Concept explainers

Activity-Based Costing for an Administrative Service

The Personnel Department at LastCall Enterprises handles many administrative tasks for the two divisions that make up LastCall: LaidBack and StressedOut. LaidBack division manages the company’s traditional business line. This business, although lucrative, is currently not growing. StressedOut, on the other hand, is the company’s new business, which has experienced double-digit growth for each of the last three years.

The cost allocation system at LastCall allocates all corporate costs to the divisions based on a variety of cost allocation bases. Personnel costs are allocated based on the average number of employees in the two divisions.

There are two basic activities in the Personnel Department. The first, which is called employee maintenance, manages employee records. Virtually all of this activity occurs when employees are hired or leave the company. The other activity is payroll, which is an ongoing activity and requires the same amount of work for each employee regardless of the employee’s salary.

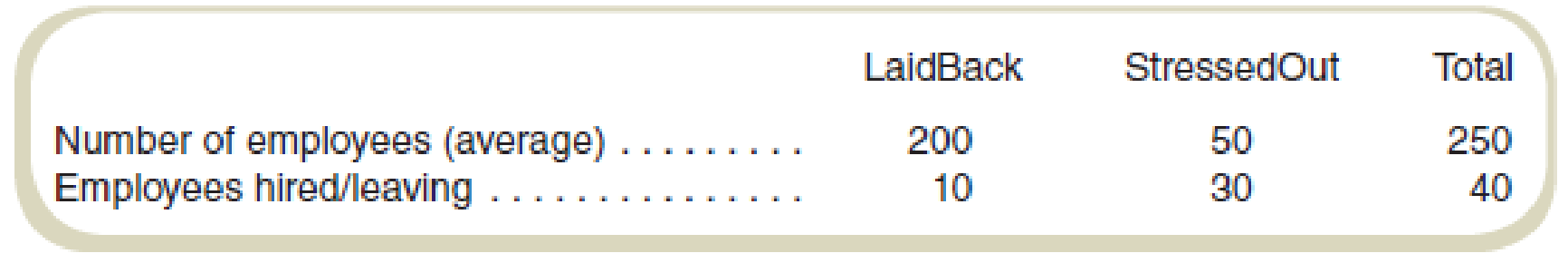

Assorted data for LastCall for the last year follow:

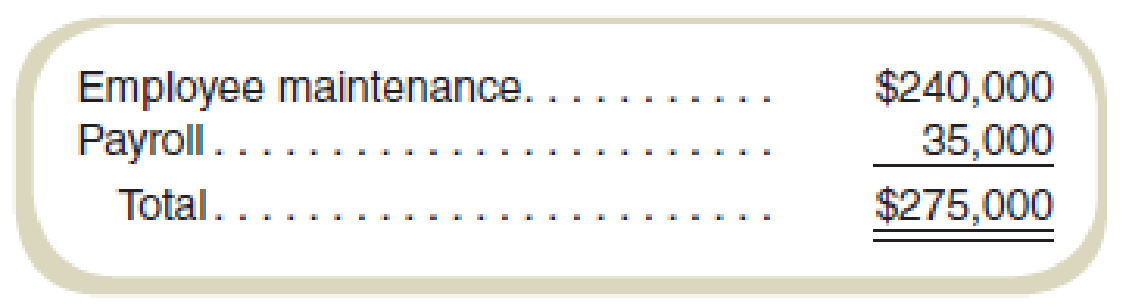

The Personnel Department incurred the following costs during the year:

Required

- a. Under the current allocation system, what are the costs that will be allocated from personnel to LaidBack? To StressedOut?

- b. Suppose the company implements an activity-based cost system for personnel with the two activities, employee maintenance and payroll. Use the number of employees hired/leaving as the cost driver for employee maintenance costs and the average number of employees for payroll costs. What are the costs that will be allocated from personnel to LaidBack? To StressedOut?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

- 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forwardWhich basis of accounting recognizes revenues and expenses when cash is exchanged?A. AccrualB. Modified AccrualC. Cash BasisD. Matchingneedarrow_forwardWhich basis of accounting recognizes revenues and expenses when cash is exchanged?A. AccrualB. Modified AccrualC. Cash BasisD. Matchingneed helparrow_forward

- Which basis of accounting recognizes revenues and expenses when cash is exchanged?A. AccrualB. Modified AccrualC. Cash BasisD. Matchingarrow_forward9. Which of the following best describes deferred revenue?A. Cash received before revenue is earnedB. Cash paid after expense is incurredC. Revenue earned but not yet receivedD. Expense incurred but not paidarrow_forwardNeed help. 2. What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward

- Dont use AI 2. What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward2. What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forwardNo chatgpt What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forward

- I need help 10. What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsneed answerarrow_forwarddont use ai What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning