INTRO MGRL ACCT LL W CONNECT

8th Edition

ISBN: 9781266376771

Author: BREWER

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 13E

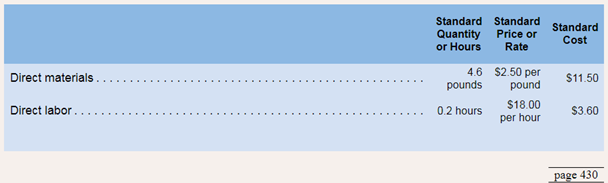

Direct Materials and Direct Labor Variances

Huron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct Labor standards for one unit of Zoom are given below:

During the most recent month, the following activity was recorded:

a. Twenty thousand pounds of material were purchased at a cost of S2.35 per pound.

b. All of the material purchased was used to produce 4.000 units of Zoom.

c. 750 hours of direct labor time were recorded at a total labor cost of S14.925.

Required:

1. Compute the materials price and quantity variances for the month.

2. Compute the labor rate and efficiency variances for the month.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Jane Yoakim, President of Estefan Co., recently read an article that claimed that at least 100 of the country's 500 largest companies were either adopting or considering adopting the last in, first out (LIFO) method for valuing inventories. The article stated that the firms were switching to LIFO to (1) neutralize the effect of inflation in their financial statements, (2) eliminate inventory profits, and (3) reduce income taxes. Ms. Yoakim wonders if the switch would benefit her company.

Estefan currently uses the first-in, first-out (FIFO) method of inventory valuation in its periodic inventory system. The company has a high inventory turnover rate, and inventories represent a significant proportion of the assets.

Ms. Yoakim has been told that the LIFO system is more costly to operate and will provide little benefit to companies with high turnover. She intends to use the inventory method that is best for the company in the long run rather than selecting a method just because it is the…

please help with how im supposed to solve this

INVOLVE was incorporated as a not-for-profit organization on January 1, 2023. During the fiscal year ended December 31,

2023, the following transactions occurred.

1. A business donated rent-free office space to the organization that would normally rent for $35,600 a year.

2. A fund drive raised $188,000 in cash and $106,000 in pledges that will be paid next year. A state government grant of

$156,000 was received for program operating costs related to public health education.

3. Salaries and fringe benefits paid during the year amounted to $209,160. At year-end, an additional $16,600 of salaries

and fringe benefits were accrued.

4. A donor pledged $106,000 for construction of a new building, payable over five fiscal years, commencing in 2025. The

discounted value of the pledge is expected to be $94,860.

5. Office equipment was purchased for $12,600. The useful life of the equipment is estimated to be five years. Office

furniture with a fair value of $10,200 was donated by a local office…

Chapter 9 Solutions

INTRO MGRL ACCT LL W CONNECT

Ch. 9.A - Fixed Overhead Variances Primara Corporation has a...Ch. 9.A - Predetermined Overhead Rate: Overhead Variances...Ch. 9.A - Applying Overhead in a Standard Costing System...Ch. 9.A - Prob. 4ECh. 9.A - Using Fixed Overhead Variances The standard cost...Ch. 9.A - Prob. 6ECh. 9.A - Relations Among Fixed Overhead Variances Selected...Ch. 9.A - Applying Overhead; Overhead Variances Lane Company...Ch. 9.A - Applying Overhead; Overhead Variances Chilczuk....Ch. 9.A - Comprehensive Standard Cost Variances "Wonderful!...

Ch. 9.A - Comprehensive Standard Cost Variances Flandro...Ch. 9.A - Selection of a Denominator: Overhead Analysis:...Ch. 9.B - Standard Cost Flows: Income Statement Preparation...Ch. 9.B - Standard Cost Flows: Income Statement Preparation...Ch. 9.B - Standard Cost Flows Bowen Company manufactures one...Ch. 9.B - Standard Cost Flows Hartwell Company manufactures...Ch. 9.B - Transaction Analysis; Income Statement Preparation...Ch. 9.B - Transaction Analysis; Income Statement Preparation...Ch. 9 - What is a static planning budget?Ch. 9 - What is a flexible budget and how does it differ...Ch. 9 - What are some of the possible reasons that actual...Ch. 9 - Why is it difficult to interpret a difference...Ch. 9 - What is a revenue variance and what does it mean?Ch. 9 - What is a spending variance and what does it mean?Ch. 9 - What does a flexible budget enable that a simple...Ch. 9 - How does a flexibe budget based on the cost...Ch. 9 - Prob. 9QCh. 9 - Why are separate price and quantity variances...Ch. 9 - Who is generally responsible for the materials...Ch. 9 - Prob. 12QCh. 9 - Prob. 13QCh. 9 - Our workers are all under labor contracts:...Ch. 9 - Prob. 15QCh. 9 - Prob. 16QCh. 9 - Prob. 17QCh. 9 - The Excel worksheet form that appears below is to...Ch. 9 - Prob. 2AECh. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 2F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 4F15Ch. 9 - Prob. 5F15Ch. 9 - Prob. 6F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 8F15Ch. 9 - Prob. 9F15Ch. 9 - Prob. 10F15Ch. 9 - Prob. 11F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prob. 13F15Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Preble Company manufactures one product. Its...Ch. 9 - Prepare a Flexible Budget Puget Sound Divers is a...Ch. 9 - Prepare a Report Shong Revenue and Spending...Ch. 9 - Prepare a Flexible Budget with More Than One Cost...Ch. 9 - Direct Materials Variances Bandar Industries...Ch. 9 - Prob. 5ECh. 9 - Prob. 6ECh. 9 - Planning Budget Lavage Rapide is a Canadian...Ch. 9 - EXERCISE 98 Flexible Budget L091 Refer to the data...Ch. 9 - Prepare a Report Showing Revenue and Spending...Ch. 9 - Direct Labor and Variable Manufacturing Overhead...Ch. 9 - Prob. 11ECh. 9 - Working with More Than One Cost Driver The...Ch. 9 - Direct Materials and Direct Labor Variances Huron...Ch. 9 - Direct Materials Variances Refer to the data in...Ch. 9 - Prob. 15ECh. 9 - Prob. 16ECh. 9 - Prob. 17ECh. 9 - Comprehensive Variance Analysis Miller Toy Company...Ch. 9 - More than One Cost Driver Milano Pizza is a small...Ch. 9 - Basic Variance Analysis: the Impact of Vanances on...Ch. 9 - Multiple Products. Materials, and Processes...Ch. 9 - Variance Analysis In a Hospital John Fleming,...Ch. 9 - Flexible Budgets and Spending Variances You have...Ch. 9 - Comprehensive Variance Analysis Marvel Parts....Ch. 9 - Direct Materials and Direct Labor Variances:...Ch. 9 - Comprehensive Variance Analysis Highland Company...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fairfield Company's payroll costs for the most recent month are summarized here: Item Hourly labor unges Description 920 hours $27 per hour 190 hours for Job 101 340 hours for Job 102 Factory supervision Production engineer Factory Janitorial work Selling, general, and administrative salaries Total payroll costs Required: 390 hours for Job 103 Total Cost $ 5,130 9,180 10,530 $ 24,840 4,350 7,100 1,200 8,800 $ 46,298 1. & 2. Prepare the journal entries for payroll and to apply manufacturing overhead to production. The company applies manufacturing overhead to products at a predetermined rate of $54 per direct labor hour Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. View transaction list Journal entry worksheet A B Record Fairfield Company's payroll costs to be paid at a later date. Note Enter debits before credits. S.No Date 1 Account Title Debit Creditarrow_forwardNo wrong answerarrow_forwardL.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7. In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question: Now assume that 5% of the L.L. Bean boots are returned by customers for various reasons. L. Bean has a 100% refund policy for returns, no matter what the reason. What would the journal entry be to accrue L.L. Bean's sales returns for this one pair of boots?arrow_forward

- The following data were taken from the records of Splish Brothers Company for the fiscal year ended June 30, 2025. Raw Materials Inventory 7/1/24 $58,100 Accounts Receivable $28,000 Raw Materials Inventory 6/30/25 46,600 Factory Insurance 4,800 Finished Goods Inventory 7/1/24 Finished Goods Inventory 6/30/25 99,700 Factory Machinery Depreciation 17,100 21,900 Factory Utilities 29,400 Work in Process Inventory 7/1/24 21,200 Office Utilities Expense 9,350 Work in Process Inventory 6/30/25 29,400 Sales Revenue 560,500 Direct Labor 147,550 Sales Discounts 4,700 Indirect Labor 25,360 Factory Manager's Salary 63,400 Factory Property Taxes 9,910 Factory Repairs 2,500 Raw Materials Purchases 97,300 Cash 39,200 SPLISH BROTHERS COMPANY Income Statement (Partial) $arrow_forwardNo AIarrow_forwardL.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7.In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question: Assume that a pair of 8" Bean Boots are ordered on December 3, 2015. The order price is $109. The sales tax rate in the state in which the boots are order is 7%. L.L. Bean ships the boots on January 29, 2016. Assume same-day shipping for the sake of simplicity. On what day would L.L. Bean recognize the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY