Cain Components manufactures and distributes various plumbing products used in homes and other buildings. Over time, the production staff has noticed that products they considered easy to make were difficult to sell at margins considered reasonable, while products that seemed to take a lot of staff time were selling well despite recent price increases. A summer intern has suggested that the cost system might be providing misleading information.

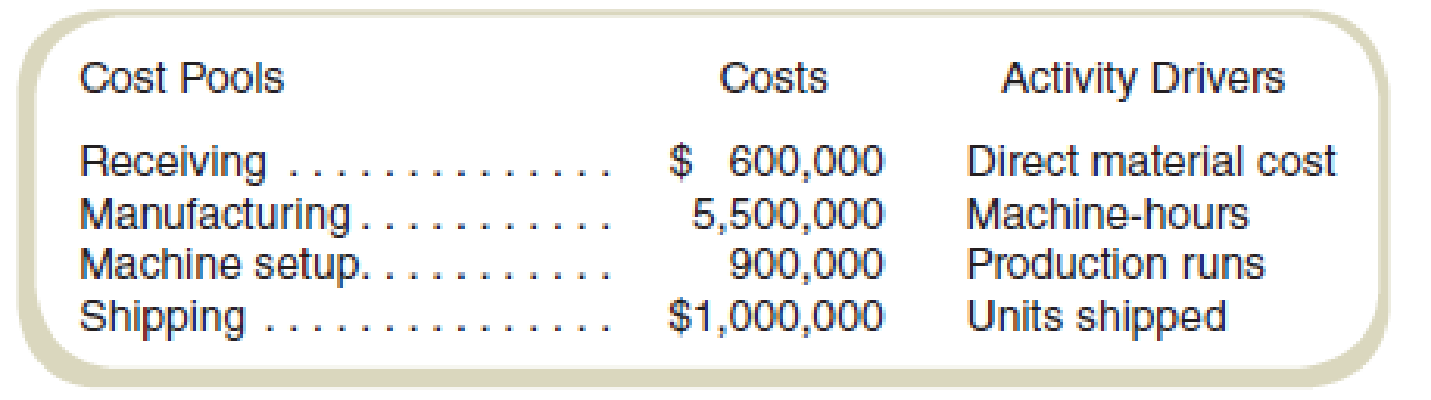

The controller decided that a good summer project for the intern would be to develop, in one self-contained area of the plant, an alternative cost system with which to compare the current system. The intern identified the following cost pools and, after discussion with some plant personnel, appropriate cost drivers for each pool. There were:

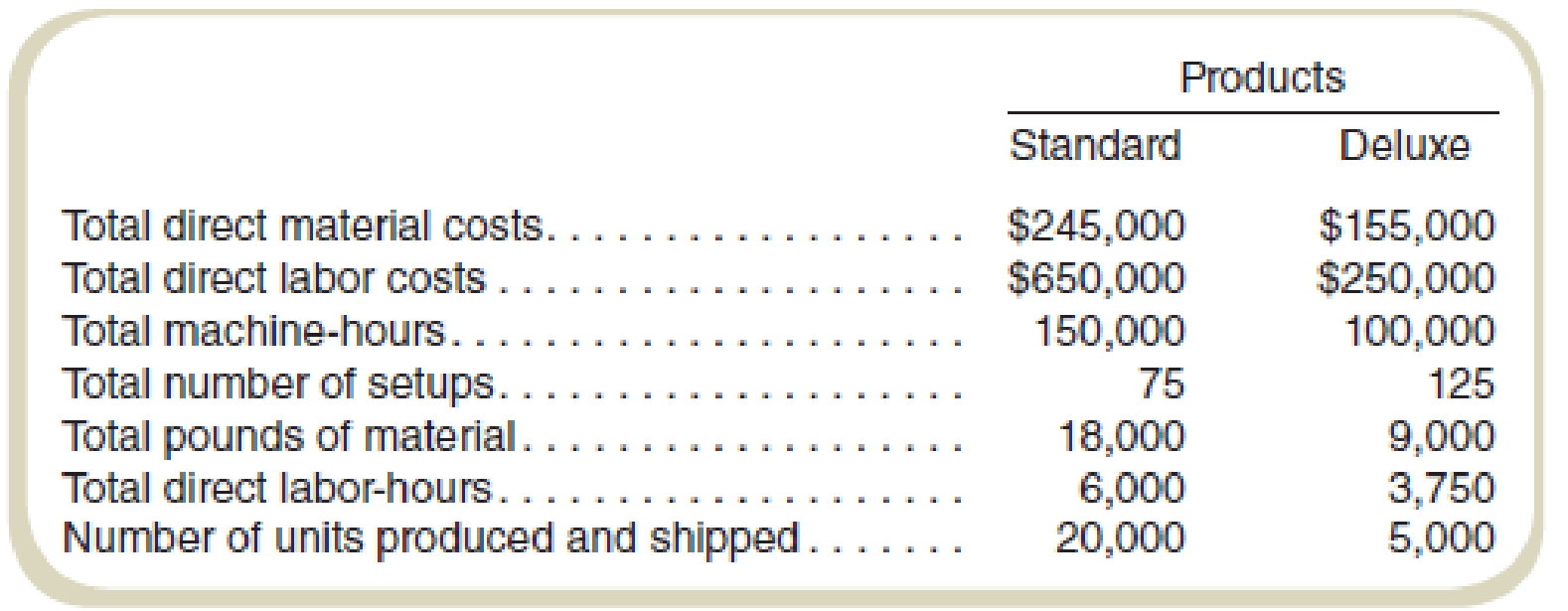

In this particular area, Cain produces two of its many products: Standard and Deluxe. The following are data for production for the latest full year of operations:

Required

- a. The current cost accounting system charges

overhead to products based on machine-hours. What unit product costs will be reported for the two products if the current cost system continues to be used? - b. The intern suggests an ABC system using the cost drivers identified above. What unit product costs will be reported for the two products if the ABC system is used?

- c. Would you recommend that Cain Components adopt the intern’s ABC system? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

- Satish's vacation home was destroyed by a hurricane. She had purchased the home 30 months ago for $925,000. She received $1,175,000 from her insurance company to replace the home. If she fails to rebuild the home or acquire a replacement home in the required time, how much gain must she recognize on this conversion? A. $250,000 B. $180,000 C. $125,000 D. $0 E. None of the above ??arrow_forwardWhat will be the ending retained Earnings balance ?arrow_forwardI want to this question answer for General accounting question not need ai solutionarrow_forward

- answer this with correct stepsarrow_forwardI am searching for the right answer to this financial accounting question using proper techniques.arrow_forwardPugh Sporting Goods manufactures two types of kayaks: River Explorers and Lake Cruisers. The company incurred manufacturing overhead costs of $320,000 in May. They have decided to allocate these costs based on units produced. During May, the company used 10,500 direct labor hours for River Explorers and 12,000 direct labor hours for Lake Cruisers. In total, the company produced 8,000 River Explorers and 6,000 Lake Cruisers. The amount of overhead allocated to each product, respectively, would be: a) $182,880 and $137,160 b) $140,000 and $180,000 c) $160,000 and $160,000 d) $175,000 and $145,000 e) $168,000 and $152,000arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning