(VAR.P and STDEV.P) Choose two well-known stocks and download the latest 61 months of adjusted prices from finance.yahoo.com. Calculate the monthly returns for each stock. Now find the variance and standard deviation of the returns for each stock by using VAR.P and STDEV.P. Annualize the variance by multiplying by 12 and the standard deviation by multiplying by the square root of 12.

To determine: The variance and standard deviation of two stocks.

Answer to Problem 1SQ

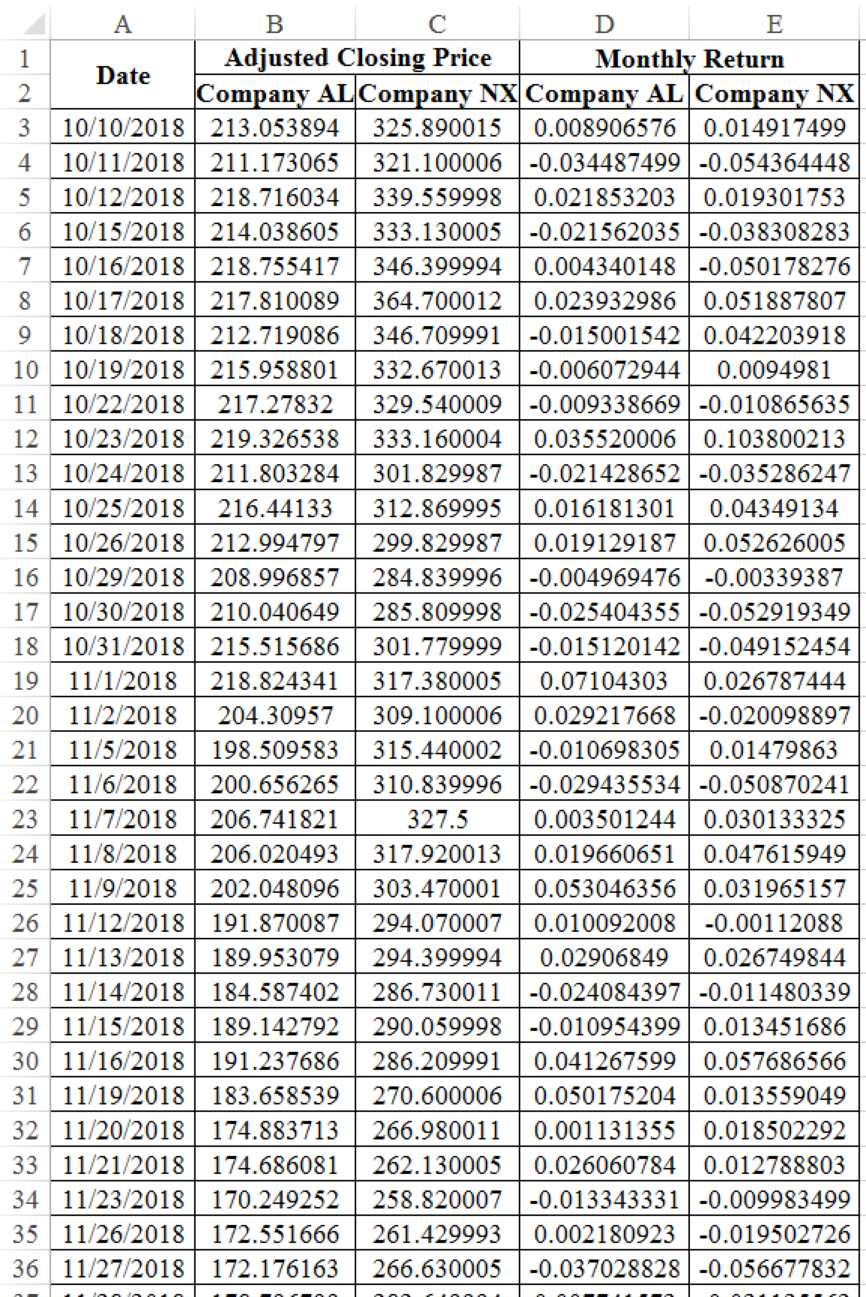

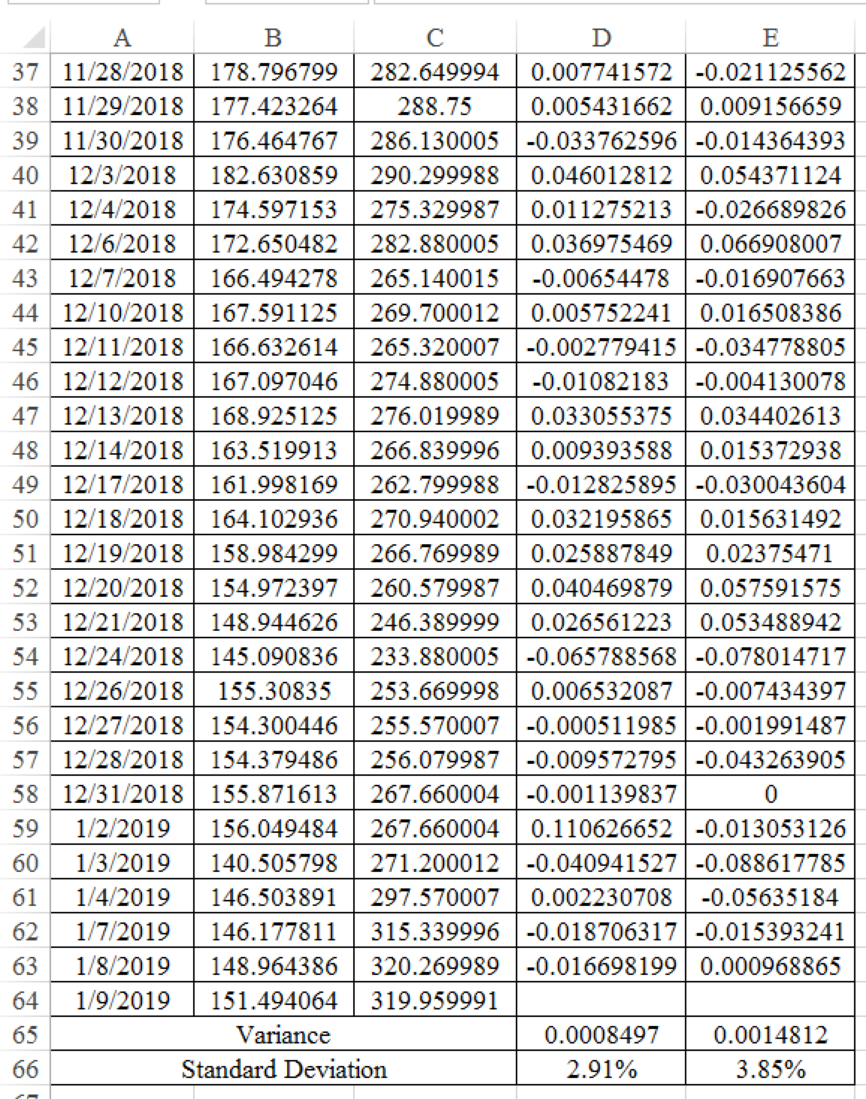

Company AL’s variance is 0.0008497 and standard deviation is 2.91%. Company NX’s variance is 0.0014812 and standard deviation is 3.85%.

Explanation of Solution

Determine the variance and standard deviation of Company AL

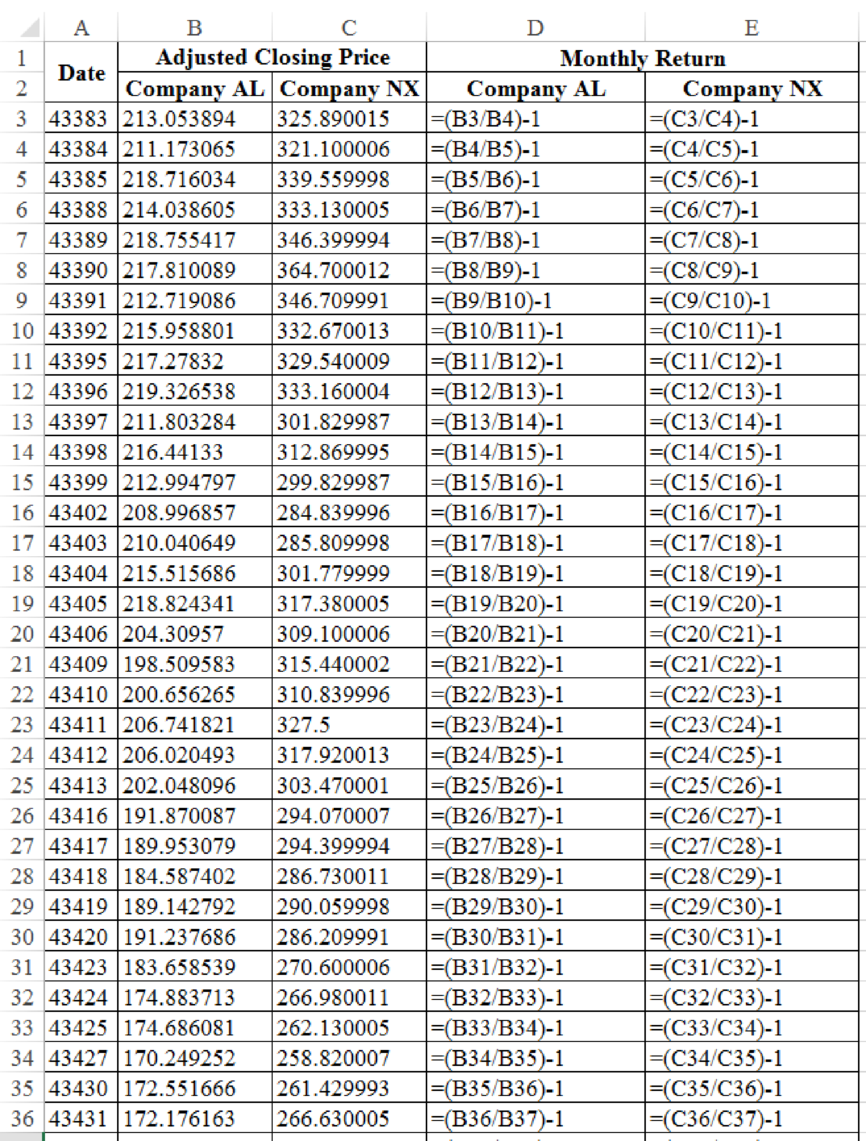

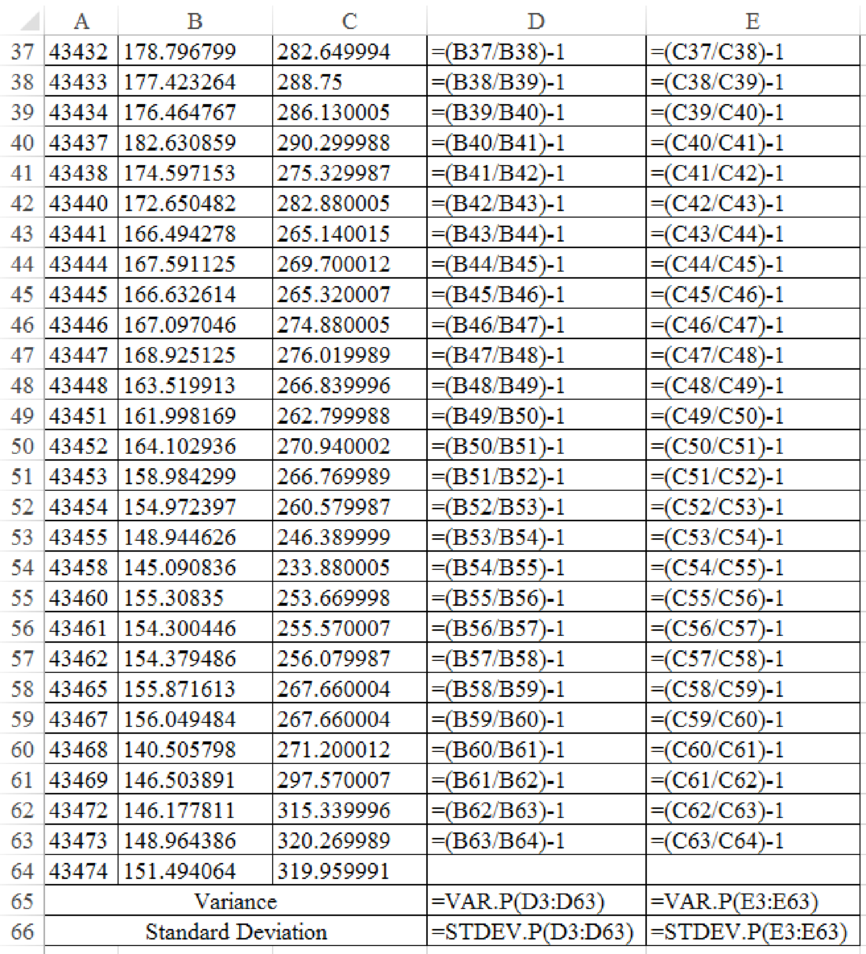

Excel Spreadsheet:

Excel Workings:

Therefore the Company AL’s variance is 0.0008497 and standard deviation is 2.91%. Company NX’s variance is 0.0014812 and standard deviation is 3.85%.

Want to see more full solutions like this?

Chapter 9 Solutions

Principles of Corporate Finance

Additional Business Textbook Solutions

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Horngren's Accounting (12th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Essentials of MIS (13th Edition)

- What is the risk-free rate typically associated with? A) Corporate bonds B) Government securities C) Real estate investments D) Equitiesarrow_forwardNo chatgpt! Which of the following financial instruments is used to hedge against interest rate risk? A) Futures contracts B) Treasury bills C) Interest rate swaps D) Corporate bondsarrow_forwardWhich of the following financial instruments is used to hedge against interest rate risk? A) Futures contracts B) Treasury bills C) Interest rate swaps D) Corporate bondsarrow_forward

- Need assistance! Which of the following is the best description of a dividend? A) The amount a company spends on research and development B) A payment made to shareholders from company profits C) The price of a company’s stock D) The cost of producing goods for salearrow_forwardI need help in this question! Which of the following is the best description of a dividend? A) The amount a company spends on research and development B) A payment made to shareholders from company profits C) The price of a company’s stock D) The cost of producing goods for salearrow_forwardNo AI Which of the following is the best description of a dividend? A) The amount a company spends on research and development B) A payment made to shareholders from company profits C) The price of a company’s stock D) The cost of producing goods for saleNeed help!arrow_forward

- Do not use ChatGPT! Which of the following is the best description of a dividend? A) The amount a company spends on research and development B) A payment made to shareholders from company profits C) The price of a company’s stock D) The cost of producing goods for salearrow_forwardDo not use AI No chatgpt The concept of risk-return tradeoff implies that: A) Investors expect higher returns for taking on more risk B) Risk is irrelevant to investment decisions C) Low-risk investments always produce high returns D) Diversification eliminates all riskarrow_forwardNo chatgpt The concept of risk-return tradeoff implies that: A) Investors expect higher returns for taking on more risk B) Risk is irrelevant to investment decisions C) Low-risk investments always produce high returns D) Diversification eliminates all riskarrow_forward

- I need help completing a chart with the following base on Amazonarrow_forwardWhat is the primary purpose of financial management? A) Maximizing profits B) Minimizing costs C) Maximizing shareholder wealth D) Managing liquidity need help!arrow_forwardWhat is the primary purpose of financial management? A) Maximizing profits B) Minimizing costs C) Maximizing shareholder wealth D) Managing liquidityarrow_forward