Principles of Corporate Finance

13th Edition

ISBN: 9781260465099

Author: BREALEY, Richard

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 22PS

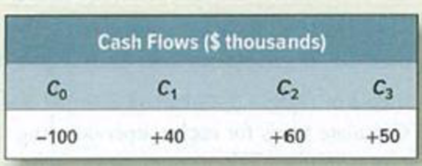

Certainty equivalents A project has the following

The estimated project beta is 1.5. The market return rm is 16%, and the risk-free rate rf is 7%.

- a. Estimate the

opportunity cost of capital and the project’s PV (using the same rate to discount each cash flow). - b. What are the certainty-equivalent cash, flows in each year?

- c. What is the ratio of the certainty-equivalent cash flow to the expected cash flow in each year?

- d. Explain why this ratio declines.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Hello tutor I need answer of this financial accounting question

Hi expert please given correct answer and fiancial accouting question

Don't use ai given answer with financial accounting question

Chapter 9 Solutions

Principles of Corporate Finance

Ch. 9 - (VAR.P and STDEV.P) Choose two well-known stocks...Ch. 9 - (AVERAGE, VAR.P and STDEV.P) Now calculate the...Ch. 9 - (SLOPE) Download the Standard Poors index for the...Ch. 9 - Definitions Define the following terms: a. Cost of...Ch. 9 - True/false True or false? a. The company cost of...Ch. 9 - Company cost of capital Quark Productions (Give...Ch. 9 - Company cost of capital The total market value of...Ch. 9 - Company cost of capital You are given the...Ch. 9 - Company cost of capital Nero Violins has the...Ch. 9 - WACC A company is 40% financed by risk-free debt....

Ch. 9 - WACC Binomial Tree Farms financing includes 5...Ch. 9 - Prob. 10PSCh. 9 - Measuring risk The following table shows estimates...Ch. 9 - Prob. 12PSCh. 9 - Asset betas Which of these projects is likely to...Ch. 9 - Asset betas EZCUBE Corp. is 50% financed with...Ch. 9 - Prob. 15PSCh. 9 - Prob. 16PSCh. 9 - Prob. 17PSCh. 9 - Fudge factors John Barleycorn estimates his firms...Ch. 9 - Prob. 19PSCh. 9 - Prob. 20PSCh. 9 - Certainty equivalents A project has a forecasted...Ch. 9 - Certainty equivalents A project has the following...Ch. 9 - Prob. 23PSCh. 9 - Beta of costs Suppose that you are valuing a...Ch. 9 - Fudge factors An oil company executive is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Need help with the Correct answer of this Financial Accounting Questionarrow_forward: A project costs $100,000 and is expected to generate cash flows of $30,000 annually for 5 years. If the discount rate is 8%, should the project be accepted based on Net Present Value (NPV)?arrow_forwardYou are considering a project in Poland, which has an initial cost of 250,000PLN. The project is expected to return a one-time payment of 400,000PLN 5 years from now. The risk-free rate of return is 3% in Canada and 4% in Poland. The inflation rate is 2% in Canada and 5% in Poland. Currently, you can buy 375PLN for $100. How much will the payment 5 years from now be worth in dollars? Question 6 options: $1,576,515 $1,489,025 $101,490 $1,462,350 $142,060arrow_forward

- : A project costs $100,000 and is expected to generate cash flows of $30,000 annually for 5 years. If the discount rate is 8%, should the project be accepted based on Net Present Value (NPV)? i need hellarrow_forwardYou invest 60% of your money in Asset A (expected return = 8%, standard deviation = 12%) and 40% in Asset B (expected return = 5%, standard deviation = 8%). The correlation coefficient between the two assets is 0.3. What is the expected return and standard deviation of the portfolio? helparrow_forwardImporters and exporters are key players in the foreign exchange market. Question 10 options: True Falsearrow_forward

- Triangle arbitrage helps keep the currency market in equilibrium. Question 9 options: True Falsearrow_forwardThe use of dividends is a method by which a foreign subsidiary can remit cash to its parent company. Question 8 options: True False\arrow_forwardThe notion that exchange rates adjust to keep the purchasing power of a currency constant across countries is called: Question 7 options: Interest rate parity. The unbiased forward rates condition. Uncovered interest rate parity. Purchasing power parity. The international Fisher effect.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License