Concept explainers

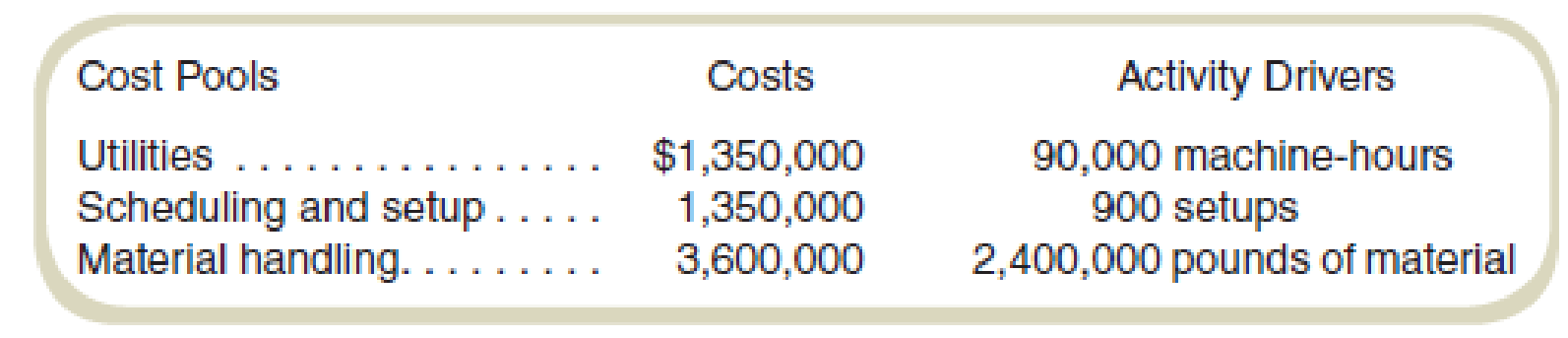

Churchill Products is considering updating its cost system to an activity-based costing system and is interested in understanding the effects. The company’s cost accountant has identified three

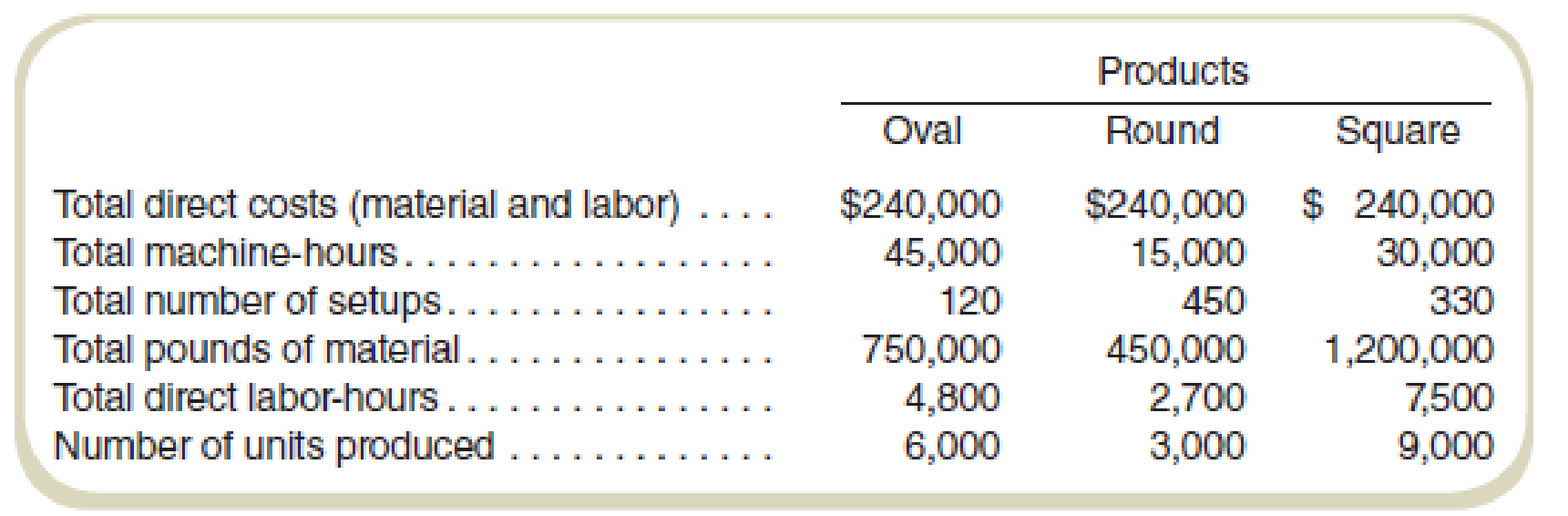

The company manufactures three models of water basins (Oval, Round, and Square). The plans for production for the next year and the budgeted direct costs and activity by product line are as follows:

Required

- a. The current cost accounting system charges overhead to products based on direct labor-hours. What unit product costs will be reported for the three products if the current cost system continues to be used?

- b. A consulting firm has recommended using an activity-based costing system, with the activities based on the cost pools identified by the cost accountant. Prepare a cost flow diagram of the proposed ABC system.

- c. What are the cost driver rates for the three cost pools identified by the cost accountant?

- d. What unit product costs will be reported for the three products if the ABC system suggested by the cost accountant’s classification of cost pools is used?

- e. If management should decide to implement an activity-based costing system, what benefits should it expect?

a.

Determine the unit product costs according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Compute the unit cost:

| Particulars | Oval | Round | Square |

| Direct costs | $240,000 | $240,000 | $240,000 |

|

Add: Overhead | $2,016,000 | $1,134,000 | $3,150,000 |

| Total costs | $2,256,000 | $1,374,000 | $3,390,000 |

| Number of units | 6,000 | 3,000 | 9,000 |

| Unit cost | $376 | $458 | $377 |

Table: (1)

Compute the burden rate:

b.

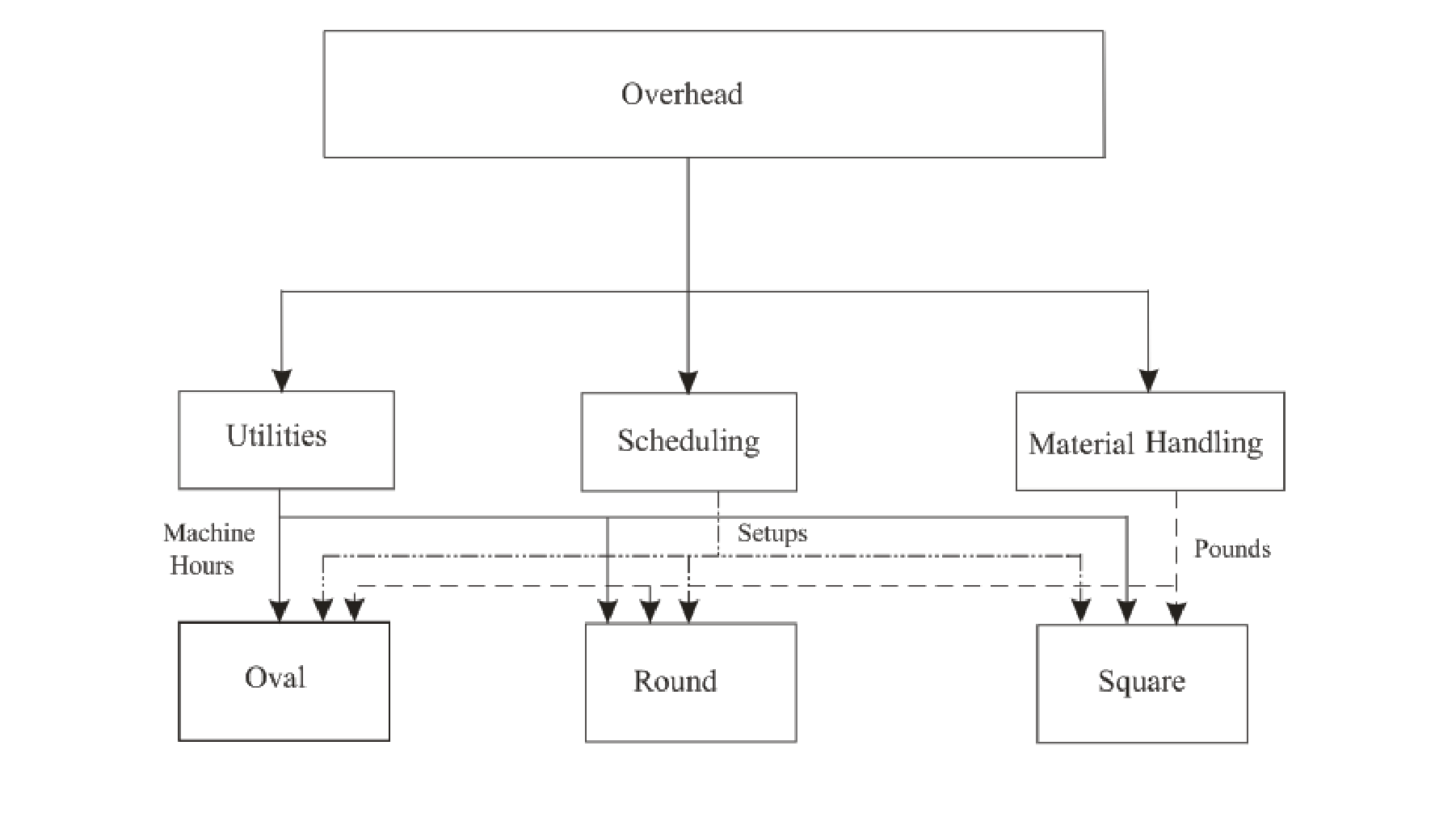

Prepare a cost flow diagram according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Cost flow diagram:

Cost flow diagram determines the flow of the cost of the operations through working dynamics of the cost flow system.

Figure (1)

c.

Determine the cost driver rate according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Determine the cost drivers and cost drivers rate:

| Particulars | Cost | Cost driver |

Cost per cost driver |

| Utilities | $1,350,000 | 90,000 machine hours | $15 |

| Scheduling and setup | $1,350,000 | 900 setups | $1,500 |

| Material handling | $3,600,000 | 2,400,000 lbs. | $1.50 |

Table: (2)

d.

Determine the unit product costs according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Compute the unit cost:

| Particulars | Oval | Round | Square |

| Direct costs | $240,000 | $240,000 | $240,000 |

| Add:Overhead: | |||

|

Utilities | $675,000 | $225,000 | $450,000 |

|

Scheduling and setup | $180,000 | $675,000 | $495,000 |

|

Material handling | $1,125,000 | $675,000 | $1,800,000 |

| Total costs | $2,220,000 | $1,815,000 | $2,985,000 |

| Number of units | $6,000 | $3,000 | $9,000 |

|

Unit cost | $370 | $605 | $332 |

Table: (3)

e.

Determine the effect of implementing activity-based costing system.

Explanation of Solution

Activity-based costing (ABC):

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

The relevance of the ABC system according to the information given in the question:

The implementation of the ABC system would make the understanding of product costs. The cost drivers would be determined by breaking down the costs with respect to the cost drivers. The determination and analysis of the product complexity, product cost, and product volume would provide the correlation between the three. This vital information would be critical for pricing decisions and profitability strategies.

Want to see more full solutions like this?

Chapter 9 Solutions

GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

- I need help solving this general accounting question with the proper methodology.arrow_forwardNo AI The accounting principle that requires matching revenues with related expenses is the:A. Going Concern PrincipleB. Matching PrincipleC. Cost PrincipleD. Full Disclosure Principlearrow_forwardRevenue is recognized in the accounting records when it is:A. CollectedB. EarnedC. DepositedD. Reportedarrow_forward

- The accounting principle that requires matching revenues with related expenses is the:A. Going Concern PrincipleB. Matching PrincipleC. Cost PrincipleD. Full Disclosure Principlearrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentneedarrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit RevenueCorrectarrow_forward

- If cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit Revenuecorrectarrow_forwardGAP Corp. is a calendar year S corporation with three shareholders. George and Anna each own 49 percent of the stock. Peter owns 2 percent of the stock. The corporation was formed on January 2, Year 1, and has been an S corporation since its inception. Using the exhibits, prepare a schedule of GAP's income, gain, loss, and deduction items for Year 2. In column B, enter the amount for federal income tax purposes. In column C, enter the amount included in GAP's Form 1120S ordinary business income (OBI) or loss. In column D, enter the amount included on GAP's Schedule K as a taxable or deductible separately stated item. Each item may have amounts entered in ordinary business income, separately stated items, or both. Enter income and gain amounts as positive numbers. Enter losses and deductions as negative numbers. If the amount is zero, enter a zero (0). A B C D 1 Income, Gain, Loss, and Deduction Items Amount for Federal Income Tax Purposes Ordinary Business Income…arrow_forwardIf cash is received before services are provided, what is the journal entry?A. Debit Revenue, Credit CashB. Debit Unearned Revenue, Credit CashC. Debit Cash, Credit Unearned RevenueD. Debit Accounts Receivable, Credit Revenue need helparrow_forward

- Dennis Green and Peter Olinto are equal partners in Foxy Partnership. Peter is an active general partner. Dennis is a limited partner and is not involved in the operations of the business. Foxy Partnership's Year 2 financial statements are provided in the exhibits. Using the information provided, enter the appropriate amounts to be reported on page 1 of Foxy Partnership's income tax return in the table below. Enter all amounts as positive whole values. If a response is zero, enter a zero (0). A B 1 Gross receipts or sales 2 Cost of goods sold 3 Salaries and wages 4 Guaranteed payments to partners 5 Repairs and maintenance 6 Bad debts 7 Rent 8 Depreciation 9 Other deductions 10 Ordinary business income (loss)arrow_forwardDennis Green and Peter Olinto are equal partners in Foxy PartneDennis Green and Peter Olinto are equal partners in Foxy Partnership. Peter is an active general partner. Dennis is a limited partner and is not involved in the operations of the business. Foxy Partnership's Year 2 financial statements are provided in the exhibits. Using the information provided, enter the appropriate amounts to be reported on page 1 of Foxy Partnership's income tax return in the table below. Enter all amounts as positive whole values. If a response is zero, enter a zero (0). 2. Cost of goods sold 3. Salaries and wages 4. Guaranteed payments to partners 5. Repairs and maintenance 6. Bad debts 7. Rent 8. Depreciation 9. Other deductions 10. Ordinary business income (loss)arrow_forwardIf a business pays off a loan, which of the following will occur?A. Assets and liabilities increaseB. Assets and liabilities decreaseC. Only liabilities increaseD. Equity decreasesarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning