Principles of Corporate Finance

13th Edition

ISBN: 9781260465099

Author: BREALEY, Richard

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 6PS

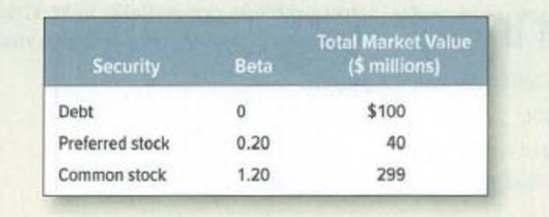

Company cost of capital Nero Violins has the following capital structure:

- a. What is the firm’s asset beta? (Hint: What is the beta of a portfolio of all the firm’s securities?)

- b. Assume that the

CAPM is correct. What discount rate should Nero set for investments that expand the scale of its operations without changing its asset beta? Assume a risk-free interest rate of 5% and a market risk premium of 6%. Ignore taxes.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Solve this question with financial accounting question

I need help with this situation and financial accounting question

Remaining Time: 50 minutes, 26 seconds.

* Question Completion Status:

A Moving to the next question prevents changes to this answer.

Question 9

Question 9 of 20

5 points

Save Answer

A currency speculator wants to speculate on the future movements of the €. The speculator expects the € to appreciate in the near future and decides to concentrate on the nearby contract. The broker requires a 2%

Initial Margin (IM) and the Maintenance Margin (MM) is 75% of IM. Following € Futures quotes are currently available from the Chicago Mercantile Exchange (CME).

Euro (CME)- €125,000; $/€

Open

High

Low

Settle Change Open Interest

June

1.2216

1.2276

1.2175 1.2259

-0.0018

Sept

1.2229

1.2288

1.2189 1.2269 0.0018

255,420

19,335

In addition to the information provided above, consider the following CME quotes that are available at the end of day one's trading:

Euro (CME) - €125,000; $/€

Open

High

Low

June

1.2216

Sept

1.2229

1.2276

1.2288

Settle Change Open Interest

1.2175 1.2176 -0.0083 255,420

1.2189…

Chapter 9 Solutions

Principles of Corporate Finance

Ch. 9 - (VAR.P and STDEV.P) Choose two well-known stocks...Ch. 9 - (AVERAGE, VAR.P and STDEV.P) Now calculate the...Ch. 9 - (SLOPE) Download the Standard Poors index for the...Ch. 9 - Definitions Define the following terms: a. Cost of...Ch. 9 - True/false True or false? a. The company cost of...Ch. 9 - Company cost of capital Quark Productions (Give...Ch. 9 - Company cost of capital The total market value of...Ch. 9 - Company cost of capital You are given the...Ch. 9 - Company cost of capital Nero Violins has the...Ch. 9 - WACC A company is 40% financed by risk-free debt....

Ch. 9 - WACC Binomial Tree Farms financing includes 5...Ch. 9 - Prob. 10PSCh. 9 - Measuring risk The following table shows estimates...Ch. 9 - Prob. 12PSCh. 9 - Asset betas Which of these projects is likely to...Ch. 9 - Asset betas EZCUBE Corp. is 50% financed with...Ch. 9 - Prob. 15PSCh. 9 - Prob. 16PSCh. 9 - Prob. 17PSCh. 9 - Fudge factors John Barleycorn estimates his firms...Ch. 9 - Prob. 19PSCh. 9 - Prob. 20PSCh. 9 - Certainty equivalents A project has a forecasted...Ch. 9 - Certainty equivalents A project has the following...Ch. 9 - Prob. 23PSCh. 9 - Beta of costs Suppose that you are valuing a...Ch. 9 - Fudge factors An oil company executive is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

What is WACC-Weighted average cost of capital; Author: Learn to invest;https://www.youtube.com/watch?v=0inqw9cCJnM;License: Standard YouTube License, CC-BY