Concept explainers

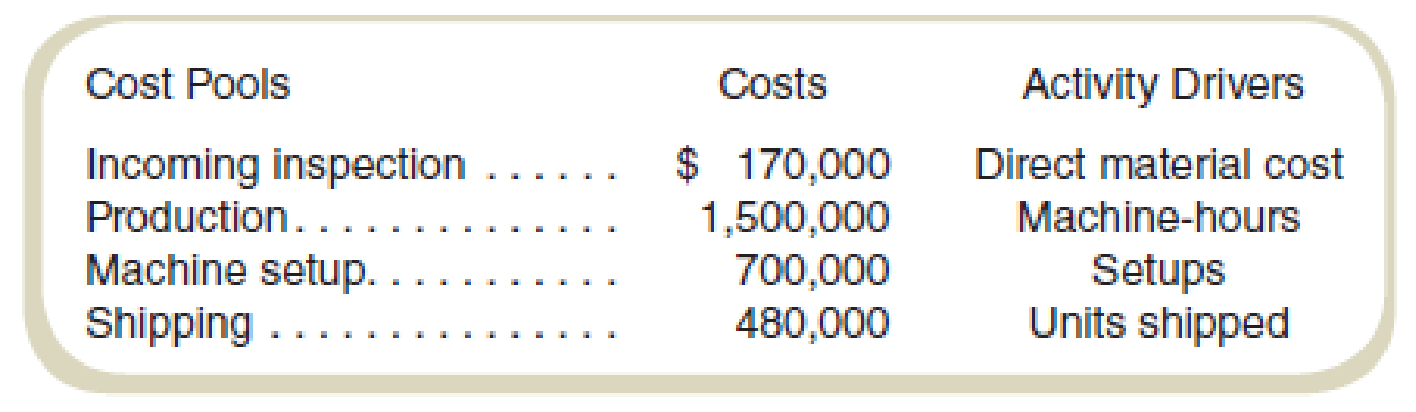

Utica Manufacturing (UM) was recently acquired by MegaMachines, Inc. (MM), and organized as a separate division within the company. Most manufacturing plants at MM use an ABC system, but UM has always used a traditional product costing system. Bob Miller, the plant controller at UM, has decided to experiment with ABC and has asked you to help develop a simple ABC system that would help him decide if it was useful. The controller’s staff has identified costs for the first month in the four

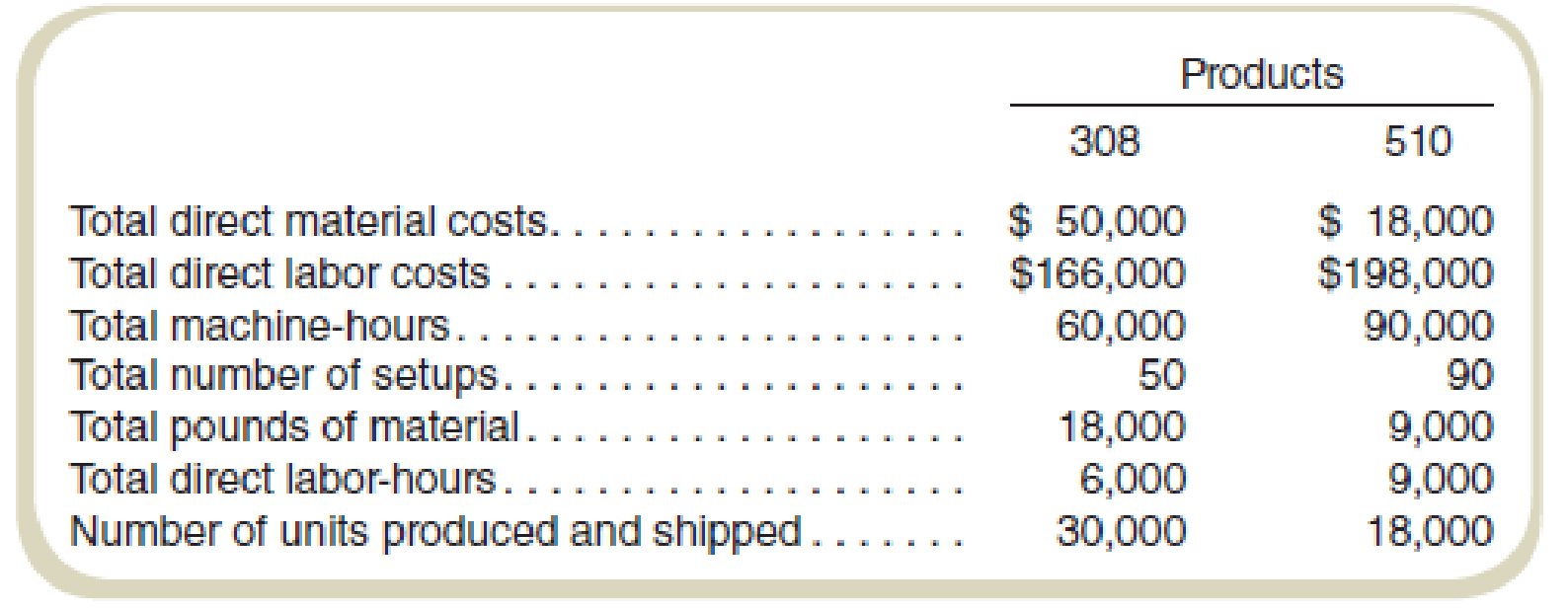

The company manufactures two basic products with model numbers 308 and 510. The following are data for production for the first month as part of MM:

Required

- a. The current cost accounting system charges overhead to products based on machine-hours. What unit product costs will be reported for the two products if the current cost system continues to be used?

- b. A consulting firm has recommended using an activity-based costing system, with the activities based on the cost pools identified by the cost accountant. What are the cost driver rates for the four cost pools identified by the cost accountant?

- c. What unit product costs will be reported for the two products if the ABC system suggested by the cost accountant’s classification of cost pools is used?

- d. If management should decide to implement an activity-based costing system, what benefits should it expect?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

- No chatgpt! Which financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings StatementNo Aiarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forward

- Which account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentcorrectarrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentcorrect solutuarrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentneedarrow_forward

- Which account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentarrow_forwardChoose the items of income or expense that belong in the described areas of Form 1120, Schedule M-1 (Sections: Income subject to tax not recorded on books, Expenses recorded on books this year not deducted on this return, Income recorded on books this year not included on this return, and Deductions on this return not charged against book income.) Note the appropriate amount for the item selected under each section. If the amount decreases taxable income relative to book income, provide the amount as a negative number. If the amount increases taxable income relative to book income, provide the amount as a positive number. The following adjusted revenue and expense accounts appeared in the accounting records of Pashi, Inc., an accrual basis taxpayer, for the year ended December 31, Year 2. Revenues Net sales $3,000,000 Interest 18,000 Gains on sales of stock 5,000 Key-man life insurance proceeds 100,000 Subtotal $3,123,000 Costs and Expenses Cost of…arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning