Derivatives; interest rate swap; fixed rate investment

(This is a variation of E A–2, modified to consider an investment in debt securities.)

On January 1, 2018, S&S Corporation invested in LLB Industries’ negotiable two-year, 10% notes, with interest receivable quarterly. The company classified the investment as available-for-sale. S&S entered into a two-year interest rate swap agreement on January 1, 2018, and designated the swap as a fair value hedge. Its intent was to hedge the risk that general interest rates will decline, causing the fair value of its investment to increase. The agreement called for the company to make payment based on a 10% fixed interest rate on a notional amount of $200,000 and to receive interest based on a floating interest rate. The contract called for cash settlement of the net interest amount quarterly.

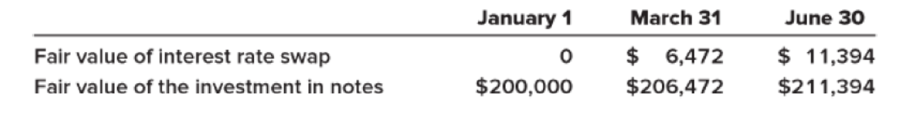

Floating (LIBOR) settlement rates were 10% at January 1, 8% at March 31, and 6% June 30, 2018. The fair values of the swap are quotes obtained from a derivatives dealer. Those quotes and the fair values of the investment in notes are as follows:

Required:

- 1. Calculate the net cash settlement at March 31 and June 30, 2018.

- 2. Prepare the

journal entries through June 30, 2018, to record the investment in notes, interest, and necessary adjustments for changes in fair value.

Want to see the full answer?

Check out a sample textbook solution

Chapter A Solutions

Intermediate Accounting

- Bansai, age 66, retires and receives a $1,450 per month annuity from his employer's qualified pension plan. Bansai made $87,600 of after-tax contributions to the plan before retirement. Under the simplified method, Bansai's number of anticipated payments is 240. What is the amount includible in income in the first year of withdrawals assuming 12 monthly payments? A. $10,560 B. $12,540 C. $17,400 D. $8,220arrow_forwardWhat is the cost of goods sold?arrow_forwardCan you help me find the accurate solution to this financial accounting problem using valid principles?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education