Concept explainers

Hartwell Company manufactures one product, it does not maintain any beginning or ending inventories, and its uses a standard cost system. Its predetermined

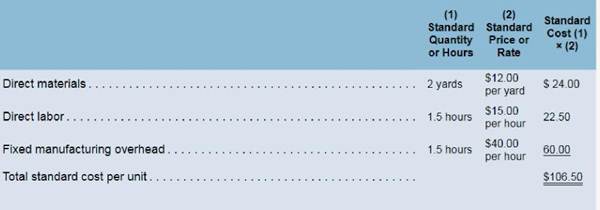

The company purchased (with cash) and used 60.000 yards of raw materials at a cost of $11.00 per yard. Its direct laborers worked 40.000 hours and were paid a total of S600.000. The company started and completed 28.000 units of finished goods during the period. Bowen’s standard cost card for its only product is as follows:

Required:

Required:

1. When recording the raw material purchases (on account):

a. The Raw Materials inventory will increase (decrease) by how much?

b. The Cash will increase (decrease) by how much?

c. The materials price variance will be favorable or unfavorable and by how much?

2. When recording the raw materials used in production:

a. The Raw Materials inventory will increase (decrease) by how much?

b. The Work in Process inventory will increase (decrease) by how" much?

c. The materials quantity variance will be favorable or unfavorable and by how much?

3. When recording the direct labor costs added to production:

a. The Work in Process inventory will increase (decrease) by how" much?

b. The Cash will increase (decrease) by how7 much?

c. The labor rate and efficiency variances will be favorable or unfavorable and by how much?

4. When applying fixed manufacturing overhead to production:

a, The Work in Process inventory will increase (decrease) by how7 much?

b. The fixed overhead budget and volume variances will be favorable or unfavorable and by how7 much?

5. When transferring costs from Work in Process to Finished Goods, the Finished Goods inventory will increase (decrease) by how7 much?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

INTRO MGRL ACCT LL W CONNECT

- 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forward6. Which of the following transactions decreases stockholders' equity?A. Issuing sharesB. Paying dividendsC. Earning net incomeD. Receiving customer paymentsarrow_forward8. Which of the following is not a current asset?A. Accounts ReceivableB. Prepaid RentC. BuildingD. Inventoryarrow_forward

- 9. If a company fails to adjust for accrued interest expense, what is the effect on the financial statements?A. Assets overstatedB. Liabilities understatedC. Revenues understatedD. Equity overstated need helllparrow_forward9. If a company fails to adjust for accrued interest expense, what is the effect on the financial statements?A. Assets overstatedB. Liabilities understatedC. Revenues understatedD. Equity overstatedarrow_forwardDont use chatgpt The journal entry to record the purchase of office supplies on account would include:A. Debit Supplies, Credit CashB. Debit Supplies, Credit Accounts PayableC. Debit Cash, Credit SuppliesD. Debit Accounts Payable, Credit Suppliesarrow_forward

- Can you help me solve this general accounting problem using the correct accounting process?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardNo use Ai The journal entry to record the purchase of office supplies on account would include:A. Debit Supplies, Credit CashB. Debit Supplies, Credit Accounts PayableC. Debit Cash, Credit SuppliesD. Debit Accounts Payable, Credit Suppliesarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,