Concept explainers

Basic

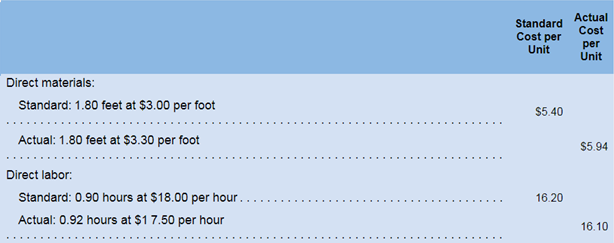

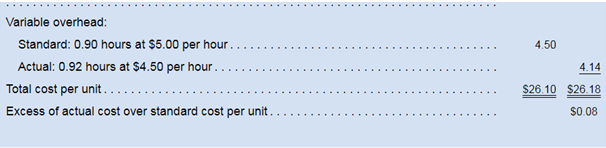

Koontz Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual Cost data for May.

The production superintendent was pleased when he saw this report and commented: ‘This S0.08 excess cost is well within the 2 percent limit management has set for acceptable variances. Its obious that theres not much to worry about with this product.”

Actual production for the month was 12,000 units. Variable

Required:

1. Compute the following variances for May:

a. Materials price and quantity variances.

b. Labor rate and efficiency variances.

c. Variable overhead rate and efficiency variances.

2. How much of the $0.08 excess unit cost is traceabk to each of the variances computed in (1) above.

3. How much of the $0.08 excess limit cost is traceable to apparent inefficient use of labor time?

4. Do you agree that the excess unit cost is not of concern’.

1

Variances

A variance shows the difference between actual cost incurred by a company and the budgeted cost. A variance may either be favorable or unfavorable. It will be considered as favorable if budgeted cost is higher than the cost that is actually incurred.

To calculate: Various variances related to material, labor and overhead.

Answer to Problem 20P

Material price variance is $6,480 unfavorable and material quantity variance is 0.

Labor rate variance is $5,520 favorable and labor efficiency variance is $4,320 unfavorable.

Variable overhead rate variance is $5,520 favorable and variable overhead efficiency variance is $1,200 unfavorable.

Explanation of Solution

Calculation of material price and quantity variance:

Formula to calculate material price variance is

Here, standard price is given as $3.00, actual price is $3.30 and actual quantity is 21,600 (1.8 * 12,000). So, the variance will be:

Formula to calculate material quantity variance is

Here, actual quantity is 21,600, standard quantity is 21,600 (1.8 *12,000) and standard price is $3 per foot. So, the variance will be:

Calculation of labor rate and efficiency variances:

Formula to calculate labor rate variance is

Here, standard rate is $18.00, actual rate is $17.50 and actual hours are 11,040 (0.92 *12,000). So, the variance will be:

Formula to calculate labor efficiency variance is

Here, standard rate is $18 per hour, actual hours are 11,040 and standard hours are 10,800 (0.90 *12,000). So, variance will be:

Calculation of variable overhead rate and efficiency variance

Formula to calculate variable overhead rate variance is

Here, standard rate is $5 per hour, actual rate is $4.5 per hour and actual hours are 11,040 (0.92 *12,000). So, the variance will be:

Formula to calculate variable overhead efficiency variance is:

Here, standard rate is $ per hour, actual hours are 11,040 and standard hours are 10,800 (0.90 *12,000). So, the variance will be:

2

Excess unit cost

This cost represents the additional cost incurred by a company. It is traceable to all the variances.

To calculate: Standard cost allowed for 20,000 units.

Answer to Problem 20P

Amount that will be traceable to material variances is $0.54U,

Amount that will be traceable to labor variances is $0.10F and

Amount that will be traceable to variable overhead variances is $0.36 F.

Explanation of Solution

The excess unit cost of $0.08 would be traceable to variances in the following way

| Particulars | Amount (in $) | Total (in $) |

| Materials | ||

| Efficiency variance (0/12,000) | 0 | |

| Price variance ($6,480/12,000) | 0.54 U | 0.54 U |

| Labor | ||

| Efficiency variance ($4,320/12,000) | 0.36 U | |

| Rate variance ($5,520/12,000) | 0.46 F | 0.10 F |

| Variable overheads | ||

| Efficiency variance ($1,200/12,000) | 0.10 U | |

| Rate variance ($5,520/12,000) | 0.46 F | 0.36 F |

| 0.08U |

$0.54 Unfavorable will be traceable to material variance, $0.10 favorable will be traceable to labor variance and $0.36 favorable will be traceable to variable overheads variance. Total will be $0.08 unfavorable (0.54U + 0.10 F + 0.36 F).

3

Excess unit cost

This is the cost that a company incurs in addition to budgeted or standard cost.

labor spending variance with the given figures.

Answer to Problem 20P

$0.36U is traceable to labor efficiency variance, $0.10U is traceable to overhead efficiency variance and $0.54 F would be due to other variances.

Explanation of Solution

When labor time is used inefficiently, both labor efficiency variance and overhead efficiency variance are affected. Traceability of cost to variances due to inefficient use is shown below:

| Particulars | Amount (in $) | Total (in $) |

| Excess of actual overhead cost | $0.08 U | |

| Less: Portion traceable to labor efficiency variance (shown in sub part 2) | 0.36 U | |

| Less: portion traceable to overhead efficiency variance (shown in sub part 2) | 0.10 U | 0.46 U |

| Portion due to other variances | 0.54 F |

$0.36 U will be traceable to labor efficiency variance, $0.10 U will be due to variable overhead efficiency variance and amount that would be left (0.54F) will be due to other variances.

4

Excess unit cost

Excess unit cost represents the additional cost that a company incurs, in excess of the budgeted cost. It is calculated by deducting standard cost from the actual cost incurred by a company.

To explain:Whether the excess cost is important to be considered.

Explanation of Solution

Excess unit cost represents the additional expense that a company incurs. Standard cost represents the ideal cost that should be incurred in the production process. This cost represents the amount that a company incurs in addition to standard or ideal cost. The statement that it is not of concern is false. It is important to be considered and shown by all the companies.

This cost is important to be considered as it is attributable to or traceable to all the variances. Traceability of this cost to all the variances is identified and then important decisions are taken. It increases the cost for a company and hence, reduces the profit. Therefore, it should be identified, considered and it should be minimized to the best possible level.

Want to see more full solutions like this?

Chapter 9 Solutions

INTRO MGRL ACCT LL W CONNECT

- I need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardNo chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forward

- No ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

- Development costs in preparing the mine $ 3,400,000 Mining equipment 159,600 Construction of various structures on site 77,900 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $12,000. The structures will be torn down. Geologists estimate that 820,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow Probability $ 620,000 40% 720,000 30% 820,000 30% Hecala’s credit-adjusted risk-free interest rate is 7%. During 2024, Hecala extracted 122,000 tons of ore from the mine. The company’s fiscal year ends on December 31. Required: Determine the amount at which Hecala will record the mine. Calculate the…arrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardwhat are the Five List of Michael Porter's 5 Force Framework that describes the competitive dynamics of a firm and the industry they are in?arrow_forward

- Hello tutor i need help I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwarddefine each item below: A competitive advantage. 2) Data incorporation. 3) Financial Statement Analysis. 4) Product Differentiation. 5) Strategic positioning for a business firmarrow_forwardHello tutor i need help I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning