Loose-leaf for Fundamentals of Financial Accounting with Connect

5th Edition

ISBN: 9781259619007

Author: Fred Phillips Associate Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 8.6SDC

Critical Thinking: Analyzing the Impact of Credit Policies

Problem Solved Company has been operating for five years as a software consulting firm. During this period, it has experienced rapid growth in Sales Revenue and in

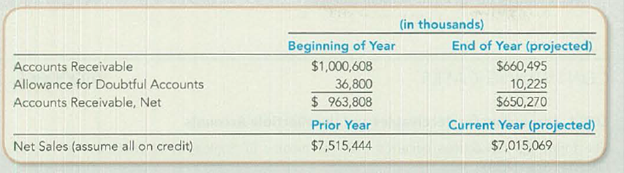

put into place more stringent credit-granting and collection procedures that you expect will reduce receivables by approximately one-third by year-end. You have gathered the following data related to the changes (in thousands):

Required:

- 1. Compute, to one decimal place, the accounts receivable turnover ratio based on three different assumptions:

- a. The stringent credit policies reduce Accounts Receivable, Net and decrease Net Sales as projected in the table.

- b. The stringent credit policies reduce Accounts Receivable, Net as projected in the table but do not decrease Net Sales from the prior year.

- c. The stringent credit policies are not implemented, resulting in no change from the beginning of the year Accounts Receivable balance and no change in Net Sales from the prior year.

- 2. On the basis of your findings in requirement 1, write a brief memo to the chief financial officer explaining the potential benefits and drawbacks of more stringent credit policies and how they are likely to affect the accounts receivable turnover ratio.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Tower Company owned a service truck that was purchased at the beginning of Year 1 for $48,000. It had an estimated life of three

years and an estimated salvage value of $3,000. Tower company uses straight-line depreciation. Its financial condition as of January 1,

Year 3, is shown on the first line of the horizontal statements model.

In Year 3, Tower Company spent the following amounts on the truck:

January 4 Overhauled the engine for $7,600. The estimated life was extended one additional year, and the salvage value was

revised to $2,000.

July 6 Obtained oil change and transmission service, $410.

August 7 Replaced the fan belt and battery, $510.

December 31 Purchased gasoline for the year, $9,100.

December 31 Recognized Year 3 depreciation expense.

Required

Record the Year 3 transactions in a statements model.

Note: In the Statement of Cash Flows column, use the initials OA for operating activities, FA for financing activities, or IA for

investing activity. Enter any decreases to…

Cara's Cookie Company provided the following accounts from its year-end trial balance.

(Click the icon to view the year-end trial balance accounts.)

The company is subject to a 35% income tax rate.

Requirement

Prepare a multiple-step income statement for the current year.

Trial balance

Cara's Cookie Company

Adjusted Trial Balance (Selected Accounts)

For the Current Year Ended

Account

Debit

Credit

Prepare Cara's multiple-step income statement for the current year, one section at a time. (List the subheadings in the order they

Cara's Cookie Company

Statement of Net Income

Common Stock (no par): Beginning Balance

Retained Earnings: Beginning Balance

$ 462,000

1,200,000

Accumulated Other Comprehensive Income: Beginning Balance

Dividends

$

63,000

69,000

Sales

3,200,000

For the Current Year Ended

Sales

Less: Cost of Goods Sold

3,200,000

610,000

Interest Income

3,800

Dividend Income

3,600

Gross Profit

Operating Expenses:

Selling Expenses:

Gain on Disposal of Plant Assets

92,000

2,590,000…

History

口

AA

1

୪

Fri Feb 14 2:45 PM

Mc

Gw Mini Cases

Qmcgrow hill goodweek tires pr × |

Ask a Question | bartleby

× +

Bookmarks

Profiles Tab Window Help

Graw McGraw Hill

MC

☑

Hill

prod.reader-ui.prod.mheducation.com/epub/sn_d82a5/data-uuid-0e12dd568f3f4e438c00faed4ea436f1

Chrome File Edit View

Λ

LTI Launch

88

Netflix

YouTube

A BlackBoard

Mail - Stiffler, Zac...

SBI Jobs

E

Aa

Finish update:

☐

All Bookmarks

Goodweek Tires, Inc.

After extensive research and development, Goodweek Tires, Inc., has recently developed a new tire, the SuperTread, and must decide whether to make the investment necessary

to produce and market it. The tire would be ideal for drivers doing a large amount of wet weather and off-road driving in addition to normal freeway usage. The research and

development costs so far have totaled about $10 million. The SuperTread would be put on the market beginning this year, and Goodweek expects it to stay on the market for a

total of four years. Test marketing costing $5…

Chapter 8 Solutions

Loose-leaf for Fundamentals of Financial Accounting with Connect

Ch. 8 - What are the advantages and disadvantages of...Ch. 8 - Prob. 2QCh. 8 - Which basic accounting principles does the...Ch. 8 - Using the allowance method, is Bad Debt Expense...Ch. 8 - What is the effect of the write-off of...Ch. 8 - How does the use of calculated estimates differ...Ch. 8 - Prob. 7QCh. 8 - What is the primary difference between accounts...Ch. 8 - What are the three components of the interest...Ch. 8 - Prob. 10Q

Ch. 8 - Does an increase in the receivables turnover ratio...Ch. 8 - What two approaches can managers take to speed up...Ch. 8 - When customers experience economic difficulties,...Ch. 8 - (Supplement 8A) Describe how (and when) the direct...Ch. 8 - (Supplement 8A) Refer to question 7. What amounts...Ch. 8 - 1. When a company using the allowance method...Ch. 8 - 2. When using the allowance method, as Bad Debt...Ch. 8 - 3. For many years, Carefree Company has estimated...Ch. 8 - 4. Which of the following best describes the...Ch. 8 - 5. If the Allowance for Doubtful Accounts opened...Ch. 8 - 6. When an account receivable is recovered a....Ch. 8 - Prob. 7MCCh. 8 - 8. If the receivables turnover ratio decreased...Ch. 8 - Prob. 9MCCh. 8 - Prob. 10MCCh. 8 - Prob. 8.1MECh. 8 - Evaluating the Decision to Extend Credit Last...Ch. 8 - Prob. 8.3MECh. 8 - Prob. 8.4MECh. 8 - Recording Write-Offs and Bad Debt Expense Using...Ch. 8 - Determining Financial Statement Effects of...Ch. 8 - Estimating Bad Debts Using the Percentage of...Ch. 8 - Estimating Bad Debts Using the Aging Method Assume...Ch. 8 - Recording Bad Debt Estimates Using the Two...Ch. 8 - Prob. 8.10MECh. 8 - Prob. 8.11MECh. 8 - Recording Note Receivable Transactions RecRoom...Ch. 8 - Prob. 8.13MECh. 8 - Determining the Effects of Credit Policy Changes...Ch. 8 - Prob. 8.15MECh. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Bad Debt Expense Estimates and...Ch. 8 - Determining Financial Statement Effects of Bad...Ch. 8 - Recording, Reporting, and Evaluating a Bad Debt...Ch. 8 - Recording Write-Offs and Recoveries Prior to...Ch. 8 - Prob. 8.5ECh. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Recording and Reporting Allowance for Doubtful...Ch. 8 - Recording and Determining the Effects of Write-Off...Ch. 8 - Prob. 8.10ECh. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Prob. 8.13ECh. 8 - Prob. 8.14ECh. 8 - Prob. 8.15ECh. 8 - Prob. 8.16ECh. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Prob. 8.2CPCh. 8 - Recording Notes Receivable Transactions Jung ...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Prob. 8.5CPCh. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Prob. 8.2PACh. 8 - Prob. 8.3PACh. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions Stinson...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Prob. 8.5PBCh. 8 - Recording and Reporting Credit Sales and Bad Debts...Ch. 8 - Prob. 8.2COPCh. 8 - Recording Daily and Adjusting Entries Using FIFO...Ch. 8 - Prob. 8.1SDCCh. 8 - Comparing Financial Information Refer to the...Ch. 8 - Ethical Decision Making: A Real-Life Example You...Ch. 8 - Critical Thinking: Analyzing the Impact of Credit...Ch. 8 - Using an Aging Schedule to Estimate Bad Debts and...Ch. 8 - Accounting for Receivables and Uncollectible...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Damerly Company (a Utah employer) wants to give a holiday bonus check of $375 to each employee. As it wants the check amount to be $375, it will need to gross-up the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. Besides being subject to social security taxes and federal income tax (supplemental rate), a 4.95% Utah income tax must be withheld on supplemental payments.arrow_forwardPlease given correct answer general Accountingarrow_forwardHii ticher please given correct answer general Accountingarrow_forward

- On a particular date, FedEx has a stock price of $89.27 and an EPS of $7.11. Its competitor, UPS, had an EPS of $0.38. What would be the expected price of UPS stock on this date, if estimated using the method of comparables? A) $4.77 B) $7.16 C) $9.54 D) $10.50arrow_forwardHow much will you accumulated after 35 year? General accountingarrow_forwardGiven correct answer general Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY