018 | |||||

| December | 31 | Notes Payable | 1,759 | ||

| Holding Gain–Hedged Note | 1,759 | ||||

| (To record decrease in fair value from $100,000 to $98,241) | |||||

Table (33)

- Notes Payable is a liability account. Since fair value of the note decreased, liability decreased, and a decrease in liability is debited.

- Holding Gain–Hedged Note is a revenue account. The fair value of hedged liability has decreased causing a holding gain. Since holding gains increase equity, equity value is increased, and an increase in equity is credited.

Want to see more full solutions like this?

Chapter A Solutions

Intermediate Accounting

- Can you explain this financial accounting question using accurate calculation methods?arrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forward

- I need help with accountingarrow_forwardWhat are two double entries the following transaction? Account Receivable. Account payable. Rent Expenses. Cell phone bill, cable, light bill, gas, and monthly income of $4,000.00 what will be your net income after all expenses are paid. Please figure out your own price for each expense.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning