Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 8.9.7MBA

Debt and price-earnings ratios

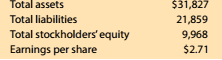

Lowe's Companies Inc. (LOW) operates over 1,800 home improvement retail stores and is a competitor of The Home Depot (HD). The following data (in millions) were adapted from a recent financial statement of Lowe's:

Compare the price-earninys ratios of Lowe's and The flotne Depot (MBA 8-8). Comment on any differences.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The balance in the dividends account is closed to:A. CashB. RevenueC. Retained EarningsD. Common Stock

need

What is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensescorrect

What is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expenses

need

Chapter 8 Solutions

Survey of Accounting (Accounting I)

Ch. 8 - A business issued a $5,000, 60-day, 12% note to...Ch. 8 - Which of the following taxes are employers usually...Ch. 8 - Prob. 3SEQCh. 8 - Prob. 4SEQCh. 8 - A corporation has issued 25,000 shares of $100 par...Ch. 8 - For most companies, what two types of transactions...Ch. 8 - When are short-term notes payable issued?Ch. 8 - Prob. 3CDQCh. 8 - Prob. 4CDQCh. 8 - Identify the two distinct obligations incurred by...

Ch. 8 - A corporation issues $40,000,000 of 6% bonds to...Ch. 8 - The following data relate to an $8,000,000,7% bond...Ch. 8 - When should the liability associated with a...Ch. 8 - Prob. 9CDQCh. 8 - Prob. 10CDQCh. 8 - Prob. 11CDQCh. 8 - Prob. 12CDQCh. 8 - Prob. 13CDQCh. 8 - A corporation reacquires 18,000 shares of its Own...Ch. 8 - Prob. 15CDQCh. 8 - Prob. 16CDQCh. 8 - Prob. 17CDQCh. 8 - Prob. 18CDQCh. 8 - Effect of financing on earnings per share BSF Co.....Ch. 8 - Evaluate alternative financing plans Obj. 1 Based...Ch. 8 - Current liabilities Zahn Inc. -told 16.000annual...Ch. 8 - Notes payable Obj. A business issued a 90-day. 7%...Ch. 8 - Compute payroll An employee earns $28 per hour and...Ch. 8 - Prob. 8.6ECh. 8 - Prob. 8.7ECh. 8 - Prob. 8.8ECh. 8 - Bond price CVS Caremark Corp. (CVS) 5-3% bonds due...Ch. 8 - Issuing bonds Cyber Tech Inc. produces and...Ch. 8 - Accrued product warranty Back in Time Inc....Ch. 8 - Accrued product warranty Ford Motor Company (F)...Ch. 8 - Prob. 8.13ECh. 8 - Prob. 8.14ECh. 8 - Issuing par stock On January 29. Quality Marble...Ch. 8 - Issuing stock for assets other than cash Obj.5 On...Ch. 8 - Treasury stock transactions Obj.5 Blue Moon Water...Ch. 8 - Prob. 8.18ECh. 8 - Treasury stock transactions Banff Water Inc....Ch. 8 - Cash dividends The date of declaration, date of...Ch. 8 - Prob. 8.21ECh. 8 - Effect of stock split Audrey's Restaurant...Ch. 8 - Prob. 8.23ECh. 8 - Prob. 8.24ECh. 8 - Prob. 8.1.1PCh. 8 - Prob. 8.1.2PCh. 8 - Prob. 8.1.3PCh. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Bond premium; bonds payable transactions Beaufort...Ch. 8 - Prob. 8.3.2PCh. 8 - Bond premium; bonds payable transactions Beaufort...Ch. 8 - Prob. 8.3.4PCh. 8 - Stock transactions for corporate expansion Vaga...Ch. 8 - Dividends on preferred and common stock Yukon Bike...Ch. 8 - Dividends on preferred and common stock Yukon Bike...Ch. 8 - Prob. 8.5.3PCh. 8 - Prob. 8.1.1MBACh. 8 - Prob. 8.1.2MBACh. 8 - Prob. 8.2.1MBACh. 8 - Prob. 8.2.2MBACh. 8 - Prob. 8.2.3MBACh. 8 - Prob. 8.3.1MBACh. 8 - Prob. 8.3.2MBACh. 8 - Prob. 8.3.3MBACh. 8 - Prob. 8.4MBACh. 8 - Prob. 8.5.1MBACh. 8 - Prob. 8.5.2MBACh. 8 - Prob. 8.6.1MBACh. 8 - Prob. 8.6.2MBACh. 8 - Prob. 8.6.3MBACh. 8 - Stock split Using the data from E8-22. indicate...Ch. 8 - Prob. 8.8.1MBACh. 8 - Prob. 8.8.2MBACh. 8 - Prob. 8.8.3MBACh. 8 - Prob. 8.8.4MBACh. 8 - Prob. 8.8.5MBACh. 8 - Prob. 8.8.6MBACh. 8 - Prob. 8.8.7MBACh. 8 - Prob. 8.8.8MBACh. 8 - Prob. 8.9.1MBACh. 8 - Prob. 8.9.2MBACh. 8 - Prob. 8.9.3MBACh. 8 - Prob. 8.9.4MBACh. 8 - Prob. 8.9.5MBACh. 8 - Prob. 8.9.6MBACh. 8 - Debt and price-earnings ratios Lowe's Companies...Ch. 8 - Prob. 8.10.1MBACh. 8 - Prob. 8.10.2MBACh. 8 - Prob. 8.10.3MBACh. 8 - Prob. 8.10.4MBACh. 8 - Prob. 8.10.5MBACh. 8 - Debt and price-earnings ratios Alphabet (formerly...Ch. 8 - Prob. 8.10.7MBACh. 8 - Prob. 8.10.8MBACh. 8 - Prob. 8.11MBACh. 8 - Prob. 8.1.1CCh. 8 - Prob. 8.1.2CCh. 8 - Prob. 8.2.1CCh. 8 - Prob. 8.2.2CCh. 8 - Prob. 8.3.1CCh. 8 - Issuing stock Sahara Unlimited Inc. began...Ch. 8 - Prob. 8.4CCh. 8 - Prob. 8.5.1CCh. 8 - Financing business expansion You hold a 30% common...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the normal balance of Accounts Payable?A. DebitB. CreditC. ZeroD. VariesNeedarrow_forwardGeneral Accounting Question Solutionarrow_forwardWhat is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expenses correctarrow_forward

- Need Help of this Financial Accountingarrow_forwardWhat is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesneed helparrow_forwardWhat is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesarrow_forward

- The purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errors correct answerarrow_forwardPlease Make Perfect Answer For this Financial Accountingarrow_forwardThe purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errors correct solutarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License