Concept explainers

Aging of receivables; estimating allowance for doubtful accounts

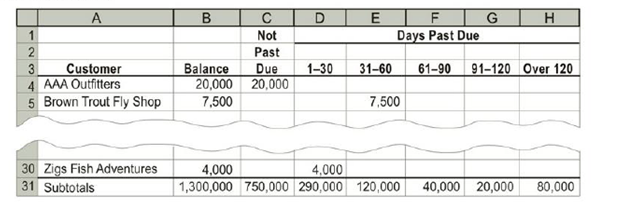

Trophy Fish Company supplies flies and fishing gear to sporting goods stores and outfitters throughout the western United States. The

The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Wolfe Sports, which is due in the next year.

| Customer | Due Date | Balance |

| Adams Sports & Flies | May 22 | $5,000 |

| Blue Dun Flies | Oct. 10 | 4,900 |

| Cicada Fish Co. | Sept. 29 | 8,400 |

| Deschutes Sports | Oct. 20 | 7,000 |

| Green River Sports | Nov. 7 | 3,500 |

| Smith River Co. | Nov. 28 | 2,400 |

| Western Trout Company | Dec. 7 | 6,800 |

| Wolfe Sports | Jan. 20 | 4,400 |

Trophy Fish has a past history of uncollectible accounts by age category, as follows:

| Age Class | Percent Uncollectible |

| Not past due | 1% |

| 1-30 days past due | 2 |

| 31-60 days past due | 10 |

| 61-90 days past due | 30 |

| 91-120 days past due | 40 |

| Over 120 days past due | 80 |

Instructions

- 1. Determine the number of days past due for each of the preceding accounts.

- 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

- 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule.

- 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,600 before adjustment on December 31. Journalize the

adjusting entry for uncollectible accounts. - 5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the

balance sheet and income statement?

Trending nowThis is a popular solution!

Chapter 8 Solutions

CengageNOWv2, 2 terms Printed Access Card for Warren/Reeve/Duchac’s Financial & Managerial Accounting, 14th

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Essentials of MIS (13th Edition)

MARKETING:REAL PEOPLE,REAL CHOICES

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

- Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2023. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2023: Asset Cost Date Placed in Service Office furniture $ 400,000 02/03 Machinery 1,810,000 07/22 Used delivery truck*Note: 90,000 08/17 *Note:Not considered a luxury automobile. During 2023, Karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2024 to increase its production capacity. These are the assets acquired during 2024: Asset Cost Date Placed in Service Computers and information system $ 450,000 03/31 Luxury auto*Note: 92,500 05/26 Assembly equipment 1,200,000 08/15 Storage building 800,000 11/13 *Note:Used 100 percent for business purposes. Karane generated taxable income in 2024 of $1,795,000 for purposes of computing the §179 expense limitation. (Use MACRS Table 1, Table…arrow_forwardPearl Leasing Company agrees to lease equipment to Martinez Corporation on January 1, 2025. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $541,000, and the fair value of the asset on January 1, 2025, is $760,000. 3. Z At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $45,000, Maz estimates that the expected residual value at the end of the lease term will be $45,000. Martinez amortizes its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2025. 5. The collectibility of the lease payments is probable. 6. Pearl desires a 10% rate of return on its investments. Martinez's incremental borrowing rate is 11%, and the lessor's implicit rate is unknown. (Assume the accounting period ends on December 31.)…arrow_forwardhello tutor provide correct answer General accounting questionarrow_forward

- Butler Tech, Inc., is expanding into India. The company must decide where to locate and how to finance the expansion. Requirement Identify the financial statement where these decision makers can find the following information about Butler Tech, Inc. In some cases, more than one statement will report the needed data. Question content area bottom Part 1 Part 2 a. Revenue Income statement b. Common stock Balance sheet c. Current liabilities Balance sheet d. Long-term debt Balance sheet e. Dividends Statement of retained earnings and Statement of cash flows f. Ending cash balance Balance sheet and Statement of cash flows g. Adjustments to reconcile net income to net cash provided by operations Statement of cash flows h. Cash spent to acquire the building i. Income tax expense j. Ending balance of retained earnings k. Selling,…arrow_forwardWhat is the depreciation expense in 2015 ??arrow_forwardPlease given correct answer general accountingarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning