Concept explainers

Ethical Decision Making: A Real-Life Example

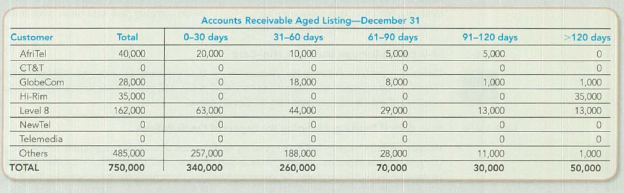

You work for a company named MCI and you have been assigned the job of adjusting the company’s Allowance for Doubtful Accounts balance. You obtained the following aged listing of customer account balances for December.

Historically,

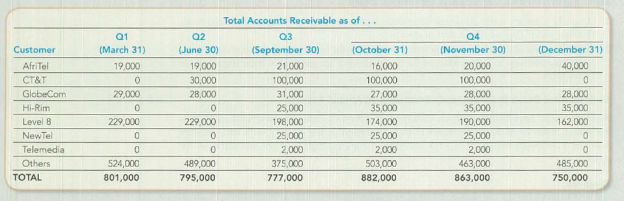

To check the reasonableness of the calculated balance, you obtain the aged listings for prior months (shown below). As you scan the listings, you notice an interesting pattern. Several account balances, which had grown quite large by the end of November, had disappeared in the final month of the year. You ask the

Required:

- 1. Calculate the balance that should be reported in Allowance for Doubtful Accounts as of December 31.

- 2. Prepare the

adjusting journal entry that is required on December 31. - 3. Show how Accounts Receivable would be reported on the

balance sheet at December 31. - 4. If the balances for CT&T, NewTel, and Telemedia at the end of November continued to exist at the end of December (in the over-120-days category), what balance would you have estimated for the Allowance for Doubtful Accounts on December 31? Would this have changed MCI’s net income in the current year? Explain.

- 5. A few days later, you overhear Mr. Pavlo talking about the account receivable from Hi-Rim. Apparently, MCI will soon loan Hi-Rim some money, creating a note receivable. Hi-Rim will use the money to pay off the Accounts Receivable balance it owes to MCI. You are aware that Mr. Pavlo receives a bonus based on MCI’s net income. Should you investigate this matter farther? Explain why or why not.

Epilogue: The events described above are based on an article in the June 10, 2002, issue of Forbes magazine that describes how Walter Pavlo was pressured to commit accounting fraud at MCI. Ironically, MCI was later taken over by WorldCom—the company that went on to commit the world’s largest accounting fraud at the time.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Loose-leaf for Fundamentals of Financial Accounting with Connect

- Ayayai Itzek manufactures and sells homemade wine, and he wants to develop a standard cost per gallon. The following are required for the production of a 50-gallon batch. - 2,910 ounces of grape concentrate at $0.08 per ounce. - 54 pounds of granulated sugar at $0.40 per pound. 60 lemons at $0.70 each. 250 yeast tablets at $0.29 each. - 200 nutrient tablets at $0.12 each. - 2,800 ounces of water at $0.005 per ounce. Ayayai estimates that 3% of the grape concentrate is wasted, 10% of the sugar is lost, and 25% of the lemons cannot be used. Compute the standard cost of the ingredients for one gallon of wine.arrow_forwardOn December 31, Strike Company decided to sell one of its batting cages. The initial cost of the equipment was $308,000 with accumulated depreciation of $199,000. Depreciation has been taken up to the end of the year. The company found a company that is willing to buy the equipment for $35,000. What is the amount of the gain or loss on this transaction?arrow_forwardFinancial accounting questionarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,