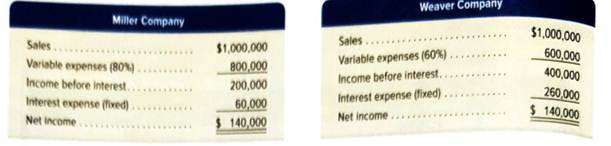

Shown here are condensed income statements for two different companies (both are organized as LLCs and pay no income taxes).

Required

- Compute times interest earned for Miller Company.

- Compute times interest earned for Weaver Company.

- What happens to each company’s net income if sales increase by 30%?

- What happens to each company’s net income if sales increase by 50%?

- What happens to each company’s net income if sales increase by 80%?

- What happens to each company’s net income if sales decrease by 10%?

- What happens to each company’s net income if sales decrease by 20%?

- What happens to each company’s net income if sales decrease by 40%? Analysis Component

- Comment on the results from parts 3 through 8 in relation to the fixed-cost strategies of the two companies and the ratio values you computed in parts 1 and 2.

1.

Introduction: The income statement also known as the profit and loss statement which consists of operating and non-operating expenses which are deducted from the revenue generated from the sales. The time’s interest earned refers to the ratio of income before interest and taxes to interest earned.

To calculate: Times interest earned for company M.

Explanation of Solution

Computation of times interest earned for company M;

2.

Introduction: The income statement also known as the profit and loss statement which consists of operating and non-operating expenses which are deducted from the revenue generated from the sales. The time’s interest earned refers to the ratio of income before interest and taxes to interest earned.

To calculate: Times interest earned for company W.

Explanation of Solution

Computation of times interest earned for company W:

3.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales increased by 30%.

Explanation of Solution

If sales increased by 30% for each company,

For company M;

For company W:

Computing net income for company M:

| Particular | Amount |

| Sales | $1,300,000 |

| Less: variable expense (80%) | (1,040,000) |

| Income before interest | 260,000 |

| Less: Interest expense(fixed) | (60,000) |

| Net income | $200,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $1,300,000 |

| Less: variable expense (60%) | (780,000) |

| Income before interest | 520,000 |

| Less: Interest expense(fixed) | (260,000) |

| Net income | $260,000 |

4.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales increased by 50%.

Explanation of Solution

If sales increased by 50% for each company,

For company M:

For company W:

Computing net income for company M:

| Particular | Amount |

| Sales | $1,500,000 |

| Less: variable expense (80%) | (1,200,000) |

| Income before interest | 3,000,000 |

| Less: Interest expense(fixed) | (60,000) |

| Net income | $240,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $1,300,000 |

| Less: variable expense (60%) | (900,000) |

| Income before interest | 400,000 |

| Less: Interest expense(fixed) | (260,000) |

| Net income | $140,000 |

5.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales increased by 80%.

Explanation of Solution

If sales increased by 80% for each company,

For company M;

For company W:

Computing net income for company M:

| Particular | Amount |

| Sales | $1,800,000 |

| Less: variable expense (80%) | (1,440,000) |

| Income before interest | 360,000 |

| Less: Interest expense(fixed) | (60,000) |

| Net income | $300,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $1,800,000 |

| Less: variable expense (60%) | (1,080,000) |

| Income before interest | 720,000 |

| Less: Interest expense(fixed) | (260,000) |

| Net income | $460,000 |

6.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales decreased by 10%.

Explanation of Solution

If sales decreased by 10% for each company,

For company M;

For company W:

Computing net income for company M:

| Particular | Amount |

| Sales | $900,000 |

| Less: variable expense (80%) | (720,000) |

| Income before interest | 180,000 |

| Less: Interest expense(fixed) | (60,000) |

| Net income | $120,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $900,000 |

| Less: variable expense (60%) | (540,000) |

| Income before interest | 360,000 |

| Less: Interest expense(fixed) | (260,000) |

| Net income | $100,000 |

7.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales decreased by 10%.

Explanation of Solution

If sales decreased by 20% for each company,

For company M;

For company W:

Computing net income for company M:

| Particular | Amount |

| Sales | $800.000 |

| Less: variable expense (80%) | (640,000) |

| Income before interest | 160,000 |

| Less: Interest expense(fixed) | (60,000) |

| Net income | $100,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $800,000 |

| Less: variable expense (60%) | (480,000) |

| Income before interest | 320,000 |

| Less: Interest expense(fixed) | (260,000) |

| Net income | $60,000 |

8.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales decreased by 10%.

Explanation of Solution

If sales decreased by 40% for each company,

For company M;

For company W:

Computing net income for company M:

| Particular | Amount |

| Sales | $600,000 |

| Less: variable expense (80%) | (480,000) |

| Income before interest | 120,000 |

| Less: Interest expense(fixed) | (60,0000) |

| Net income | $60,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $60,0000 |

| Less: variable expense (60%) | (360,000) |

| Income before interest | 240,000 |

| Less: Interest expense(fixed) | (260,000) |

| Net income | ($20,000) |

9.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

The time's interest earned refers to the ratio of income before interest and taxes to interest earned.

To comment: On the result for interest earned by both the companies and for part 3 to 8.

Explanation of Solution

Comments on times interest earned by both the companies are:

The time's interest earned by company M is 3.3 times which indicates a healthy position to invest in the company from the investor point of view.

For company W:

The time's interest earned by the company W is 1.5 times which lesser than 2.5 times this indicates the riskier to invest in the company from an investor point of view.

Comments on the fixed cost strategies for the company The company fixed cost is decreasing the net income of the company on different sales revenue. This leads the company W to lose on 40% sales.

Want to see more full solutions like this?

Chapter 9 Solutions

Loose Leaf for Financial Accounting: Information for Decisions

- NO WRONG ANSWERarrow_forwardAnjali Brewery has estimated budgeted costs of $72,600, $78,900, and $85,200 for the manufacture of 4,000, 5,000, and 6,000 gallons of beer, respectively, next quarter. What are the variable and fixed manufacturing costs in the flexible budget for Anjali Brewery? Answerarrow_forwardCalculate the labor variancearrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning